Saputo (TSE:SAP - Get Free Report) had its price objective raised by equities research analysts at Jefferies Financial Group from C$38.00 to C$40.00 in a research note issued on Wednesday,BayStreet.CA reports. The brokerage presently has a "buy" rating on the stock. Jefferies Financial Group's price target would indicate a potential upside of 14.03% from the company's previous close.

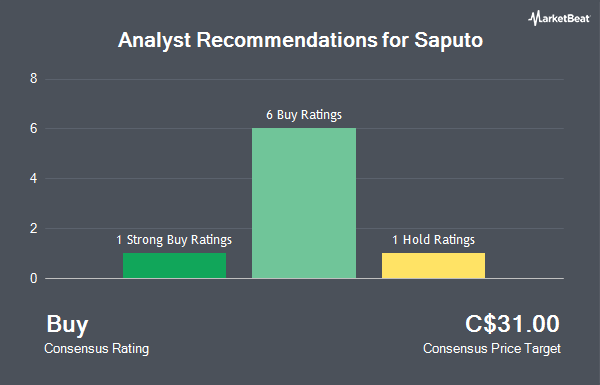

Several other research analysts have also recently weighed in on the company. National Bankshares lifted their price target on Saputo from C$29.00 to C$35.00 and gave the company an "outperform" rating in a research report on Monday, August 11th. BMO Capital Markets lifted their price target on Saputo from C$27.00 to C$34.00 in a research report on Monday, August 11th. Desjardins lifted their price target on Saputo from C$31.00 to C$36.00 and gave the company a "buy" rating in a research report on Monday, August 11th. TD Securities lifted their price target on Saputo from C$35.00 to C$38.00 and gave the company a "buy" rating in a research report on Monday, August 11th. Finally, Royal Bank Of Canada lifted their price target on Saputo from C$35.00 to C$37.00 and gave the company an "outperform" rating in a research report on Friday, August 8th. Six research analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of C$35.75.

Check Out Our Latest Report on Saputo

Saputo Stock Performance

Shares of Saputo stock traded up C$0.70 on Wednesday, reaching C$35.08. 421,997 shares of the stock were exchanged, compared to its average volume of 713,880. The company has a quick ratio of 0.67, a current ratio of 1.53 and a debt-to-equity ratio of 51.68. Saputo has a twelve month low of C$22.59 and a twelve month high of C$35.10. The firm has a market capitalization of C$14.46 billion, a price-to-earnings ratio of -103.18, a PEG ratio of 0.56 and a beta of 0.07. The business has a 50 day moving average price of C$33.74 and a two-hundred day moving average price of C$29.36.

Insider Activity at Saputo

In other Saputo news, insider Leanne Cutts purchased 4,000 shares of the firm's stock in a transaction dated Friday, August 15th. The shares were acquired at an average price of C$32.93 per share, with a total value of C$131,720.00. Following the purchase, the insider directly owned 23,500 shares in the company, valued at approximately C$773,855. This trade represents a 20.51% increase in their position. 40.45% of the stock is currently owned by company insiders.

Saputo Company Profile

(

Get Free Report)

Saputo is a global dairy processor domiciled in Canada (28% of fiscal 2022 sales) with operations in the United States (43%), the U.K. (6%), and other international markets (23%). It sells cheese, cream, fluid milk, and other dairy products. In the retail segment (50% of revenue), its mix of brands include Saputo, Armstrong, Cheer, Cathedral City, and Frylight.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Saputo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saputo wasn't on the list.

While Saputo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.