Saia (NASDAQ:SAIA - Free Report) had its price target boosted by JPMorgan Chase & Co. from $295.00 to $380.00 in a report released on Monday,Benzinga reports. JPMorgan Chase & Co. currently has an overweight rating on the transportation company's stock.

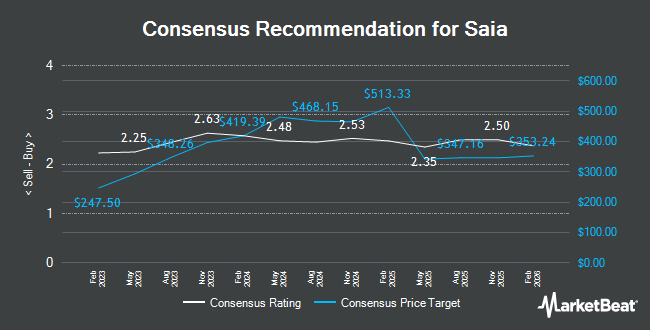

Several other research analysts have also recently issued reports on the company. Raymond James Financial set a $310.00 target price on Saia and gave the stock an "outperform" rating in a research report on Monday, April 28th. Susquehanna raised their target price on Saia from $275.00 to $340.00 and gave the stock a "neutral" rating in a research report on Monday. Morgan Stanley set a $250.00 target price on Saia in a research report on Friday, April 25th. Citigroup reissued a "buy" rating and issued a $393.00 target price (up from $350.00) on shares of Saia in a research report on Monday. Finally, Evercore ISI raised their price objective on Saia from $297.00 to $345.00 and gave the stock an "outperform" rating in a research note on Monday. One investment analyst has rated the stock with a sell rating, ten have issued a hold rating, nine have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of $347.16.

Read Our Latest Analysis on Saia

Saia Stock Performance

Shares of Saia stock traded down $0.44 during trading on Monday, hitting $302.24. 486,587 shares of the company's stock traded hands, compared to its average volume of 665,535. The company has a debt-to-equity ratio of 0.13, a current ratio of 1.49 and a quick ratio of 1.43. Saia has a 1 year low of $229.12 and a 1 year high of $624.55. The stock has a market capitalization of $8.05 billion, a P/E ratio of 27.91, a PEG ratio of 14.54 and a beta of 1.98. The business has a 50-day simple moving average of $279.61 and a 200-day simple moving average of $346.20.

Saia (NASDAQ:SAIA - Get Free Report) last released its quarterly earnings data on Friday, July 25th. The transportation company reported $2.67 EPS for the quarter, beating the consensus estimate of $2.39 by $0.28. Saia had a return on equity of 12.42% and a net margin of 8.96%. The company had revenue of $817.12 million for the quarter, compared to analysts' expectations of $826.59 million. During the same period last year, the firm posted $3.83 earnings per share. Saia's revenue was down .7% compared to the same quarter last year. As a group, analysts forecast that Saia will post 15.46 EPS for the current year.

Institutional Trading of Saia

A number of large investors have recently added to or reduced their stakes in the company. MQS Management LLC bought a new stake in Saia in the 2nd quarter worth approximately $202,000. State of New Jersey Common Pension Fund D boosted its holdings in shares of Saia by 2.2% in the 2nd quarter. State of New Jersey Common Pension Fund D now owns 9,369 shares of the transportation company's stock worth $2,567,000 after purchasing an additional 198 shares during the period. AlphaQuest LLC purchased a new position in shares of Saia in the 2nd quarter worth approximately $41,000. Stephens Investment Management Group LLC boosted its holdings in shares of Saia by 4.3% in the 2nd quarter. Stephens Investment Management Group LLC now owns 113,791 shares of the transportation company's stock worth $31,178,000 after purchasing an additional 4,695 shares during the period. Finally, DekaBank Deutsche Girozentrale boosted its holdings in shares of Saia by 46.2% in the 2nd quarter. DekaBank Deutsche Girozentrale now owns 721 shares of the transportation company's stock worth $200,000 after purchasing an additional 228 shares during the period.

About Saia

(

Get Free Report)

Saia, Inc, together with its subsidiaries, operates as a transportation company in North America. The company provides less-than-truckload services for shipments between 100 and 10,000 pounds; and other value-added services, including non-asset truckload, expedited, and logistics services. It also offers other value-added services, including non-asset truckload, expedited, and logistics services.

Featured Articles

Before you consider Saia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saia wasn't on the list.

While Saia currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.