Crinetics Pharmaceuticals (NASDAQ:CRNX - Get Free Report) had its price target lowered by research analysts at JMP Securities from $90.00 to $86.00 in a research report issued to clients and investors on Monday,Benzinga reports. The brokerage currently has a "market outperform" rating on the stock. JMP Securities' target price indicates a potential upside of 184.84% from the stock's previous close.

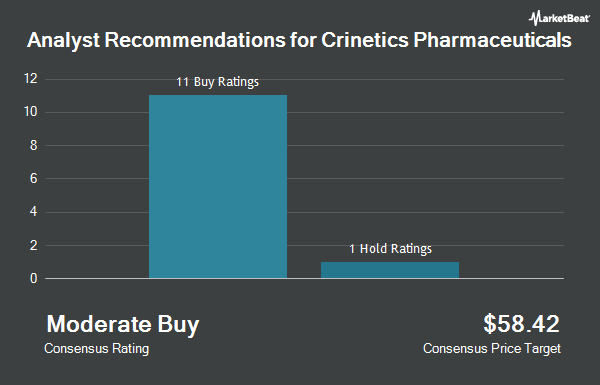

A number of other research analysts have also recently issued reports on the stock. The Goldman Sachs Group began coverage on shares of Crinetics Pharmaceuticals in a report on Thursday, July 10th. They issued a "neutral" rating and a $36.00 price target for the company. HC Wainwright restated a "buy" rating and set a $81.00 price target on shares of Crinetics Pharmaceuticals in a research report on Friday, June 27th. Two research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $68.86.

Check Out Our Latest Report on Crinetics Pharmaceuticals

Crinetics Pharmaceuticals Stock Performance

CRNX traded up $0.50 during trading on Monday, hitting $30.19. The stock had a trading volume of 347,797 shares, compared to its average volume of 942,322. The company has a market capitalization of $2.84 billion, a PE ratio of -7.34 and a beta of 0.33. Crinetics Pharmaceuticals has a twelve month low of $24.10 and a twelve month high of $62.53. The stock has a 50 day simple moving average of $30.33 and a two-hundred day simple moving average of $32.07.

Crinetics Pharmaceuticals (NASDAQ:CRNX - Get Free Report) last announced its earnings results on Thursday, August 7th. The company reported ($1.23) earnings per share for the quarter, missing the consensus estimate of ($1.13) by ($0.10). The business had revenue of $1.03 million for the quarter, compared to the consensus estimate of $0.52 million. The firm's quarterly revenue was up 158.4% compared to the same quarter last year. During the same period last year, the business posted ($0.94) EPS. On average, equities research analysts anticipate that Crinetics Pharmaceuticals will post -3.73 EPS for the current year.

Insiders Place Their Bets

In other Crinetics Pharmaceuticals news, insider Stephen F. Betz sold 97,483 shares of Crinetics Pharmaceuticals stock in a transaction dated Thursday, June 12th. The shares were sold at an average price of $32.23, for a total transaction of $3,141,877.09. Following the transaction, the insider directly owned 99,713 shares of the company's stock, valued at $3,213,749.99. The trade was a 49.43% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 4.60% of the company's stock.

Hedge Funds Weigh In On Crinetics Pharmaceuticals

Institutional investors have recently bought and sold shares of the company. State of Wyoming acquired a new position in shares of Crinetics Pharmaceuticals in the fourth quarter valued at approximately $50,000. Raymond James Financial Inc. acquired a new position in shares of Crinetics Pharmaceuticals in the second quarter valued at approximately $45,000. Penserra Capital Management LLC acquired a new position in shares of Crinetics Pharmaceuticals in the second quarter valued at approximately $48,000. GF Fund Management CO. LTD. acquired a new position in shares of Crinetics Pharmaceuticals in the fourth quarter valued at approximately $100,000. Finally, Kestra Investment Management LLC acquired a new position in shares of Crinetics Pharmaceuticals in the first quarter valued at approximately $95,000. 98.51% of the stock is owned by hedge funds and other institutional investors.

Crinetics Pharmaceuticals Company Profile

(

Get Free Report)

Crinetics Pharmaceuticals, Inc, a clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors. The company's lead product candidate is paltusotine, an oral selective nonpeptide somatostatin receptor type 2 agonist, which is in Phase 3 trial for the treatment of acromegaly; and Phase 2 trial for treating carcinoid syndrome associated with neuroendocrine tumors.

Featured Stories

Before you consider Crinetics Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crinetics Pharmaceuticals wasn't on the list.

While Crinetics Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.