Fortis (TSE:FTS - Get Free Report) had its price objective increased by Jefferies Financial Group from C$70.00 to C$72.00 in a research report issued on Monday,BayStreet.CA reports. Jefferies Financial Group's price target points to a potential upside of 5.98% from the stock's current price.

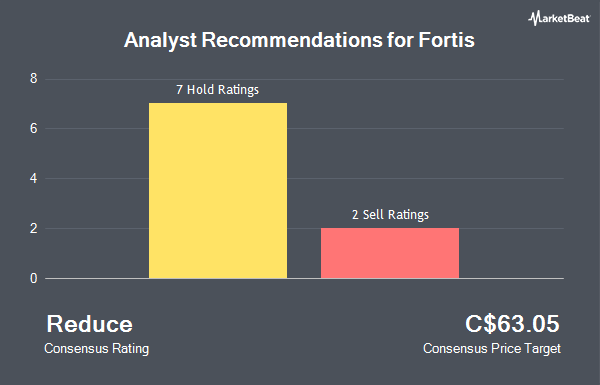

Other analysts also recently issued reports about the company. Raymond James Financial boosted their target price on Fortis from C$69.00 to C$72.00 and gave the stock an "outperform" rating in a research report on Tuesday, August 5th. Desjardins upgraded Fortis from a "hold" rating to a "moderate buy" rating and upped their price objective for the company from C$71.00 to C$76.00 in a research report on Tuesday, August 5th. Cibc World Mkts upgraded Fortis from a "hold" rating to a "strong-buy" rating in a research report on Monday, July 21st. TD Securities upped their price objective on Fortis from C$74.00 to C$77.00 and gave the company a "buy" rating in a research report on Tuesday, August 5th. Finally, National Bankshares upped their price objective on Fortis from C$65.00 to C$67.00 and gave the company a "sector perform" rating in a research report on Tuesday, August 5th. One research analyst has rated the stock with a Strong Buy rating, two have given a Buy rating, five have assigned a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat, Fortis presently has an average rating of "Hold" and a consensus price target of C$69.80.

Check Out Our Latest Analysis on Fortis

Fortis Price Performance

FTS traded up C$0.56 during trading on Monday, reaching C$67.94. 2,735,799 shares of the stock were exchanged, compared to its average volume of 1,621,206. The business's 50 day moving average price is C$68.04 and its two-hundred day moving average price is C$66.29. The company has a debt-to-equity ratio of 142.31, a current ratio of 0.74 and a quick ratio of 0.36. The company has a market capitalization of C$34.21 billion, a price-to-earnings ratio of 19.98, a P/E/G ratio of 3.01 and a beta of 0.38. Fortis has a 1 year low of C$57.98 and a 1 year high of C$71.02.

Fortis Company Profile

(

Get Free Report)

Fortis owns and operates 10 utility transmission and distribution assets in Canada and the United States, serving more than 3.4 million electricity and gas customers. The company has smaller stakes in electricity generation and several Caribbean utilities. ITC operates electric transmission in seven U.S.

Featured Stories

Before you consider Fortis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortis wasn't on the list.

While Fortis currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.