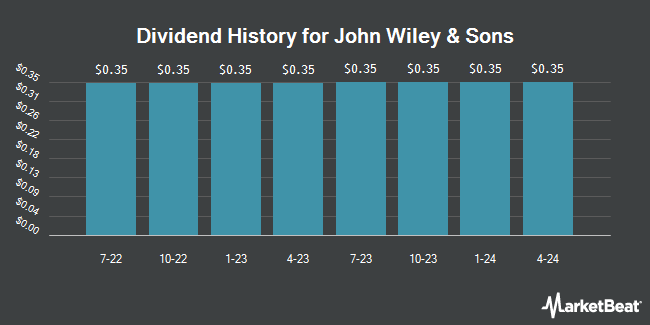

John Wiley & Sons, Inc. (NYSE:WLYB - Get Free Report) announced a quarterly dividend on Thursday, September 25th. Stockholders of record on Tuesday, October 7th will be given a dividend of 0.355 per share on Thursday, October 23rd. This represents a c) annualized dividend and a dividend yield of 3.6%. The ex-dividend date of this dividend is Tuesday, October 7th.

John Wiley & Sons has a dividend payout ratio of 33.6% meaning its dividend is sufficiently covered by earnings.

John Wiley & Sons Stock Performance

WLYB traded down $0.86 on Thursday, hitting $39.44. 348 shares of the company traded hands, compared to its average volume of 1,216. The company has a 50 day moving average of $40.16 and a 200-day moving average of $41.93. The company has a quick ratio of 0.61, a current ratio of 0.65 and a debt-to-equity ratio of 1.12. The stock has a market capitalization of $2.10 billion, a PE ratio of 22.15 and a beta of 0.81. John Wiley & Sons has a 12-month low of $37.27 and a 12-month high of $52.90.

John Wiley & Sons (NYSE:WLYB - Get Free Report) last released its quarterly earnings results on Thursday, September 4th. The company reported $0.49 earnings per share for the quarter, topping analysts' consensus estimates of $0.32 by $0.17. The business had revenue of $396.80 million for the quarter, compared to analysts' expectations of $375.00 million. John Wiley & Sons had a return on equity of 27.31% and a net margin of 5.82%.

Institutional Inflows and Outflows

A hedge fund recently bought a new stake in John Wiley & Sons stock. Gabelli Funds LLC bought a new position in John Wiley & Sons, Inc. (NYSE:WLYB - Free Report) during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm bought 4,500 shares of the company's stock, valued at approximately $201,000. Hedge funds and other institutional investors own 0.49% of the company's stock.

About John Wiley & Sons

(

Get Free Report)

John Wiley & Sons, Inc engages in the provision of research and learning materials. It operates through the following segments: Research, Learning, and Held for Sale or Sold. The Research segment consists of research publishing and research solutions. The Learning segment includes academic and professional reporting lines and consists of publishing and related knowledge solutions.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider John Wiley & Sons, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and John Wiley & Sons wasn't on the list.

While John Wiley & Sons currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.