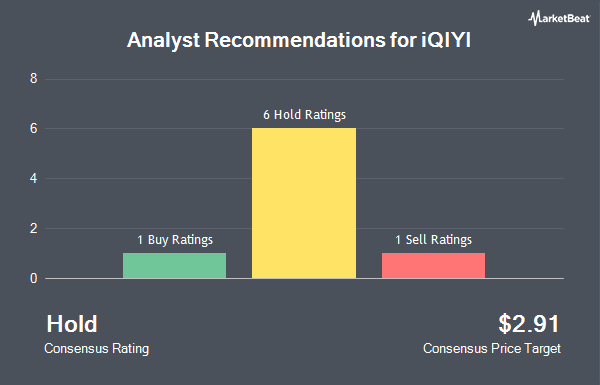

iQIYI (NASDAQ:IQ - Get Free Report) was downgraded by investment analysts at Wall Street Zen from a "hold" rating to a "sell" rating in a research note issued on Saturday.

iQIYI Price Performance

Shares of NASDAQ:IQ traded down $0.04 during trading on Friday, hitting $1.89. 15,827,966 shares of the company were exchanged, compared to its average volume of 20,174,028. The business's 50 day moving average is $1.78 and its 200-day moving average is $1.97. The company has a market capitalization of $1.82 billion, a P/E ratio of 47.26 and a beta of -0.17. The company has a quick ratio of 0.46, a current ratio of 0.46 and a debt-to-equity ratio of 0.61. iQIYI has a 1-year low of $1.50 and a 1-year high of $3.40.

iQIYI (NASDAQ:IQ - Get Free Report) last issued its quarterly earnings results on Wednesday, May 21st. The company reported $0.03 earnings per share for the quarter, missing analysts' consensus estimates of $0.05 by ($0.02). iQIYI had a return on equity of 3.62% and a net margin of 1.02%. The business had revenue of $988.19 million for the quarter, compared to analyst estimates of $7.10 billion. Equities analysts forecast that iQIYI will post 0.04 earnings per share for the current year.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the business. Corient Private Wealth LLC grew its position in iQIYI by 37.3% in the fourth quarter. Corient Private Wealth LLC now owns 28,138 shares of the company's stock worth $57,000 after acquiring an additional 7,645 shares in the last quarter. American Century Companies Inc. raised its stake in shares of iQIYI by 5.6% during the fourth quarter. American Century Companies Inc. now owns 1,904,565 shares of the company's stock valued at $3,828,000 after acquiring an additional 101,241 shares during the last quarter. Vanguard Group Inc. raised its stake in iQIYI by 2.8% in the fourth quarter. Vanguard Group Inc. now owns 18,293,085 shares of the company's stock worth $36,769,000 after buying an additional 502,154 shares in the last quarter. Mitsubishi UFJ Trust & Banking Corp raised its stake in iQIYI by 263.2% in the fourth quarter. Mitsubishi UFJ Trust & Banking Corp now owns 283,532 shares of the company's stock worth $570,000 after buying an additional 205,470 shares in the last quarter. Finally, Norges Bank purchased a new stake in iQIYI in the fourth quarter worth about $3,914,000. 52.69% of the stock is currently owned by hedge funds and other institutional investors.

iQIYI Company Profile

(

Get Free Report)

iQIYI, Inc, together with its subsidiaries, provides online entertainment video services in the People's Republic of China. It offers various products and services, including online video, online games, online literature, animations, and other products. The company operates a platform that provides a collection of internet video content, such as professionally produced content licensed from professional content providers and self-produced content.

See Also

Before you consider iQIYI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and iQIYI wasn't on the list.

While iQIYI currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.