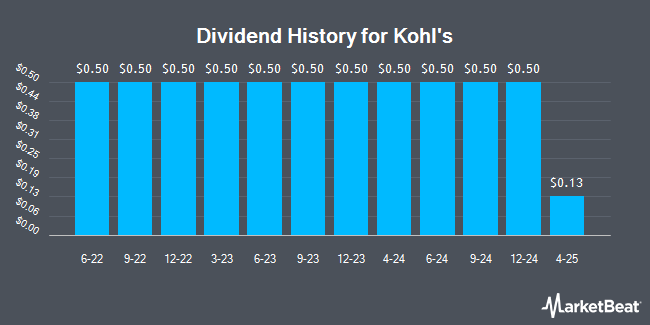

Kohl's Corporation (NYSE:KSS - Get Free Report) declared a quarterly dividend on Tuesday, August 12th, RTT News reports. Stockholders of record on Wednesday, September 10th will be paid a dividend of 0.125 per share on Wednesday, September 24th. This represents a c) dividend on an annualized basis and a dividend yield of 3.9%.

Kohl's has a dividend payout ratio of 98.0% indicating that its dividend is currently covered by earnings, but may not be in the future if the company's earnings decline. Research analysts expect Kohl's to earn $1.22 per share next year, which means the company should continue to be able to cover its $0.50 annual dividend with an expected future payout ratio of 41.0%.

Kohl's Price Performance

Shares of KSS traded up $0.61 during trading hours on Tuesday, reaching $12.82. The stock had a trading volume of 6,240,384 shares, compared to its average volume of 11,481,111. Kohl's has a 12 month low of $6.04 and a 12 month high of $21.39. The stock has a market capitalization of $1.44 billion, a PE ratio of 11.76 and a beta of 1.73. The company has a debt-to-equity ratio of 0.95, a quick ratio of 0.14 and a current ratio of 1.09. The company's 50-day moving average is $9.83 and its two-hundred day moving average is $9.38.

Kohl's (NYSE:KSS - Get Free Report) last announced its quarterly earnings results on Thursday, May 29th. The company reported ($0.13) EPS for the quarter, beating analysts' consensus estimates of ($0.22) by $0.09. Kohl's had a return on equity of 4.71% and a net margin of 0.75%. The company had revenue of $3.05 billion during the quarter, compared to analysts' expectations of $3.01 billion. During the same period in the prior year, the company earned ($0.24) EPS. Kohl's's revenue was down 4.1% compared to the same quarter last year. Research analysts expect that Kohl's will post 1.3 EPS for the current year.

Analysts Set New Price Targets

KSS has been the subject of a number of research reports. Barclays increased their price target on Kohl's from $4.00 to $5.00 and gave the company an "underweight" rating in a research note on Friday, May 30th. JPMorgan Chase & Co. raised their target price on Kohl's from $8.00 to $10.00 and gave the stock an "underweight" rating in a research report on Monday, July 28th. Wall Street Zen cut Kohl's from a "hold" rating to a "sell" rating in a research note on Sunday, June 22nd. Gordon Haskett raised Kohl's from a "reduce" rating to a "hold" rating in a research note on Tuesday. Finally, Evercore ISI decreased their price target on Kohl's from $9.00 to $8.00 and set an "in-line" rating for the company in a research note on Friday, May 2nd. Seven research analysts have rated the stock with a sell rating and nine have given a hold rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $9.89.

Get Our Latest Stock Analysis on KSS

About Kohl's

(

Get Free Report)

Kohl's Corporation operates as an omnichannel retailer in the United States. It offers branded apparel, footwear, accessories, beauty, and home products through its stores and website. The company provides its products primarily under the brand names of Croft & Barrow, Jumping Beans, SO, Sonoma Goods for Life, and Tek Gear, as well as Food Network, LC Lauren Conrad, Nine West, and Simply Vera Vera Wang.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kohl's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kohl's wasn't on the list.

While Kohl's currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.