Wall Street Zen upgraded shares of Intercontinental Hotels Group (NYSE:IHG - Free Report) from a hold rating to a buy rating in a report issued on Friday.

Intercontinental Hotels Group Price Performance

Intercontinental Hotels Group stock traded up $0.43 during mid-day trading on Friday, hitting $122.85. The company's stock had a trading volume of 121,236 shares, compared to its average volume of 207,676. The stock has a market cap of $18.91 billion, a price-to-earnings ratio of 21.78, a price-to-earnings-growth ratio of 1.69 and a beta of 1.33. The business has a 50 day moving average price of $118.46 and a 200-day moving average price of $116.14. Intercontinental Hotels Group has a 12 month low of $94.78 and a 12 month high of $137.25.

Intercontinental Hotels Group Cuts Dividend

The company also recently disclosed a semi-annual dividend, which will be paid on Thursday, October 2nd. Stockholders of record on Friday, August 22nd will be paid a dividend of $0.566 per share. This represents a dividend yield of 140.0%. The ex-dividend date of this dividend is Friday, August 22nd. Intercontinental Hotels Group's dividend payout ratio is 20.04%.

Hedge Funds Weigh In On Intercontinental Hotels Group

Several hedge funds and other institutional investors have recently modified their holdings of the company. Allspring Global Investments Holdings LLC raised its stake in shares of Intercontinental Hotels Group by 4.8% during the first quarter. Allspring Global Investments Holdings LLC now owns 2,092 shares of the company's stock valued at $232,000 after acquiring an additional 96 shares during the last quarter. Aaron Wealth Advisors LLC increased its position in shares of Intercontinental Hotels Group by 4.5% during the first quarter. Aaron Wealth Advisors LLC now owns 2,245 shares of the company's stock valued at $246,000 after buying an additional 96 shares during the period. Frank Rimerman Advisors LLC increased its position in shares of Intercontinental Hotels Group by 3.9% during the second quarter. Frank Rimerman Advisors LLC now owns 2,571 shares of the company's stock valued at $297,000 after buying an additional 97 shares during the period. Golden State Wealth Management LLC increased its position in shares of Intercontinental Hotels Group by 100.0% during the first quarter. Golden State Wealth Management LLC now owns 228 shares of the company's stock valued at $25,000 after buying an additional 114 shares during the period. Finally, TD Private Client Wealth LLC increased its position in shares of Intercontinental Hotels Group by 48.7% during the first quarter. TD Private Client Wealth LLC now owns 348 shares of the company's stock valued at $38,000 after buying an additional 114 shares during the period. 15.09% of the stock is owned by institutional investors.

About Intercontinental Hotels Group

(

Get Free Report)

InterContinental Hotels Group PLC owns, manages, franchises, and leases hotels in the Americas, Europe, Asia, the Middle East, Africa, and Greater China. The company operates hotels under the Six Senses, Regent, InterContinental Hotels & Resorts, Vignette Collection, Kimpton Hotels & Restaurants, Hotel Indigo, voco, HUALUXE, Crowne Plaza, Iberostar Beachfront Resorts, EVEN, Holiday Inn Express, Holiday Inn, Garner, avid hotels, Atwell Suites, Staybridge Suites, Iberostar Beachfront Resorts, Holiday Inn Club Vacations, and Candlewood Suites brand names.

See Also

Before you consider Intercontinental Hotels Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intercontinental Hotels Group wasn't on the list.

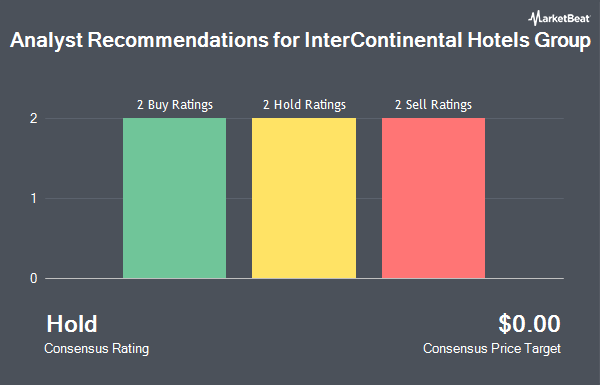

While Intercontinental Hotels Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.