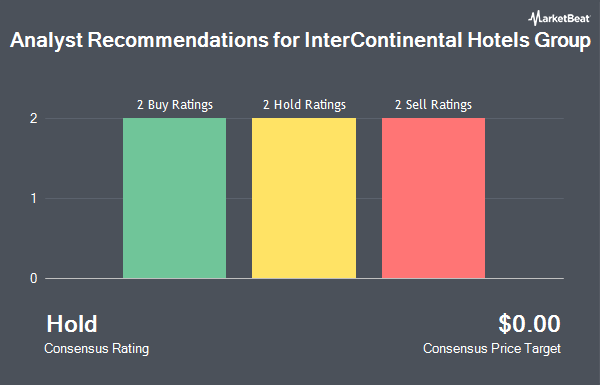

InterContinental Hotels Group PLC (NYSE:IHG - Get Free Report) has received a consensus recommendation of "Hold" from the six analysts that are currently covering the stock, MarketBeat Ratings reports. Two research analysts have rated the stock with a sell rating, two have issued a hold rating and two have given a buy rating to the company.

A number of equities research analysts recently weighed in on the company. Citigroup assumed coverage on InterContinental Hotels Group in a research note on Monday, February 24th. They issued a "sell" rating on the stock. Deutsche Bank Aktiengesellschaft raised shares of InterContinental Hotels Group from a "sell" rating to a "hold" rating in a research report on Monday, April 14th.

Check Out Our Latest Analysis on IHG

Hedge Funds Weigh In On InterContinental Hotels Group

Large investors have recently made changes to their positions in the company. Richardson Financial Services Inc. bought a new position in InterContinental Hotels Group during the 4th quarter worth $25,000. Golden State Wealth Management LLC increased its position in InterContinental Hotels Group by 100.0% during the first quarter. Golden State Wealth Management LLC now owns 228 shares of the company's stock worth $25,000 after acquiring an additional 114 shares during the period. Brooklyn Investment Group increased its position in InterContinental Hotels Group by 219.5% during the first quarter. Brooklyn Investment Group now owns 246 shares of the company's stock worth $27,000 after acquiring an additional 169 shares during the period. Whittier Trust Co. increased its position in InterContinental Hotels Group by 186.3% during the first quarter. Whittier Trust Co. now owns 272 shares of the company's stock worth $30,000 after acquiring an additional 177 shares during the period. Finally, Farther Finance Advisors LLC increased its position in InterContinental Hotels Group by 67.3% during the fourth quarter. Farther Finance Advisors LLC now owns 251 shares of the company's stock worth $31,000 after acquiring an additional 101 shares during the period. Institutional investors own 15.09% of the company's stock.

InterContinental Hotels Group Trading Up 0.9%

NYSE:IHG traded up $1.05 on Tuesday, hitting $116.57. The company's stock had a trading volume of 124,181 shares, compared to its average volume of 193,513. The stock has a fifty day moving average of $111.03 and a two-hundred day moving average of $120.17. The firm has a market capitalization of $18.13 billion, a P/E ratio of 20.67, a price-to-earnings-growth ratio of 1.69 and a beta of 1.34. InterContinental Hotels Group has a one year low of $91.57 and a one year high of $137.25.

InterContinental Hotels Group Increases Dividend

The company also recently announced a semi-annual dividend, which was paid on Thursday, May 15th. Stockholders of record on Friday, April 4th were paid a dividend of $1.144 per share. The ex-dividend date was Friday, April 4th. This represents a dividend yield of 1.4%. This is a positive change from InterContinental Hotels Group's previous semi-annual dividend of $0.53. InterContinental Hotels Group's dividend payout ratio (DPR) is 39.36%.

About InterContinental Hotels Group

(

Get Free ReportInterContinental Hotels Group PLC owns, manages, franchises, and leases hotels in the Americas, Europe, Asia, the Middle East, Africa, and Greater China. The company operates hotels under the Six Senses, Regent, InterContinental Hotels & Resorts, Vignette Collection, Kimpton Hotels & Restaurants, Hotel Indigo, voco, HUALUXE, Crowne Plaza, Iberostar Beachfront Resorts, EVEN, Holiday Inn Express, Holiday Inn, Garner, avid hotels, Atwell Suites, Staybridge Suites, Iberostar Beachfront Resorts, Holiday Inn Club Vacations, and Candlewood Suites brand names.

Further Reading

Before you consider Intercontinental Hotels Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intercontinental Hotels Group wasn't on the list.

While Intercontinental Hotels Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.