Jefferies Financial Group Inc. purchased a new stake in Summit Therapeutics Inc. (NASDAQ:SMMT - Free Report) in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 45,001 shares of the company's stock, valued at approximately $803,000.

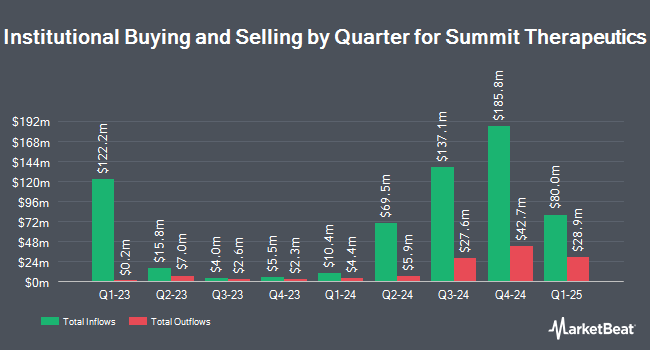

Other hedge funds have also bought and sold shares of the company. Griffin Asset Management Inc. grew its position in Summit Therapeutics by 63.3% in the 4th quarter. Griffin Asset Management Inc. now owns 110,660 shares of the company's stock valued at $1,975,000 after purchasing an additional 42,900 shares during the period. SeaCrest Wealth Management LLC acquired a new stake in Summit Therapeutics in the 4th quarter valued at $444,000. China Universal Asset Management Co. Ltd. boosted its holdings in Summit Therapeutics by 12.2% during the 4th quarter. China Universal Asset Management Co. Ltd. now owns 156,366 shares of the company's stock worth $2,790,000 after acquiring an additional 17,014 shares during the last quarter. Wells Fargo & Company MN boosted its holdings in Summit Therapeutics by 79.2% during the 4th quarter. Wells Fargo & Company MN now owns 95,265 shares of the company's stock worth $1,700,000 after acquiring an additional 42,090 shares during the last quarter. Finally, Principal Financial Group Inc. boosted its holdings in Summit Therapeutics by 252.8% during the 4th quarter. Principal Financial Group Inc. now owns 205,150 shares of the company's stock worth $3,661,000 after acquiring an additional 147,003 shares during the last quarter. Institutional investors and hedge funds own 4.61% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms have issued reports on SMMT. Jefferies Financial Group set a $44.00 price objective on shares of Summit Therapeutics and gave the stock a "buy" rating in a report on Friday, April 25th. Citigroup raised shares of Summit Therapeutics from a "neutral" rating to a "buy" rating and lifted their price objective for the stock from $23.00 to $35.00 in a report on Wednesday, March 26th. The Goldman Sachs Group lifted their price objective on shares of Summit Therapeutics from $37.00 to $41.00 and gave the stock a "buy" rating in a report on Friday, May 2nd. JMP Securities reaffirmed a "market outperform" rating and set a $40.00 price objective on shares of Summit Therapeutics in a report on Monday, April 28th. Finally, StockNews.com raised shares of Summit Therapeutics from a "sell" rating to a "hold" rating in a report on Tuesday, May 13th. One research analyst has rated the stock with a hold rating, ten have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, Summit Therapeutics has a consensus rating of "Buy" and a consensus price target of $37.40.

Check Out Our Latest Research Report on SMMT

Summit Therapeutics Trading Up 3.2%

Shares of NASDAQ:SMMT traded up $0.79 during midday trading on Wednesday, reaching $25.18. The company had a trading volume of 883,336 shares, compared to its average volume of 3,874,556. Summit Therapeutics Inc. has a 52-week low of $2.10 and a 52-week high of $36.91. The company's 50 day moving average price is $22.67 and its 200 day moving average price is $20.61. The stock has a market cap of $18.70 billion, a P/E ratio of -89.60 and a beta of -0.94.

Summit Therapeutics (NASDAQ:SMMT - Get Free Report) last announced its quarterly earnings data on Thursday, May 1st. The company reported ($0.09) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.10) by $0.01. Research analysts forecast that Summit Therapeutics Inc. will post -0.3 EPS for the current fiscal year.

Summit Therapeutics Profile

(

Free Report)

Summit Therapeutics Inc, a biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies in the United States, and the United Kingdom. The company's lead development candidate is Ivonescimab, a bispecific antibody for immunotherapy through blockade of PD-1 with the anti-angiogenesis; and anti-infectives portfolio includes SMT-738, a novel class of precision antibiotics for the treatment of multidrug resistant infections, which primarily includes carbapenem-resistant Enterobacteriaceae infections.

Further Reading

Before you consider Summit Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Summit Therapeutics wasn't on the list.

While Summit Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.