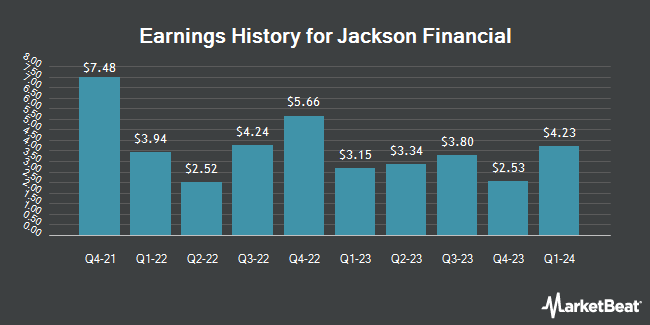

Jackson Financial (NYSE:JXN - Get Free Report) announced its quarterly earnings results on Tuesday. The company reported $4.87 earnings per share for the quarter, topping analysts' consensus estimates of $4.61 by $0.26, Zacks reports. Jackson Financial had a net margin of 1.73% and a return on equity of 14.73%. The firm had revenue of ($471.00) million during the quarter, compared to analysts' expectations of $1.77 billion. During the same period in the prior year, the company earned $5.32 EPS. The firm's revenue was down 3.3% on a year-over-year basis.

Jackson Financial Stock Performance

Shares of JXN traded up $1.54 during mid-day trading on Friday, reaching $90.46. 437,454 shares of the company's stock traded hands, compared to its average volume of 774,546. The company has a debt-to-equity ratio of 0.46, a quick ratio of 0.29 and a current ratio of 0.28. The business's 50-day moving average price is $86.35 and its 200-day moving average price is $84.89. The stock has a market capitalization of $6.46 billion, a P/E ratio of -1,507.38 and a beta of 1.46. Jackson Financial has a 12 month low of $64.70 and a 12 month high of $115.22.

Jackson Financial Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, September 25th. Stockholders of record on Monday, September 15th will be issued a dividend of $0.80 per share. This represents a $3.20 dividend on an annualized basis and a dividend yield of 3.5%. The ex-dividend date of this dividend is Monday, September 15th. Jackson Financial's payout ratio is -5,333.33%.

Wall Street Analysts Forecast Growth

JXN has been the topic of several recent research reports. Keefe, Bruyette & Woods boosted their price target on Jackson Financial from $100.00 to $102.00 and gave the stock a "market perform" rating in a research report on Wednesday, July 9th. Barclays boosted their price objective on Jackson Financial from $108.00 to $114.00 and gave the company an "overweight" rating in a report on Monday, July 7th. Finally, Morgan Stanley set a $91.00 price objective on shares of Jackson Financial and gave the stock an "equal weight" rating in a research note on Monday, May 19th.

Get Our Latest Research Report on Jackson Financial

Institutional Trading of Jackson Financial

Several large investors have recently added to or reduced their stakes in the business. Integrated Wealth Concepts LLC increased its stake in shares of Jackson Financial by 33.2% during the first quarter. Integrated Wealth Concepts LLC now owns 5,471 shares of the company's stock valued at $458,000 after acquiring an additional 1,363 shares during the period. Woodline Partners LP bought a new position in Jackson Financial during the 1st quarter valued at $4,081,000. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC increased its position in shares of Jackson Financial by 3.6% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 210,836 shares of the company's stock valued at $17,664,000 after purchasing an additional 7,380 shares during the period. 89.96% of the stock is currently owned by institutional investors and hedge funds.

Jackson Financial Company Profile

(

Get Free Report)

Jackson Financial Inc, through its subsidiaries, provides suite of annuities to retail investors in the United States. The company operates through three segments: Retail Annuities, Institutional Products, and Closed Life and Annuity Blocks. The Retail Annuities segment offers various retirement income and savings products, including variable, fixed index, fixed, and payout annuities, as well as registered index-linked annuities and lifetime income solutions.

Recommended Stories

Before you consider Jackson Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jackson Financial wasn't on the list.

While Jackson Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.