JELD-WEN (NYSE:JELD - Free Report) had its target price lifted by Barclays from $4.50 to $5.00 in a research note published on Thursday morning,Benzinga reports. Barclays currently has an equal weight rating on the stock.

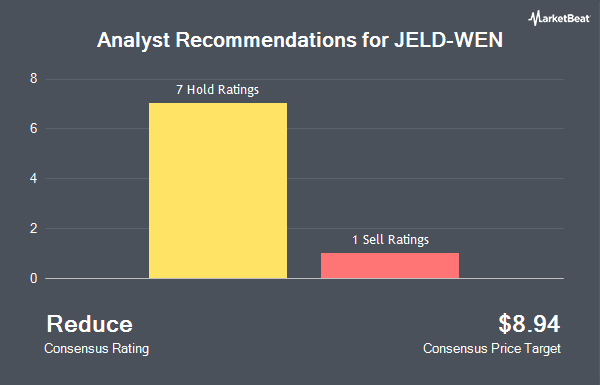

A number of other brokerages also recently issued reports on JELD. Royal Bank Of Canada cut their price objective on JELD-WEN from $5.00 to $2.00 and set an "underperform" rating for the company in a research report on Wednesday, May 7th. Wall Street Zen downgraded JELD-WEN from a "hold" rating to a "sell" rating in a research report on Wednesday, May 14th. Loop Capital dropped their target price on JELD-WEN from $8.00 to $4.00 and set a "hold" rating for the company in a research report on Thursday, May 8th. The Goldman Sachs Group dropped their target price on JELD-WEN from $6.00 to $5.25 and set a "neutral" rating for the company in a research report on Wednesday, May 7th. Finally, UBS Group dropped their target price on JELD-WEN from $7.50 to $5.00 and set a "neutral" rating for the company in a research report on Wednesday, May 7th. One research analyst has rated the stock with a sell rating and eight have assigned a hold rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $7.50.

Check Out Our Latest Research Report on JELD

JELD-WEN Trading Down 4.1%

Shares of NYSE:JELD traded down $0.22 during midday trading on Thursday, reaching $5.21. 1,473,176 shares of the company's stock were exchanged, compared to its average volume of 1,523,579. The firm's 50 day simple moving average is $4.29 and its two-hundred day simple moving average is $5.38. The company has a debt-to-equity ratio of 2.56, a current ratio of 1.87 and a quick ratio of 1.12. The stock has a market cap of $444.76 million, a price-to-earnings ratio of -1.28 and a beta of 1.65. JELD-WEN has a fifty-two week low of $3.27 and a fifty-two week high of $16.43.

Hedge Funds Weigh In On JELD-WEN

Several hedge funds and other institutional investors have recently made changes to their positions in JELD. Leavell Investment Management Inc. lifted its stake in JELD-WEN by 14.0% during the first quarter. Leavell Investment Management Inc. now owns 17,107 shares of the company's stock worth $102,000 after purchasing an additional 2,107 shares during the last quarter. SummerHaven Investment Management LLC lifted its stake in JELD-WEN by 4.5% in the second quarter. SummerHaven Investment Management LLC now owns 62,381 shares of the company's stock valued at $245,000 after buying an additional 2,661 shares during the last quarter. MetLife Investment Management LLC lifted its stake in JELD-WEN by 6.3% in the fourth quarter. MetLife Investment Management LLC now owns 51,911 shares of the company's stock valued at $425,000 after buying an additional 3,066 shares during the last quarter. Intech Investment Management LLC lifted its stake in JELD-WEN by 12.3% in the second quarter. Intech Investment Management LLC now owns 40,648 shares of the company's stock valued at $159,000 after buying an additional 4,455 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD increased its holdings in shares of JELD-WEN by 10.9% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 50,261 shares of the company's stock valued at $412,000 after purchasing an additional 4,944 shares during the period. Hedge funds and other institutional investors own 95.04% of the company's stock.

About JELD-WEN

(

Get Free Report)

JELD-WEN Holding, Inc designs, manufactures, and sells wood, metal, and composite materials doors, windows, and related building products in North America and Europe. The company offers a line of residential interior and exterior door products, including patio doors, and folding or sliding wall systems; non-residential doors; stile and rail doors; and wood, vinyl, and wood composite windows.

Read More

Before you consider JELD-WEN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JELD-WEN wasn't on the list.

While JELD-WEN currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.