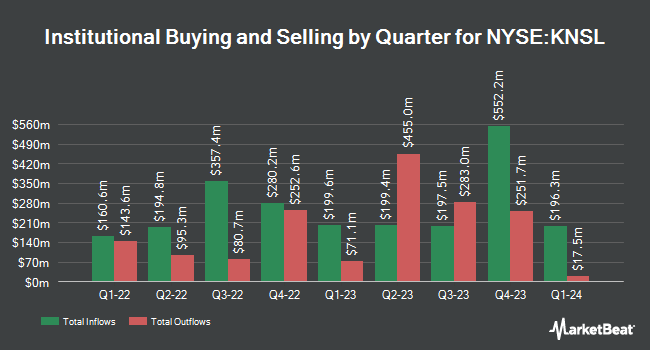

United Capital Financial Advisors LLC raised its stake in Kinsale Capital Group, Inc. (NYSE:KNSL - Free Report) by 31.4% during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 33,360 shares of the financial services provider's stock after purchasing an additional 7,969 shares during the period. United Capital Financial Advisors LLC owned 0.14% of Kinsale Capital Group worth $15,517,000 at the end of the most recent quarter.

Several other large investors also recently modified their holdings of the stock. Vanguard Group Inc. grew its position in shares of Kinsale Capital Group by 1.4% during the 4th quarter. Vanguard Group Inc. now owns 2,113,683 shares of the financial services provider's stock worth $983,137,000 after purchasing an additional 29,553 shares in the last quarter. Geode Capital Management LLC increased its stake in shares of Kinsale Capital Group by 3.1% in the 4th quarter. Geode Capital Management LLC now owns 544,954 shares of the financial services provider's stock valued at $254,441,000 after purchasing an additional 16,246 shares during the last quarter. DAVENPORT & Co LLC raised its holdings in shares of Kinsale Capital Group by 9.6% during the 4th quarter. DAVENPORT & Co LLC now owns 511,869 shares of the financial services provider's stock worth $238,193,000 after buying an additional 44,931 shares in the last quarter. JPMorgan Chase & Co. lifted its position in shares of Kinsale Capital Group by 6.0% during the 4th quarter. JPMorgan Chase & Co. now owns 329,595 shares of the financial services provider's stock worth $153,305,000 after buying an additional 18,661 shares during the last quarter. Finally, DF Dent & Co. Inc. boosted its stake in Kinsale Capital Group by 8.4% in the fourth quarter. DF Dent & Co. Inc. now owns 245,560 shares of the financial services provider's stock valued at $114,218,000 after buying an additional 18,946 shares in the last quarter. 85.36% of the stock is owned by institutional investors.

Kinsale Capital Group Stock Down 1.5 %

KNSL traded down $7.40 during midday trading on Monday, reaching $478.30. 18,514 shares of the company were exchanged, compared to its average volume of 174,615. The company has a market cap of $11.13 billion, a price-to-earnings ratio of 26.89, a price-to-earnings-growth ratio of 1.66 and a beta of 1.16. Kinsale Capital Group, Inc. has a one year low of $355.12 and a one year high of $531.79. The company's fifty day moving average price is $459.06 and its 200 day moving average price is $462.75. The company has a debt-to-equity ratio of 0.12, a quick ratio of 0.09 and a current ratio of 0.09.

Kinsale Capital Group (NYSE:KNSL - Get Free Report) last announced its quarterly earnings results on Thursday, February 13th. The financial services provider reported $4.62 earnings per share (EPS) for the quarter, topping the consensus estimate of $4.23 by $0.39. Kinsale Capital Group had a return on equity of 28.04% and a net margin of 26.13%. The business had revenue of $412.12 million during the quarter, compared to the consensus estimate of $418.32 million. As a group, analysts expect that Kinsale Capital Group, Inc. will post 17.72 EPS for the current year.

Kinsale Capital Group Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, March 13th. Investors of record on Thursday, February 27th were given a dividend of $0.17 per share. This is a positive change from Kinsale Capital Group's previous quarterly dividend of $0.15. This represents a $0.68 dividend on an annualized basis and a dividend yield of 0.14%. The ex-dividend date of this dividend was Thursday, February 27th. Kinsale Capital Group's dividend payout ratio (DPR) is presently 3.82%.

Analyst Upgrades and Downgrades

A number of research firms recently issued reports on KNSL. JPMorgan Chase & Co. lowered their price objective on shares of Kinsale Capital Group from $415.00 to $412.00 and set a "neutral" rating for the company in a research report on Friday, January 3rd. Royal Bank of Canada restated a "sector perform" rating and set a $500.00 price target on shares of Kinsale Capital Group in a report on Tuesday, February 18th. Morgan Stanley cut their target price on Kinsale Capital Group from $535.00 to $520.00 and set an "overweight" rating on the stock in a research report on Friday, February 14th. Truist Financial boosted their target price on shares of Kinsale Capital Group from $480.00 to $525.00 and gave the company a "buy" rating in a research report on Tuesday, February 18th. Finally, JMP Securities reissued a "market perform" rating on shares of Kinsale Capital Group in a research report on Friday, February 14th. Eight analysts have rated the stock with a hold rating and three have given a buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $468.56.

Read Our Latest Research Report on Kinsale Capital Group

Kinsale Capital Group Company Profile

(

Free Report)

Kinsale Capital Group, Inc, a specialty insurance company, engages in the provision of property and casualty insurance products in the United States. The company's commercial lines offerings include commercial property, small business casualty and property, excess and general casualty, construction, allied health, life sciences, entertainment, energy, environmental, excess professional, health care, public entity, commercial auto, inland marine, aviation, ocean marine, product recall, and railroad, as well as product, professional, and management liability insurance.

Recommended Stories

Before you consider Kinsale Capital Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinsale Capital Group wasn't on the list.

While Kinsale Capital Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.