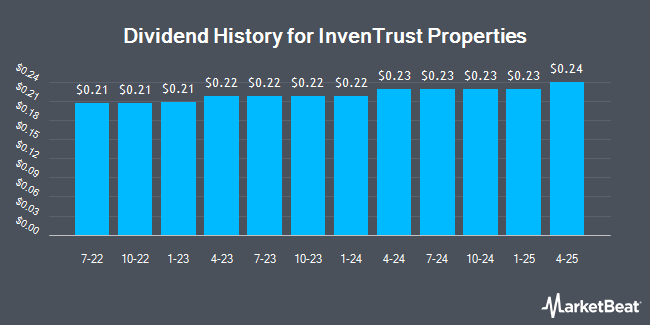

InvenTrust Properties Corp. (NYSE:IVT - Get Free Report) declared a quarterly dividend on Tuesday, September 16th, RTT News reports. Stockholders of record on Tuesday, September 30th will be given a dividend of 0.2377 per share on Wednesday, October 15th. This represents a c) dividend on an annualized basis and a dividend yield of 3.2%. The ex-dividend date is Tuesday, September 30th.

InvenTrust Properties has a payout ratio of 296.9% meaning the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Research analysts expect InvenTrust Properties to earn $1.89 per share next year, which means the company should continue to be able to cover its $0.95 annual dividend with an expected future payout ratio of 50.3%.

InvenTrust Properties Trading Down 0.6%

Shares of IVT stock traded down $0.18 on Friday, reaching $29.68. 916,230 shares of the company's stock were exchanged, compared to its average volume of 371,042. The company's fifty day simple moving average is $28.46 and its 200 day simple moving average is $28.13. InvenTrust Properties has a 52 week low of $25.21 and a 52 week high of $31.65. The company has a current ratio of 5.26, a quick ratio of 5.26 and a debt-to-equity ratio of 0.41. The stock has a market capitalization of $2.30 billion, a PE ratio of 20.61, a P/E/G ratio of 3.25 and a beta of 0.88.

Institutional Trading of InvenTrust Properties

Several institutional investors and hedge funds have recently made changes to their positions in the company. Nuveen LLC purchased a new stake in shares of InvenTrust Properties in the 1st quarter worth approximately $30,620,000. Vision Capital Corp raised its stake in InvenTrust Properties by 182.7% in the second quarter. Vision Capital Corp now owns 989,472 shares of the company's stock worth $27,112,000 after buying an additional 639,472 shares in the last quarter. Balyasny Asset Management L.P. lifted its holdings in InvenTrust Properties by 111.1% during the second quarter. Balyasny Asset Management L.P. now owns 968,157 shares of the company's stock worth $26,528,000 after buying an additional 509,518 shares during the period. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its holdings in InvenTrust Properties by 443.7% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 586,825 shares of the company's stock worth $17,235,000 after buying an additional 478,887 shares during the period. Finally, Aberdeen Group plc boosted its position in InvenTrust Properties by 1,423.7% during the 2nd quarter. Aberdeen Group plc now owns 437,441 shares of the company's stock valued at $11,986,000 after acquiring an additional 408,731 shares in the last quarter. 61.70% of the stock is currently owned by institutional investors.

About InvenTrust Properties

(

Get Free Report)

InvenTrust Properties Corp. (the "Company," "IVT," or "InvenTrust") is a premier Sun Belt, multi-tenant essential retail REIT that owns, leases, redevelops, acquires and manages grocery-anchored neighborhood and community centers as well as high-quality power centers that often have a grocery component.

Featured Articles

Before you consider InvenTrust Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InvenTrust Properties wasn't on the list.

While InvenTrust Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.