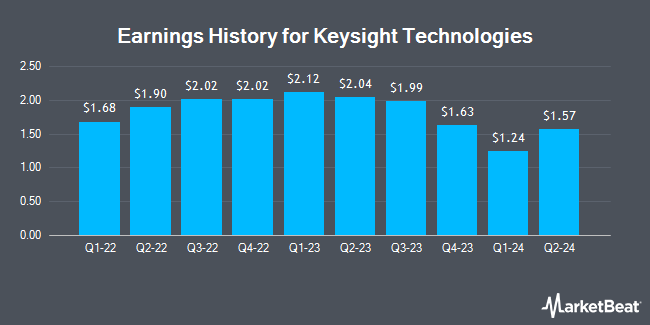

Keysight Technologies (NYSE:KEYS - Get Free Report) is expected to be issuing its Q3 2025 quarterly earnings data after the market closes on Tuesday, August 19th. Analysts expect Keysight Technologies to post earnings of $1.68 per share and revenue of $1.32 billion for the quarter. Keysight Technologies has set its Q3 2025 guidance at 1.630-1.690 EPS.

Keysight Technologies (NYSE:KEYS - Get Free Report) last announced its quarterly earnings data on Tuesday, May 20th. The scientific and technical instruments company reported $1.70 EPS for the quarter, beating the consensus estimate of $1.65 by $0.05. The business had revenue of $1.32 billion for the quarter, compared to the consensus estimate of $1.28 billion. Keysight Technologies had a return on equity of 19.65% and a net margin of 14.50%. The business's revenue was up 7.4% on a year-over-year basis. During the same period in the previous year, the business earned $1.41 earnings per share. On average, analysts expect Keysight Technologies to post $6 EPS for the current fiscal year and $7 EPS for the next fiscal year.

Keysight Technologies Price Performance

Shares of NYSE KEYS traded down $5.62 during mid-day trading on Thursday, reaching $164.61. The company's stock had a trading volume of 841,749 shares, compared to its average volume of 972,804. The company has a debt-to-equity ratio of 0.46, a current ratio of 3.39 and a quick ratio of 2.75. Keysight Technologies has a 52 week low of $121.43 and a 52 week high of $186.20. The stock has a fifty day moving average of $163.06 and a two-hundred day moving average of $158.68. The firm has a market capitalization of $28.33 billion, a PE ratio of 38.64, a P/E/G ratio of 2.36 and a beta of 1.11.

Analysts Set New Price Targets

Several equities research analysts have recently issued reports on the stock. JPMorgan Chase & Co. lifted their price objective on shares of Keysight Technologies from $177.00 to $200.00 and gave the company an "overweight" rating in a research report on Thursday, July 17th. Morgan Stanley lifted their price target on shares of Keysight Technologies from $156.00 to $180.00 and gave the company an "overweight" rating in a report on Tuesday, May 13th. Finally, Bank of America upgraded shares of Keysight Technologies from an "underperform" rating to a "neutral" rating and boosted their price target for the stock from $170.00 to $175.00 in a research note on Monday, July 21st. One investment analyst has rated the stock with a hold rating and eight have given a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $187.50.

Check Out Our Latest Stock Report on Keysight Technologies

Insider Activity at Keysight Technologies

In other Keysight Technologies news, SVP Ingrid A. Estrada sold 10,000 shares of the company's stock in a transaction on Friday, June 20th. The shares were sold at an average price of $158.97, for a total transaction of $1,589,700.00. Following the completion of the transaction, the senior vice president directly owned 108,590 shares in the company, valued at approximately $17,262,552.30. This represents a 8.43% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, CFO Neil Dougherty sold 12,215 shares of the company's stock in a transaction on Monday, June 30th. The stock was sold at an average price of $164.60, for a total transaction of $2,010,589.00. Following the transaction, the chief financial officer owned 115,228 shares of the company's stock, valued at $18,966,528.80. This represents a 9.58% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 31,830 shares of company stock worth $5,124,049 in the last ninety days. 0.61% of the stock is owned by company insiders.

Hedge Funds Weigh In On Keysight Technologies

Large investors have recently added to or reduced their stakes in the stock. Geneos Wealth Management Inc. raised its position in shares of Keysight Technologies by 66.5% in the first quarter. Geneos Wealth Management Inc. now owns 393 shares of the scientific and technical instruments company's stock valued at $59,000 after buying an additional 157 shares during the last quarter. Quantbot Technologies LP acquired a new stake in shares of Keysight Technologies in the second quarter valued at about $71,000. Integrated Wealth Concepts LLC raised its position in shares of Keysight Technologies by 5.0% in the first quarter. Integrated Wealth Concepts LLC now owns 2,581 shares of the scientific and technical instruments company's stock valued at $387,000 after buying an additional 122 shares during the last quarter. Jump Financial LLC raised its position in shares of Keysight Technologies by 61.2% in the second quarter. Jump Financial LLC now owns 3,102 shares of the scientific and technical instruments company's stock valued at $508,000 after buying an additional 1,178 shares during the last quarter. Finally, Cresset Asset Management LLC raised its position in shares of Keysight Technologies by 14.5% in the second quarter. Cresset Asset Management LLC now owns 4,804 shares of the scientific and technical instruments company's stock valued at $787,000 after buying an additional 610 shares during the last quarter. 84.58% of the stock is currently owned by institutional investors and hedge funds.

About Keysight Technologies

(

Get Free Report)

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

See Also

Before you consider Keysight Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keysight Technologies wasn't on the list.

While Keysight Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.