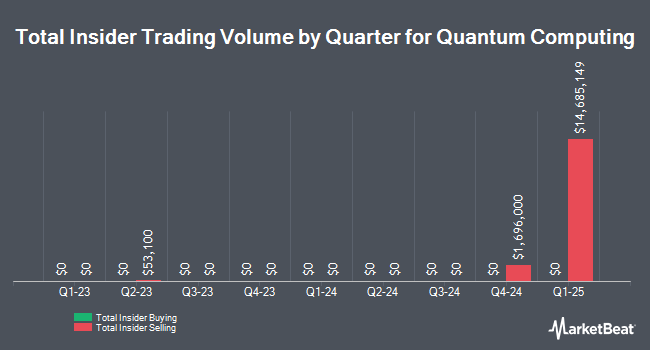

Quantum Computing Inc. (NASDAQ:QUBT - Get Free Report) CEO Yuping Huang sold 1,000,000 shares of the company's stock in a transaction that occurred on Thursday, September 4th. The shares were sold at an average price of $14.41, for a total value of $14,410,000.00. Following the sale, the chief executive officer directly owned 21,287,718 shares in the company, valued at approximately $306,756,016.38. This represents a 4.49% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink.

Quantum Computing Price Performance

Shares of QUBT stock traded up $0.19 on Tuesday, hitting $15.43. 3,430,436 shares of the stock traded hands, compared to its average volume of 23,341,947. The company has a market capitalization of $2.47 billion, a PE ratio of -22.51 and a beta of 3.88. Quantum Computing Inc. has a 1-year low of $0.59 and a 1-year high of $27.15. The company's fifty day moving average is $16.71 and its 200 day moving average is $12.21.

Quantum Computing (NASDAQ:QUBT - Get Free Report) last posted its quarterly earnings results on Thursday, August 14th. The company reported ($0.06) earnings per share (EPS) for the quarter, meeting the consensus estimate of ($0.06). The firm had revenue of $0.06 million for the quarter, compared to analyst estimates of $0.10 million.

Institutional Inflows and Outflows

A number of large investors have recently modified their holdings of QUBT. Rhumbline Advisers acquired a new position in shares of Quantum Computing during the first quarter valued at $28,000. Nisa Investment Advisors LLC acquired a new position in shares of Quantum Computing during the second quarter valued at $28,000. Thurston Springer Miller Herd & Titak Inc. acquired a new position in shares of Quantum Computing during the second quarter valued at $29,000. Tower Research Capital LLC TRC bought a new position in Quantum Computing during the fourth quarter valued at about $30,000. Finally, Hollencrest Capital Management boosted its stake in Quantum Computing by 60.0% during the first quarter. Hollencrest Capital Management now owns 4,000 shares of the company's stock valued at $32,000 after buying an additional 1,500 shares in the last quarter. 4.26% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several equities research analysts have weighed in on the company. Cantor Fitzgerald assumed coverage on Quantum Computing in a research report on Wednesday, July 2nd. They issued a "neutral" rating and a $15.00 target price on the stock. Wall Street Zen lowered Quantum Computing from a "hold" rating to a "strong sell" rating in a research report on Saturday, August 16th. Finally, Ascendiant Capital Markets increased their target price on Quantum Computing from $14.00 to $22.00 and gave the stock a "buy" rating in a research report on Friday, June 6th. One research analyst has rated the stock with a Buy rating and one has issued a Hold rating to the stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $18.50.

Get Our Latest Analysis on QUBT

About Quantum Computing

(

Get Free Report)

Quantum Computing Inc, an integrated photonics company, offers accessible and affordable quantum machines. The company offers Dirac systems are portable, low power, and room temperature qubit and qudit entropy quantum computers (EQC); reservoir computing; remote sensing; and single photon imaging. It also provides Quantum random number generator (uQRNG), a portable device that provides genuine random numbers directly from quantum processes; and quantum authentication which eliminates vulnerabilities inherent in classical cryptographic schemes by offering a comprehensive entanglement-based quantum cyber solution that seamlessly integrates into existing telecom fiber and communication infrastructure.

Featured Articles

Before you consider Quantum Computing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quantum Computing wasn't on the list.

While Quantum Computing currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.