Invesco Ltd. cut its stake in shares of Rocket Companies, Inc. (NYSE:RKT - Free Report) by 55.7% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 192,252 shares of the company's stock after selling 241,622 shares during the period. Invesco Ltd.'s holdings in Rocket Companies were worth $2,165,000 as of its most recent SEC filing.

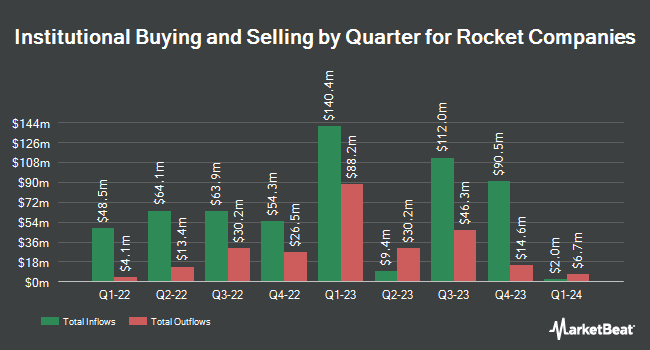

Other hedge funds and other institutional investors have also recently modified their holdings of the company. AXQ Capital LP grew its position in shares of Rocket Companies by 125.7% during the 4th quarter. AXQ Capital LP now owns 146,691 shares of the company's stock valued at $1,652,000 after acquiring an additional 81,695 shares during the period. Vanguard Group Inc. increased its holdings in Rocket Companies by 3.6% in the 4th quarter. Vanguard Group Inc. now owns 12,520,074 shares of the company's stock worth $140,976,000 after acquiring an additional 431,054 shares in the last quarter. Quantbot Technologies LP increased its holdings in Rocket Companies by 76.9% in the 4th quarter. Quantbot Technologies LP now owns 270,761 shares of the company's stock worth $3,049,000 after acquiring an additional 117,728 shares in the last quarter. Charles Schwab Investment Management Inc. raised its stake in Rocket Companies by 11.8% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 1,163,243 shares of the company's stock worth $13,098,000 after acquiring an additional 122,534 shares during the period. Finally, Wellington Management Group LLP lifted its holdings in Rocket Companies by 174.5% during the fourth quarter. Wellington Management Group LLP now owns 4,705,177 shares of the company's stock valued at $52,980,000 after purchasing an additional 2,990,837 shares in the last quarter. 4.59% of the stock is owned by institutional investors.

Rocket Companies Trading Down 3.9 %

Shares of NYSE:RKT traded down $0.50 on Monday, hitting $12.13. 1,028,853 shares of the company's stock were exchanged, compared to its average volume of 8,152,129. Rocket Companies, Inc. has a 12 month low of $10.06 and a 12 month high of $21.38. The business's 50 day simple moving average is $13.39 and its two-hundred day simple moving average is $13.27. The stock has a market capitalization of $24.20 billion, a price-to-earnings ratio of -75.78 and a beta of 2.35. The company has a debt-to-equity ratio of 1.51, a current ratio of 15.47 and a quick ratio of 15.47.

Rocket Companies Cuts Dividend

The company also recently disclosed a dividend, which was paid on Thursday, April 3rd. Investors of record on Thursday, March 20th were paid a $0.80 dividend. The ex-dividend date was Thursday, March 20th. Rocket Companies's dividend payout ratio (DPR) is currently 801.25%.

Wall Street Analysts Forecast Growth

A number of equities research analysts have issued reports on RKT shares. Deutsche Bank Aktiengesellschaft upgraded Rocket Companies from a "hold" rating to a "buy" rating and set a $16.00 price target for the company in a research note on Wednesday, April 2nd. JPMorgan Chase & Co. dropped their price target on Rocket Companies from $14.00 to $10.50 and set an "underweight" rating for the company in a research note on Tuesday, January 14th. UBS Group reduced their price objective on shares of Rocket Companies from $14.00 to $13.00 and set a "neutral" rating on the stock in a research report on Wednesday, April 16th. Keefe, Bruyette & Woods upped their target price on shares of Rocket Companies from $14.00 to $15.00 and gave the stock a "market perform" rating in a research report on Tuesday, April 8th. Finally, Royal Bank of Canada reissued a "sector perform" rating and set a $18.00 price objective on shares of Rocket Companies in a report on Tuesday, April 1st. Two research analysts have rated the stock with a sell rating, eight have assigned a hold rating and two have issued a buy rating to the stock. Based on data from MarketBeat, Rocket Companies presently has an average rating of "Hold" and a consensus target price of $14.38.

Read Our Latest Report on RKT

Rocket Companies Profile

(

Free Report)

Rocket Companies, Inc, a fintech holding company, provides mortgage lending, title and settlement services, and other financial technology services in the United States and Canada. It operates through two segments, Direct to Consumer and Partner Network. The company's solutions include Rocket Mortgage, a mortgage lender; Amrock that provides title insurance, property valuation, and settlement services; Rocket Homes, a home search platform and real estate agent referral network, which offers technology-enabled services to support the home buying and selling experience; and Rocket Loans, an online-based personal loans business.

Featured Stories

Before you consider Rocket Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rocket Companies wasn't on the list.

While Rocket Companies currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.