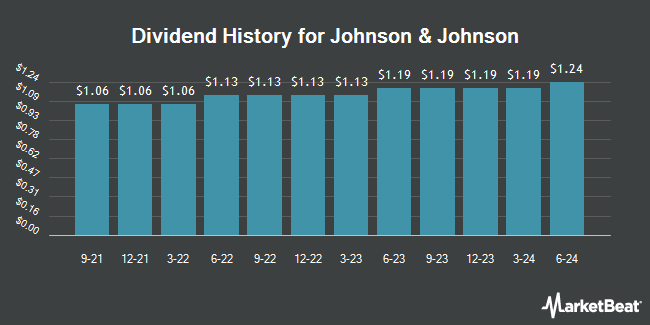

Johnson & Johnson (NYSE:JNJ - Get Free Report) announced a quarterly dividend on Tuesday, October 14th, RTT News reports. Shareholders of record on Tuesday, November 25th will be given a dividend of 1.30 per share on Tuesday, December 9th. This represents a c) dividend on an annualized basis and a yield of 2.7%. The ex-dividend date of this dividend is Tuesday, November 25th.

Johnson & Johnson has a dividend payout ratio of 46.8% indicating that its dividend is sufficiently covered by earnings. Analysts expect Johnson & Johnson to earn $11.07 per share next year, which means the company should continue to be able to cover its $5.20 annual dividend with an expected future payout ratio of 47.0%.

Johnson & Johnson Stock Up 0.1%

Shares of JNJ opened at $190.88 on Tuesday. The company has a 50-day simple moving average of $178.88 and a 200-day simple moving average of $163.97. The firm has a market capitalization of $459.71 billion, a P/E ratio of 20.42, a P/E/G ratio of 2.40 and a beta of 0.40. The company has a debt-to-equity ratio of 0.50, a quick ratio of 0.76 and a current ratio of 1.01. Johnson & Johnson has a 52 week low of $140.68 and a 52 week high of $192.10.

Johnson & Johnson (NYSE:JNJ - Get Free Report) last announced its quarterly earnings data on Wednesday, August 30th. The company reported $2.26 EPS for the quarter. The business had revenue of $24.02 billion during the quarter. Johnson & Johnson had a net margin of 25.00% and a return on equity of 32.49%. On average, equities research analysts expect that Johnson & Johnson will post 10.58 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of brokerages have recently commented on JNJ. HSBC upped their price objective on shares of Johnson & Johnson from $188.00 to $210.00 in a research report on Tuesday, September 30th. Royal Bank Of Canada reissued an "outperform" rating and issued a $209.00 price target on shares of Johnson & Johnson in a research report on Friday. Guggenheim raised shares of Johnson & Johnson from a "neutral" rating to a "buy" rating and increased their price target for the stock from $167.00 to $206.00 in a research report on Tuesday, September 23rd. Wells Fargo & Company set a $212.00 price target on shares of Johnson & Johnson and gave the stock an "overweight" rating in a research report on Friday, October 3rd. Finally, JPMorgan Chase & Co. increased their price target on shares of Johnson & Johnson from $185.00 to $200.00 and gave the stock a "neutral" rating in a research report on Tuesday, September 16th. Two analysts have rated the stock with a Strong Buy rating, twelve have given a Buy rating and eight have issued a Hold rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $192.94.

Read Our Latest Stock Analysis on JNJ

About Johnson & Johnson

(

Get Free Report)

Johnson & Johnson is a holding company, which engages in the research, development, manufacture, and sale of products in the healthcare field. It operates through the Innovative Medicine and MedTech segments. The Innovative Medicine segment focuses on immunology, infectious diseases, neuroscience, oncology, cardiovascular and metabolism, and pulmonary hypertension.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Johnson & Johnson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Johnson & Johnson wasn't on the list.

While Johnson & Johnson currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.