Ivanhoe Mines Ltd. (OTCMKTS:IVPAF - Free Report) - Investment analysts at Stifel Canada dropped their FY2029 EPS estimates for shares of Ivanhoe Mines in a report released on Tuesday, September 23rd. Stifel Canada analyst R. Profiti now forecasts that the company will post earnings of $0.63 per share for the year, down from their prior estimate of $0.66. Stifel Canada has a "Strong-Buy" rating on the stock.

A number of other brokerages have also commented on IVPAF. TD Securities upgraded shares of Ivanhoe Mines to a "strong-buy" rating in a research note on Tuesday, June 3rd. Raymond James Financial upgraded shares of Ivanhoe Mines to a "moderate buy" rating in a report on Monday, June 30th. Citigroup upgraded shares of Ivanhoe Mines to a "strong-buy" rating in a report on Monday, June 16th. Royal Bank Of Canada upgraded shares of Ivanhoe Mines to a "moderate buy" rating in a report on Tuesday, June 17th. Finally, UBS Group upgraded shares of Ivanhoe Mines to a "strong-buy" rating in a report on Thursday, June 12th. Five analysts have rated the stock with a Strong Buy rating and one has assigned a Hold rating to the company's stock. According to data from MarketBeat, Ivanhoe Mines presently has an average rating of "Strong Buy".

Check Out Our Latest Stock Report on Ivanhoe Mines

Ivanhoe Mines Trading Down 4.3%

Shares of IVPAF stock opened at $9.87 on Friday. The firm has a market capitalization of $13.36 billion and a PE ratio of 19.95. The firm has a fifty day simple moving average of $8.65 and a two-hundred day simple moving average of $8.70. Ivanhoe Mines has a 12 month low of $6.50 and a 12 month high of $15.53.

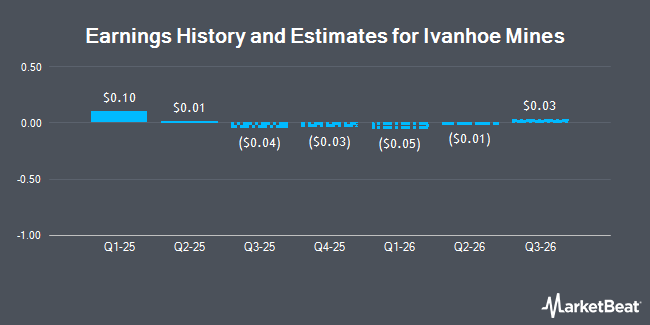

Ivanhoe Mines (OTCMKTS:IVPAF - Get Free Report) last announced its quarterly earnings results on Wednesday, July 30th. The company reported $0.03 EPS for the quarter, missing analysts' consensus estimates of $0.04 by ($0.01). The business had revenue of $96.76 million for the quarter, compared to analyst estimates of $101.84 million.

Ivanhoe Mines Company Profile

(

Get Free Report)

Ivanhoe Mines Ltd. engages in the mining, development, and exploration of minerals and precious metals primarily in Africa. It explores for platinum, palladium, nickel, copper, gold, rhodium, zinc, silver, germanium, and lead deposits. The company's projects include the Platreef project located in the Northern Limb of South Africa's Bushveld Complex; the Kipushi project located in Haut-Katanga Province, Democratic Republic of Congo; and the Kamoa-Kakula project located within the Central African Copperbelt.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ivanhoe Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ivanhoe Mines wasn't on the list.

While Ivanhoe Mines currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.