GDS (NASDAQ:GDS - Get Free Report)'s stock had its "market outperform" rating reissued by JMP Securities in a research report issued on Wednesday,Benzinga reports. They presently have a $40.00 target price on the stock. JMP Securities' price objective suggests a potential upside of 40.35% from the company's current price.

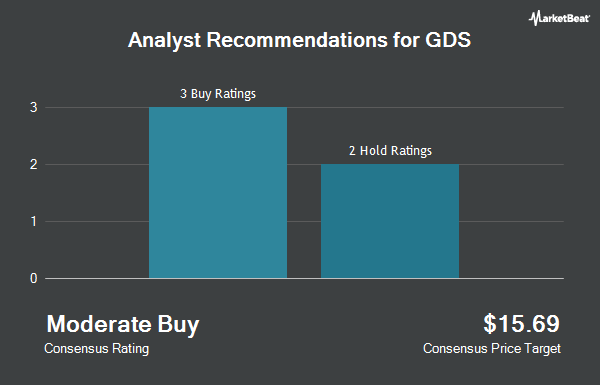

A number of other equities research analysts have also recently commented on the stock. Wall Street Zen cut shares of GDS from a "hold" rating to a "sell" rating in a research note on Friday, February 28th. Citizens Jmp upgraded shares of GDS to a "strong-buy" rating in a research report on Monday, January 27th. Daiwa Capital Markets upgraded GDS from a "neutral" rating to a "buy" rating in a research report on Tuesday, February 11th. Royal Bank of Canada downgraded GDS from an "outperform" rating to a "sector perform" rating and upped their price objective for the company from $26.00 to $37.00 in a research report on Tuesday, February 25th. Finally, Jefferies Financial Group upgraded GDS from a "hold" rating to a "buy" rating and set a $45.00 price target for the company in a report on Tuesday, March 18th. Two equities research analysts have rated the stock with a hold rating, five have issued a buy rating and three have given a strong buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Buy" and a consensus price target of $39.48.

Check Out Our Latest Research Report on GDS

GDS Stock Performance

Shares of NASDAQ GDS traded up $0.34 during midday trading on Wednesday, reaching $28.50. 844,079 shares of the company were exchanged, compared to its average volume of 2,097,635. The stock has a market cap of $5.43 billion, a P/E ratio of -9.34 and a beta of 0.28. GDS has a 1 year low of $7.35 and a 1 year high of $52.50. The stock has a fifty day simple moving average of $24.71 and a 200 day simple moving average of $25.92. The company has a current ratio of 1.19, a quick ratio of 1.19 and a debt-to-equity ratio of 2.25.

GDS (NASDAQ:GDS - Get Free Report) last announced its quarterly earnings data on Tuesday, May 20th. The company reported $0.48 EPS for the quarter, beating analysts' consensus estimates of ($0.22) by $0.70. The firm had revenue of $375.14 million during the quarter, compared to the consensus estimate of $2.72 billion. GDS had a negative net margin of 35.97% and a negative return on equity of 8.22%. The firm's revenue was up 3.6% compared to the same quarter last year. During the same quarter last year, the firm earned ($1.96) earnings per share. On average, research analysts forecast that GDS will post -0.89 earnings per share for the current fiscal year.

Institutional Trading of GDS

Several hedge funds have recently added to or reduced their stakes in the business. Brooklyn Investment Group increased its holdings in shares of GDS by 2,390.0% during the first quarter. Brooklyn Investment Group now owns 996 shares of the company's stock valued at $25,000 after purchasing an additional 956 shares during the period. Advisors Asset Management Inc. bought a new stake in shares of GDS during the 1st quarter worth about $25,000. NewEdge Advisors LLC acquired a new stake in shares of GDS in the 1st quarter worth approximately $25,000. Summit Securities Group LLC acquired a new stake in shares of GDS in the 1st quarter worth approximately $26,000. Finally, PNC Financial Services Group Inc. boosted its holdings in shares of GDS by 26.8% in the fourth quarter. PNC Financial Services Group Inc. now owns 3,177 shares of the company's stock valued at $75,000 after acquiring an additional 672 shares in the last quarter. Institutional investors own 33.71% of the company's stock.

GDS Company Profile

(

Get Free Report)

GDS Holdings Limited, together with its subsidiaries, develops and operates data centers in the People's Republic of China. The company provides colocation services comprising critical facilities space, customer-available power, racks, and cooling; managed hosting services, including business continuity and disaster recovery, network management, data storage, system security, operating system, database, and server middleware services; managed cloud services; and consulting services.

Read More

Before you consider GDS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GDS wasn't on the list.

While GDS currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.