Fortinet (NASDAQ:FTNT - Free Report) had its price target lowered by JPMorgan Chase & Co. from $105.00 to $87.00 in a report published on Thursday,Benzinga reports. JPMorgan Chase & Co. currently has a neutral rating on the software maker's stock.

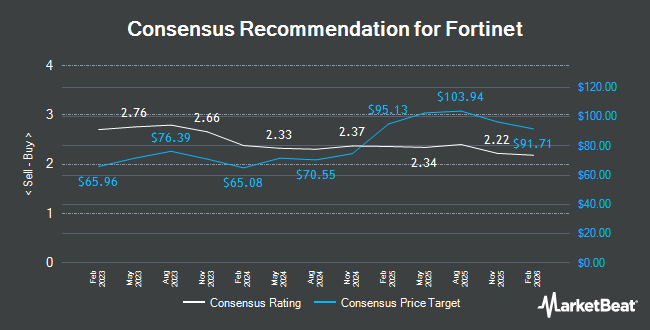

Other analysts also recently issued reports about the stock. Royal Bank Of Canada decreased their price objective on shares of Fortinet from $110.00 to $95.00 and set a "sector perform" rating for the company in a report on Thursday. BMO Capital Markets dropped their target price on shares of Fortinet from $110.00 to $90.00 and set a "market perform" rating for the company in a report on Thursday. Cantor Fitzgerald lifted their price target on shares of Fortinet from $100.00 to $110.00 and gave the company a "neutral" rating in a research report on Wednesday, July 16th. Mizuho lowered their price target on shares of Fortinet from $87.00 to $75.00 and set an "underperform" rating on the stock in a report on Thursday. Finally, Roth Capital set a $103.00 price objective on Fortinet and gave the stock a "neutral" rating in a report on Tuesday, April 22nd. Two analysts have rated the stock with a sell rating, twenty-five have given a hold rating, eight have assigned a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat, the stock has an average rating of "Hold" and an average price target of $97.93.

Get Our Latest Research Report on Fortinet

Fortinet Price Performance

FTNT traded up $1.67 during trading on Thursday, reaching $76.06. The company's stock had a trading volume of 3,258,388 shares, compared to its average volume of 5,119,424. Fortinet has a 1 year low of $69.40 and a 1 year high of $114.82. The company has a quick ratio of 1.24, a current ratio of 1.33 and a debt-to-equity ratio of 0.24. The firm has a fifty day simple moving average of $101.76 and a two-hundred day simple moving average of $101.65. The company has a market cap of $58.22 billion, a price-to-earnings ratio of 30.26, a PEG ratio of 2.50 and a beta of 1.07.

Fortinet (NASDAQ:FTNT - Get Free Report) last issued its earnings results on Wednesday, August 6th. The software maker reported $0.64 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.59 by $0.05. Fortinet had a net margin of 30.60% and a return on equity of 111.46%. The company had revenue of $1.63 billion during the quarter, compared to analysts' expectations of $1.63 billion. During the same period last year, the company posted $0.57 earnings per share. The firm's quarterly revenue was up 13.6% compared to the same quarter last year. As a group, analysts anticipate that Fortinet will post 2.09 EPS for the current year.

Insiders Place Their Bets

In other news, Director William H. Neukom purchased 335 shares of the company's stock in a transaction dated Friday, June 6th. The stock was bought at an average cost of $104.22 per share, for a total transaction of $34,913.70. Following the purchase, the director owned 301,471 shares of the company's stock, valued at approximately $31,419,307.62. The trade was a 0.11% increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Ken Xie sold 158,486 shares of the firm's stock in a transaction dated Monday, August 4th. The shares were sold at an average price of $98.48, for a total value of $15,607,701.28. Following the completion of the sale, the chief executive officer owned 51,391,879 shares of the company's stock, valued at approximately $5,061,072,243.92. This represents a 0.31% decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 18.00% of the company's stock.

Institutional Investors Weigh In On Fortinet

A number of institutional investors have recently made changes to their positions in FTNT. SJS Investment Consulting Inc. raised its position in shares of Fortinet by 703.1% during the 1st quarter. SJS Investment Consulting Inc. now owns 257 shares of the software maker's stock valued at $25,000 after purchasing an additional 225 shares during the period. Saudi Central Bank acquired a new position in Fortinet during the 1st quarter valued at approximately $25,000. Clearstead Trust LLC purchased a new stake in shares of Fortinet in the 1st quarter valued at $28,000. Caitong International Asset Management Co. Ltd increased its holdings in Fortinet by 2,184.6% in the first quarter. Caitong International Asset Management Co. Ltd now owns 297 shares of the software maker's stock valued at $29,000 after buying an additional 284 shares in the last quarter. Finally, ORG Partners LLC grew its position in shares of Fortinet by 47.5% in the first quarter. ORG Partners LLC now owns 348 shares of the software maker's stock valued at $34,000 after purchasing an additional 112 shares during the period. Hedge funds and other institutional investors own 83.71% of the company's stock.

Fortinet Company Profile

(

Get Free Report)

Fortinet, Inc provides cybersecurity and convergence of networking and security solutions worldwide. It offers secure networking solutions focus on the convergence of networking and security; network firewall solutions that consist of FortiGate data centers, hyperscale, and distributed firewalls, as well as encrypted applications; wireless LAN solutions; and secure connectivity solutions, including FortiSwitch secure ethernet switches, FortiAP wireless local area network access points, FortiExtender 5G connectivity gateways, and other products.

See Also

Before you consider Fortinet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortinet wasn't on the list.

While Fortinet currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.