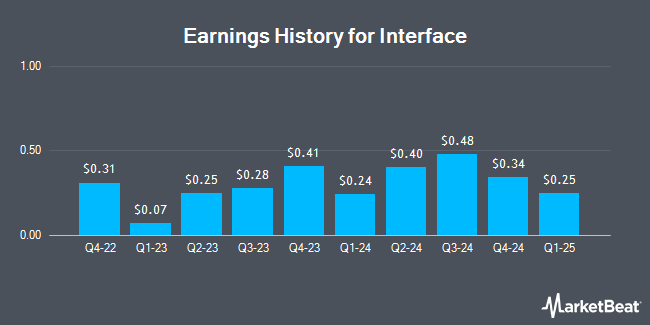

Interface (NASDAQ:TILE - Get Free Report) issued its earnings results on Friday. The textile maker reported $0.25 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.21 by $0.04, Zacks reports. The business had revenue of $297.41 million during the quarter, compared to the consensus estimate of $297.11 million. Interface had a net margin of 6.49% and a return on equity of 19.91%. Interface's revenue was up 2.7% on a year-over-year basis. During the same period last year, the business posted $0.24 EPS. Interface updated its FY 2025 guidance to EPS and its Q2 2025 guidance to EPS.

Interface Price Performance

Interface stock traded up $0.58 during trading hours on Thursday, reaching $20.44. 150,162 shares of the stock were exchanged, compared to its average volume of 522,142. The stock has a 50 day moving average of $19.05 and a two-hundred day moving average of $22.12. The company has a market cap of $1.19 billion, a P/E ratio of 14.29, a price-to-earnings-growth ratio of 0.96 and a beta of 1.95. The company has a current ratio of 2.57, a quick ratio of 1.38 and a debt-to-equity ratio of 0.66. Interface has a twelve month low of $14.13 and a twelve month high of $27.34.

Interface Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, April 11th. Investors of record on Friday, March 28th were paid a $0.01 dividend. This represents a $0.04 dividend on an annualized basis and a yield of 0.20%. The ex-dividend date of this dividend was Friday, March 28th. Interface's dividend payout ratio (DPR) is presently 2.76%.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently weighed in on TILE shares. StockNews.com upgraded Interface from a "hold" rating to a "buy" rating in a research note on Monday, April 28th. Barrington Research reiterated an "outperform" rating and issued a $30.00 price objective on shares of Interface in a research note on Friday, May 2nd.

Get Our Latest Stock Analysis on TILE

Insider Buying and Selling at Interface

In related news, Director Daniel T. Hendrix sold 7,500 shares of Interface stock in a transaction that occurred on Monday, March 3rd. The shares were sold at an average price of $19.95, for a total transaction of $149,625.00. Following the sale, the director now directly owns 96,147 shares of the company's stock, valued at approximately $1,918,132.65. The trade was a 7.24 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Company insiders own 2.30% of the company's stock.

About Interface

(

Get Free Report)

Interface, Inc designs, produces, and sells modular carpet products primarily worldwide. The company operates in two segments, Americas (AMS), and Europe, Africa, Asia and Australia (EAAA). The company offers modular carpets under the Interface and FLOR brand names; luxury vinyl tiles; carpet tiles under the CQuestGB name for use in commercial interiors, include offices, healthcare facilities, airports, educational and other institutions, hospitality spaces, and retail facilities, as well as residential interiors; and modular resilient flooring products.

Further Reading

Before you consider Interface, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Interface wasn't on the list.

While Interface currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.