Altimmune (NASDAQ:ALT - Free Report) had its price objective decreased by JMP Securities from $25.00 to $15.00 in a research report released on Thursday morning,Benzinga reports. JMP Securities currently has a market outperform rating on the stock.

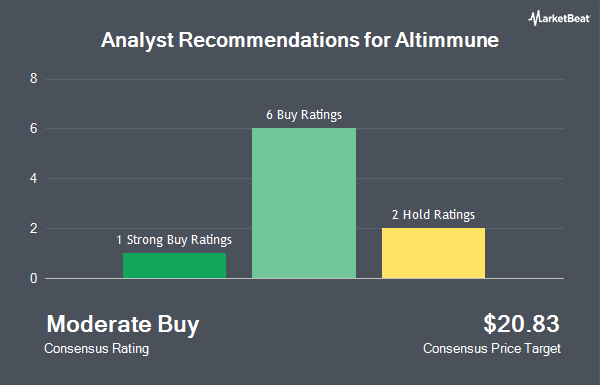

ALT has been the subject of several other research reports. HC Wainwright reaffirmed a "buy" rating and issued a $12.00 target price on shares of Altimmune in a research report on Friday, June 27th. Wall Street Zen cut Altimmune from a "hold" rating to a "sell" rating in a research report on Saturday, June 14th. Finally, William Blair reaffirmed a "market perform" rating on shares of Altimmune in a research report on Friday, June 27th. Two research analysts have rated the stock with a sell rating, one has given a hold rating, five have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, Altimmune has a consensus rating of "Moderate Buy" and a consensus price target of $18.20.

Read Our Latest Research Report on ALT

Altimmune Price Performance

Shares of ALT traded down $0.26 during trading hours on Thursday, hitting $4.14. 4,145,523 shares of the company were exchanged, compared to its average volume of 3,371,841. The company has a market capitalization of $335.80 million, a PE ratio of -3.29 and a beta of 0.47. The firm has a fifty day simple moving average of $5.62 and a 200-day simple moving average of $5.82. Altimmune has a one year low of $2.90 and a one year high of $11.16.

Altimmune (NASDAQ:ALT - Get Free Report) last issued its earnings results on Tuesday, May 13th. The company reported ($0.26) EPS for the quarter, topping the consensus estimate of ($0.35) by $0.09. The business had revenue of $0.01 million during the quarter, compared to analysts' expectations of $0.00 million. Altimmune had a negative return on equity of 65.44% and a negative net margin of 451,200.00%. During the same quarter last year, the firm posted ($0.34) earnings per share. Sell-side analysts expect that Altimmune will post -1.35 EPS for the current year.

Institutional Trading of Altimmune

Several hedge funds and other institutional investors have recently modified their holdings of the company. GAMMA Investing LLC raised its holdings in Altimmune by 214.2% during the first quarter. GAMMA Investing LLC now owns 6,745 shares of the company's stock valued at $34,000 after buying an additional 4,598 shares in the last quarter. Virtus ETF Advisers LLC bought a new position in Altimmune during the fourth quarter valued at about $60,000. Magnus Financial Group LLC bought a new position in Altimmune during the first quarter valued at about $50,000. Geneos Wealth Management Inc. bought a new position in Altimmune during the first quarter valued at about $50,000. Finally, Headland Capital LLC bought a new position in Altimmune during the first quarter valued at about $50,000. 78.05% of the stock is currently owned by hedge funds and other institutional investors.

Altimmune Company Profile

(

Get Free Report)

Altimmune, Inc, a clinical stage biopharmaceutical company, focuses on developing treatments for obesity and liver diseases. The company's lead product candidate, pemvidutide, a GLP-1/glucagon dual receptor agonist that is in Phase 2 trial for the treatment of obesity and metabolic dysfunction-associated steatohepatitis.

Featured Articles

Before you consider Altimmune, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altimmune wasn't on the list.

While Altimmune currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.