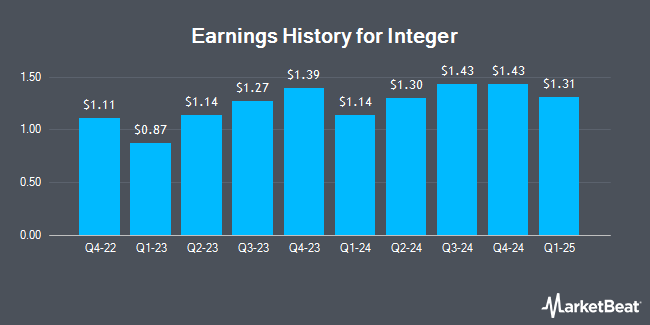

Integer (NYSE:ITGR - Get Free Report) is expected to be posting its Q3 2025 results before the market opens on Thursday, October 23rd. Analysts expect Integer to post earnings of $1.68 per share and revenue of $466.4510 million for the quarter. Integer has set its FY 2025 guidance at 6.250-6.510 EPS.Interested persons may review the information on the company's upcoming Q3 2025 earningreport for the latest details on the call scheduled for Thursday, October 23, 2025 at 9:00 AM ET.

Integer (NYSE:ITGR - Get Free Report) last released its quarterly earnings results on Thursday, July 24th. The medical equipment provider reported $1.55 earnings per share for the quarter, missing analysts' consensus estimates of $1.57 by ($0.02). The firm had revenue of $476.00 million during the quarter, compared to the consensus estimate of $464.37 million. Integer had a net margin of 4.61% and a return on equity of 12.27%. The firm's quarterly revenue was up 11.4% on a year-over-year basis. During the same quarter in the prior year, the business posted $1.30 earnings per share. On average, analysts expect Integer to post $6 EPS for the current fiscal year and $7 EPS for the next fiscal year.

Integer Trading Down 0.2%

NYSE ITGR opened at $103.73 on Thursday. Integer has a 52 week low of $99.54 and a 52 week high of $146.36. The company has a 50 day moving average price of $104.99 and a 200 day moving average price of $113.32. The company has a quick ratio of 2.18, a current ratio of 3.41 and a debt-to-equity ratio of 0.72. The firm has a market cap of $3.63 billion, a PE ratio of 45.69, a price-to-earnings-growth ratio of 0.82 and a beta of 0.97.

Institutional Investors Weigh In On Integer

Several hedge funds and other institutional investors have recently added to or reduced their stakes in ITGR. Alliancebernstein L.P. lifted its holdings in shares of Integer by 885.1% in the 2nd quarter. Alliancebernstein L.P. now owns 1,106,091 shares of the medical equipment provider's stock valued at $136,016,000 after buying an additional 993,810 shares during the period. Millennium Management LLC lifted its holdings in Integer by 2,408.8% in the first quarter. Millennium Management LLC now owns 123,132 shares of the medical equipment provider's stock valued at $14,531,000 after acquiring an additional 118,224 shares during the period. Viking Global Investors LP boosted its position in Integer by 9.1% in the 2nd quarter. Viking Global Investors LP now owns 1,283,965 shares of the medical equipment provider's stock worth $157,889,000 after purchasing an additional 106,692 shares in the last quarter. Man Group plc acquired a new stake in shares of Integer during the 2nd quarter worth approximately $8,807,000. Finally, Squarepoint Ops LLC increased its holdings in shares of Integer by 80.2% during the 2nd quarter. Squarepoint Ops LLC now owns 156,393 shares of the medical equipment provider's stock valued at $19,232,000 after purchasing an additional 69,591 shares in the last quarter. 99.29% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of analysts have recently weighed in on ITGR shares. Wells Fargo & Company lowered their price objective on Integer from $152.00 to $132.00 and set an "overweight" rating for the company in a research report on Friday, July 25th. Raymond James Financial lowered their price target on Integer from $150.00 to $143.00 and set an "outperform" rating for the company in a report on Friday, July 25th. Wall Street Zen upgraded shares of Integer from a "hold" rating to a "buy" rating in a report on Saturday, August 30th. Truist Financial lowered their target price on shares of Integer from $137.00 to $121.00 and set a "buy" rating for the company in a research note on Wednesday. Finally, Weiss Ratings restated a "hold (c)" rating on shares of Integer in a research note on Wednesday, October 8th. One analyst has rated the stock with a Strong Buy rating, six have assigned a Buy rating and two have given a Hold rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $137.29.

Get Our Latest Stock Report on ITGR

About Integer

(

Get Free Report)

Integer Holdings Corporation operates as a medical device outsource manufacturer in the United States, Puerto Rico, Costa Rica, and internationally. It operates through two segments, Medical and Non-Medical. The company offers products for interventional cardiology, structural heart, heart failure, peripheral vascular, neurovascular, interventional oncology, electrophysiology, vascular access, infusion therapy, hemodialysis, non-vascular, urology, and gastroenterology procedures.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Integer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Integer wasn't on the list.

While Integer currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.