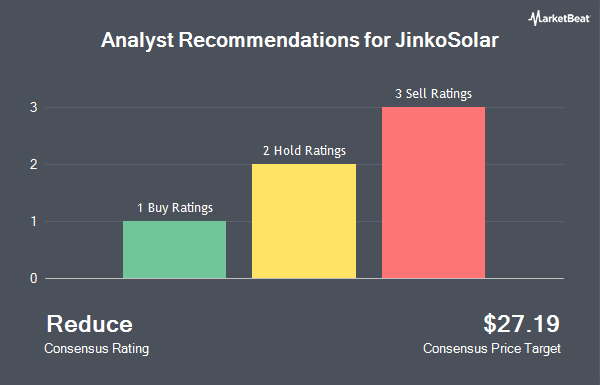

Wall Street Zen cut shares of JinkoSolar (NYSE:JKS - Free Report) from a hold rating to a sell rating in a report published on Saturday.

JinkoSolar Trading Down 0.4%

NYSE:JKS traded down $0.10 during mid-day trading on Friday, reaching $25.16. The company's stock had a trading volume of 60,402 shares, compared to its average volume of 745,718. The company's fifty day simple moving average is $23.42 and its two-hundred day simple moving average is $20.75. The company has a debt-to-equity ratio of 1.11, a current ratio of 1.33 and a quick ratio of 1.07. JinkoSolar has a twelve month low of $13.42 and a twelve month high of $37.36. The stock has a market cap of $1.30 billion, a P/E ratio of -5.02 and a beta of 0.13.

Hedge Funds Weigh In On JinkoSolar

Hedge funds and other institutional investors have recently modified their holdings of the company. MTM Investment Management LLC acquired a new position in shares of JinkoSolar in the 2nd quarter valued at about $28,000. Banque Cantonale Vaudoise acquired a new position in shares of JinkoSolar in the 1st quarter valued at about $36,000. Raymond James Financial Inc. acquired a new position in shares of JinkoSolar in the 2nd quarter valued at about $47,000. Caitong International Asset Management Co. Ltd lifted its stake in shares of JinkoSolar by 502.4% in the 1st quarter. Caitong International Asset Management Co. Ltd now owns 5,470 shares of the semiconductor company's stock valued at $102,000 after purchasing an additional 4,562 shares in the last quarter. Finally, JPMorgan Chase & Co. lifted its stake in shares of JinkoSolar by 7,759.6% in the 2nd quarter. JPMorgan Chase & Co. now owns 11,082 shares of the semiconductor company's stock valued at $235,000 after purchasing an additional 10,941 shares in the last quarter. 35.82% of the stock is owned by institutional investors and hedge funds.

About JinkoSolar

(

Get Free Report)

JinkoSolar Holding Co, Ltd., together with its subsidiaries, engages in the design, development, production, and marketing of photovoltaic products. The company offers solar modules, silicon wafers, solar cells, recovered silicon materials, and silicon ingots. It also provides solar system integration services; solar power generation and solar system EPC services; and energy storage system, as well as undertakes solar power projects.

Featured Stories

Before you consider JinkoSolar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JinkoSolar wasn't on the list.

While JinkoSolar currently has a Strong Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.