Abivax (NASDAQ:ABVX - Free Report) had its price objective upped by JMP Securities from $33.00 to $95.00 in a report published on Wednesday morning,Benzinga reports. They currently have a market outperform rating on the stock.

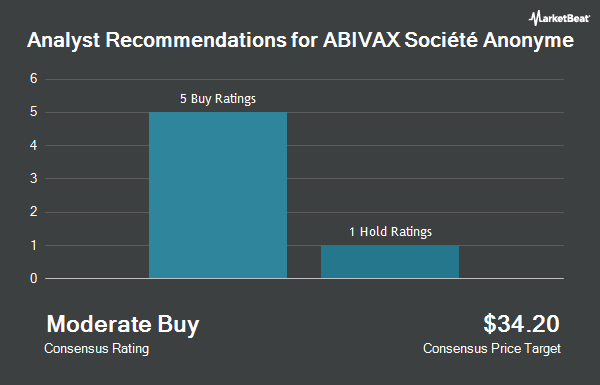

Separately, Citigroup reissued a "market outperform" rating on shares of Abivax in a report on Friday, July 18th. Eight analysts have rated the stock with a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Buy" and a consensus price target of $80.00.

View Our Latest Research Report on ABVX

Abivax Price Performance

ABVX stock traded down $3.27 during mid-day trading on Wednesday, reaching $66.49. 3,538,569 shares of the company's stock were exchanged, compared to its average volume of 2,638,802. The stock's 50 day moving average is $11.03 and its 200 day moving average is $8.11. The company has a debt-to-equity ratio of 1.29, a quick ratio of 1.25 and a current ratio of 1.25. Abivax has a 12-month low of $4.77 and a 12-month high of $72.90.

Institutional Investors Weigh In On Abivax

Several hedge funds and other institutional investors have recently made changes to their positions in the stock. Bank of America Corp DE boosted its position in shares of Abivax by 56.1% during the fourth quarter. Bank of America Corp DE now owns 5,536 shares of the company's stock worth $41,000 after buying an additional 1,990 shares during the period. Cubist Systematic Strategies LLC increased its position in shares of Abivax by 34.3% during the first quarter. Cubist Systematic Strategies LLC now owns 10,152 shares of the company's stock worth $63,000 after purchasing an additional 2,595 shares in the last quarter. Ameriprise Financial Inc. acquired a new position in Abivax in the 4th quarter valued at about $85,000. Guggenheim Capital LLC purchased a new stake in shares of Abivax during the 4th quarter worth approximately $92,000. Finally, Stonepine Capital Management LLC purchased a new stake in shares of Abivax during the 4th quarter worth approximately $110,000. Institutional investors and hedge funds own 47.91% of the company's stock.

Abivax Company Profile

(

Get Free Report)

ABIVAX Société Anonyme, a clinical-stage biotechnology company, focuses on developing therapeutics that harness the body's natural regulatory mechanisms to stablize the immune response in patients with chronic inflammatory diseases. The company is evaluating its lead drug candidate, obefazimod, in Phase 3 clinical trials for the treatment of moderately to severely active ulcerative colitis in adults.

Featured Stories

Before you consider Abivax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abivax wasn't on the list.

While Abivax currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.