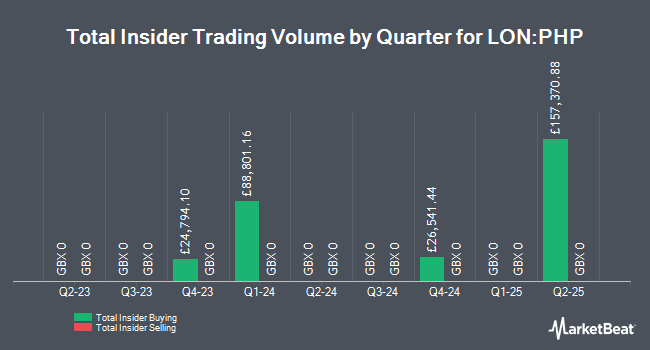

Primary Health Properties Plc (LON:PHP - Get Free Report) insider Harry Abraham Hyman acquired 4,055 shares of the business's stock in a transaction that occurred on Friday, August 15th. The shares were acquired at an average cost of GBX 91 per share, for a total transaction of £3,690.05.

Harry Abraham Hyman also recently made the following trade(s):

- On Monday, August 11th, Harry Abraham Hyman bought 14,853 shares of Primary Health Properties stock. The stock was acquired at an average cost of GBX 95 per share, with a total value of £14,110.35.

- On Monday, August 11th, Harry Abraham Hyman purchased 13,360 shares of Primary Health Properties stock. The shares were acquired at an average price of GBX 95 per share, for a total transaction of £12,692.

- On Friday, August 1st, Harry Abraham Hyman purchased 25,660 shares of Primary Health Properties stock. The shares were acquired at an average price of GBX 96 per share, for a total transaction of £24,633.60.

Primary Health Properties Stock Up 0.3%

Shares of PHP traded up GBX 0.30 during mid-day trading on Friday, hitting GBX 93.90. 21,737,811 shares of the company's stock were exchanged, compared to its average volume of 9,507,945. The firm has a fifty day moving average of GBX 96.84 and a two-hundred day moving average of GBX 96.72. Primary Health Properties Plc has a twelve month low of GBX 85.40 and a twelve month high of GBX 105.50. The stock has a market cap of £1.26 billion, a price-to-earnings ratio of -146.58, a P/E/G ratio of 5.64 and a beta of 0.41. The company has a quick ratio of 0.62, a current ratio of 0.50 and a debt-to-equity ratio of 96.73.

Primary Health Properties (LON:PHP - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The real estate investment trust reported GBX 3.50 EPS for the quarter. Primary Health Properties had a negative net margin of 4.84% and a negative return on equity of 0.61%. On average, sell-side analysts forecast that Primary Health Properties Plc will post 7.0875912 earnings per share for the current year.

Analyst Ratings Changes

Separately, Shore Capital restated a "buy" rating on shares of Primary Health Properties in a research note on Thursday, August 7th. Three analysts have rated the stock with a Buy rating, According to data from MarketBeat, the stock currently has an average rating of "Buy" and a consensus target price of GBX 107.50.

Get Our Latest Research Report on Primary Health Properties

Primary Health Properties Company Profile

(

Get Free Report)

Primary Health Properties plc is a leading investor in modern primary healthcare properties. The Company acquires or forward funds the development of modern, purpose-built premises that are leased to GP's, government healthcare bodies, pharmacies and other providers of related healthcare services.

Featured Articles

Before you consider Primary Health Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Primary Health Properties wasn't on the list.

While Primary Health Properties currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.