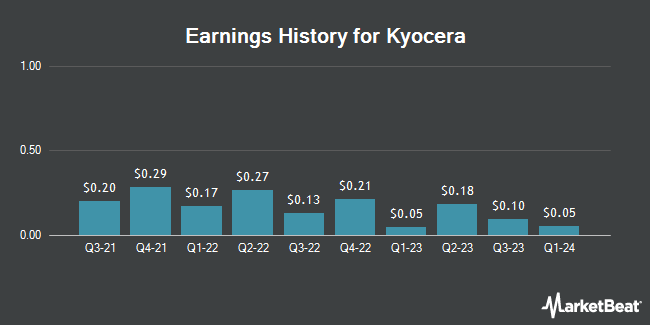

Kyocera (OTCMKTS:KYOCY - Get Free Report) issued its earnings results on Wednesday. The company reported $0.18 earnings per share for the quarter, beating analysts' consensus estimates of $0.13 by $0.05, Zacks reports. Kyocera had a return on equity of 0.80% and a net margin of 1.30%. The firm had revenue of $3.21 billion for the quarter, compared to analysts' expectations of $3.30 billion.

Kyocera Stock Up 2.8%

OTCMKTS:KYOCY traded up $0.33 during mid-day trading on Friday, hitting $12.19. The company had a trading volume of 19,750 shares, compared to its average volume of 61,932. The business has a fifty day simple moving average of $11.59 and a 200-day simple moving average of $11.50. The company has a current ratio of 2.92, a quick ratio of 1.86 and a debt-to-equity ratio of 0.06. Kyocera has a 1 year low of $9.21 and a 1 year high of $13.18. The firm has a market capitalization of $17.17 billion, a price-to-earnings ratio of 93.77 and a beta of 0.32.

Analyst Ratings Changes

Separately, Wall Street Zen raised Kyocera from a "sell" rating to a "hold" rating in a research report on Thursday, May 22nd.

Get Our Latest Stock Analysis on Kyocera

Kyocera Company Profile

(

Get Free Report)

Kyocera Corporation develops, produces, and distributes products based on fine ceramic technologies in Japan, rest of Asia, Europe, the United States, and internationally. It operates through Core Components Business, Electronic Components Business, and Solutions Business segments. The Core Components Business segment offers components, such as fine ceramic components for semiconductor processing equipment, automotive camera modules, and ceramic packages, as well as organic packages and boards to protect electronic components and ICs to industrial machinery, automotive-related, and the information and communication-related markets; optical components, and jewelry and applied ceramic related products; and medical devices comprising prosthetic joints and dental implants.

Recommended Stories

Before you consider Kyocera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kyocera wasn't on the list.

While Kyocera currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.