Interface (NASDAQ:TILE - Get Free Report) is anticipated to release its Q2 2025 earnings data before the market opens on Friday, August 1st. Analysts expect Interface to post earnings of $0.47 per share and revenue of $360.57 million for the quarter. Interface has set its FY 2025 guidance at EPS and its Q2 2025 guidance at EPS.

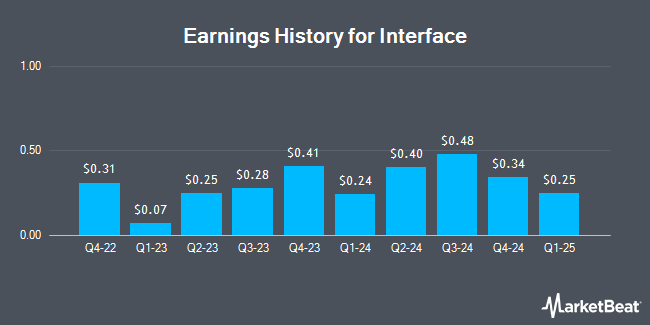

Interface (NASDAQ:TILE - Get Free Report) last posted its quarterly earnings results on Friday, May 2nd. The textile maker reported $0.25 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.21 by $0.04. Interface had a net margin of 6.48% and a return on equity of 17.73%. The business had revenue of $297.41 million during the quarter, compared to the consensus estimate of $297.11 million. During the same quarter last year, the firm posted $0.24 EPS. Interface's revenue was up 2.7% compared to the same quarter last year. On average, analysts expect Interface to post $1 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Interface Stock Up 1.1%

NASDAQ TILE traded up $0.23 during mid-day trading on Friday, hitting $20.90. The company's stock had a trading volume of 276,675 shares, compared to its average volume of 311,265. The company's 50 day simple moving average is $20.74 and its 200 day simple moving average is $20.75. Interface has a twelve month low of $14.75 and a twelve month high of $27.34. The company has a current ratio of 2.76, a quick ratio of 1.42 and a debt-to-equity ratio of 0.59. The firm has a market capitalization of $1.22 billion, a price-to-earnings ratio of 14.41, a PEG ratio of 0.88 and a beta of 1.97.

Interface Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, June 13th. Investors of record on Friday, May 30th were given a $0.01 dividend. This represents a $0.04 annualized dividend and a yield of 0.19%. The ex-dividend date was Friday, May 30th. Interface's payout ratio is currently 2.76%.

Wall Street Analysts Forecast Growth

TILE has been the subject of several research reports. Barrington Research reissued an "outperform" rating and issued a $30.00 price target on shares of Interface in a research report on Tuesday, July 22nd. Wall Street Zen upgraded Interface from a "hold" rating to a "buy" rating in a research note on Saturday, May 10th.

Check Out Our Latest Analysis on Interface

Insiders Place Their Bets

In other Interface news, VP James Poppens sold 19,474 shares of the firm's stock in a transaction on Thursday, May 29th. The stock was sold at an average price of $20.14, for a total transaction of $392,206.36. Following the transaction, the vice president directly owned 130,142 shares in the company, valued at approximately $2,621,059.88. This trade represents a 13.02% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Company insiders own 2.30% of the company's stock.

Hedge Funds Weigh In On Interface

Large investors have recently bought and sold shares of the stock. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC raised its stake in shares of Interface by 6.7% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 151,950 shares of the textile maker's stock worth $3,015,000 after purchasing an additional 9,580 shares during the period. Goldman Sachs Group Inc. raised its stake in shares of Interface by 5.9% during the 1st quarter. Goldman Sachs Group Inc. now owns 748,701 shares of the textile maker's stock worth $14,854,000 after purchasing an additional 42,011 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its stake in shares of Interface by 4.6% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 34,118 shares of the textile maker's stock worth $677,000 after purchasing an additional 1,485 shares during the period. Finally, Royal Bank of Canada raised its stake in shares of Interface by 8.4% during the 1st quarter. Royal Bank of Canada now owns 19,657 shares of the textile maker's stock worth $390,000 after purchasing an additional 1,522 shares during the period. 98.34% of the stock is currently owned by institutional investors.

About Interface

(

Get Free Report)

Interface, Inc designs, produces, and sells modular carpet products primarily worldwide. The company operates in two segments, Americas (AMS), and Europe, Africa, Asia and Australia (EAAA). The company offers modular carpets under the Interface and FLOR brand names; luxury vinyl tiles; carpet tiles under the CQuestGB name for use in commercial interiors, include offices, healthcare facilities, airports, educational and other institutions, hospitality spaces, and retail facilities, as well as residential interiors; and modular resilient flooring products.

See Also

Before you consider Interface, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Interface wasn't on the list.

While Interface currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.