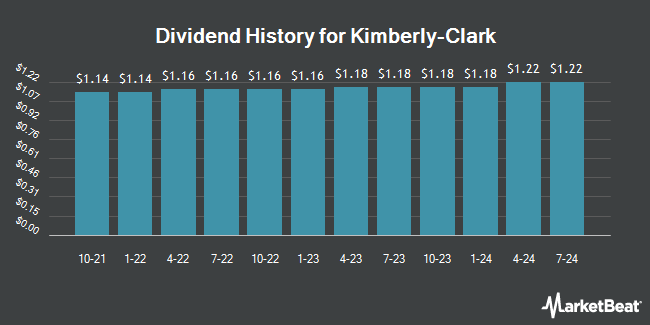

Kimberly-Clark Co. (NYSE:KMB - Get Free Report) announced a quarterly dividend on Friday, August 1st, RTT News reports. Shareholders of record on Friday, September 5th will be paid a dividend of 1.26 per share on Thursday, October 2nd. This represents a c) annualized dividend and a yield of 3.8%. The ex-dividend date of this dividend is Friday, September 5th.

Kimberly-Clark has a payout ratio of 66.0% meaning its dividend is sufficiently covered by earnings. Research analysts expect Kimberly-Clark to earn $7.88 per share next year, which means the company should continue to be able to cover its $5.04 annual dividend with an expected future payout ratio of 64.0%.

Kimberly-Clark Price Performance

KMB traded up $0.59 on Tuesday, hitting $133.73. 1,229,448 shares of the company's stock were exchanged, compared to its average volume of 2,319,321. Kimberly-Clark has a fifty-two week low of $124.10 and a fifty-two week high of $150.45. The company has a current ratio of 0.80, a quick ratio of 0.54 and a debt-to-equity ratio of 7.05. The firm has a 50-day moving average price of $131.40 and a 200-day moving average price of $134.72. The stock has a market cap of $44.37 billion, a price-to-earnings ratio of 17.73, a P/E/G ratio of 4.46 and a beta of 0.33.

Kimberly-Clark (NYSE:KMB - Get Free Report) last announced its earnings results on Friday, August 1st. The company reported $1.92 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.67 by $0.25. Kimberly-Clark had a net margin of 12.69% and a return on equity of 201.43%. During the same quarter in the previous year, the firm posted $1.96 EPS. The business's quarterly revenue was down 1.6% on a year-over-year basis. As a group, equities analysts anticipate that Kimberly-Clark will post 7.5 earnings per share for the current year.

Kimberly-Clark Company Profile

(

Get Free Report)

Kimberly-Clark Corporation, together with its subsidiaries, manufactures and markets personal care and consumer tissue products in the United States. It operates through three segments: Personal Care, Consumer Tissue, and K-C Professional. The company's Personal Care segment offers disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, reusable underwear, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Thinx, Poise, Depend, Plenitud, Softex, and other brand names.

Recommended Stories

Before you consider Kimberly-Clark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kimberly-Clark wasn't on the list.

While Kimberly-Clark currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.