L3Harris Technologies (NYSE:LHX - Get Free Report) was upgraded by equities researchers at Wall Street Zen from a "hold" rating to a "buy" rating in a note issued to investors on Monday.

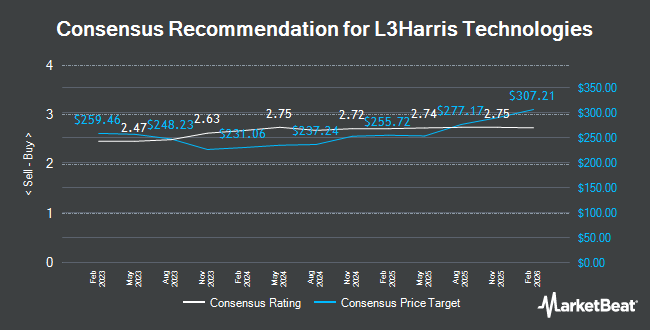

LHX has been the topic of several other research reports. The Goldman Sachs Group upgraded L3Harris Technologies from a "sell" rating to a "buy" rating and boosted their target price for the company from $198.00 to $263.00 in a research note on Friday, April 11th. Truist Financial boosted their price objective on shares of L3Harris Technologies from $279.00 to $302.00 and gave the stock a "buy" rating in a research report on Friday. Citigroup raised their target price on shares of L3Harris Technologies from $300.00 to $323.00 and gave the company a "buy" rating in a research report on Friday. UBS Group lifted their price target on shares of L3Harris Technologies from $262.00 to $280.00 and gave the company a "neutral" rating in a research note on Friday. Finally, Royal Bank Of Canada increased their price objective on shares of L3Harris Technologies from $265.00 to $280.00 and gave the stock a "sector perform" rating in a research note on Friday. Five investment analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $276.53.

Read Our Latest Stock Analysis on L3Harris Technologies

L3Harris Technologies Trading Down 1.5%

Shares of NYSE LHX opened at $269.07 on Monday. L3Harris Technologies has a twelve month low of $193.09 and a twelve month high of $280.03. The stock has a market cap of $50.30 billion, a price-to-earnings ratio of 30.06, a P/E/G ratio of 2.09 and a beta of 0.75. The company has a quick ratio of 0.87, a current ratio of 1.04 and a debt-to-equity ratio of 0.57. The company's fifty day moving average is $251.14 and its 200-day moving average is $225.88.

L3Harris Technologies (NYSE:LHX - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The company reported $2.78 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.48 by $0.30. The company had revenue of $5.43 billion during the quarter, compared to the consensus estimate of $5.31 billion. L3Harris Technologies had a return on equity of 11.82% and a net margin of 7.94%. The company's revenue for the quarter was up 2.4% compared to the same quarter last year. During the same period in the prior year, the company earned $3.24 earnings per share. Equities research analysts predict that L3Harris Technologies will post 11.12 EPS for the current year.

Insider Activity

In related news, CEO Christopher E. Kubasik sold 33,061 shares of the stock in a transaction on Thursday, June 12th. The stock was sold at an average price of $248.48, for a total value of $8,214,997.28. Following the completion of the sale, the chief executive officer directly owned 145,572 shares in the company, valued at $36,171,730.56. This represents a 18.51% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, insider Edward J. Zoiss sold 2,000 shares of L3Harris Technologies stock in a transaction dated Tuesday, May 27th. The stock was sold at an average price of $245.00, for a total value of $490,000.00. Following the transaction, the insider directly owned 25,325 shares in the company, valued at $6,204,625. The trade was a 7.32% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 0.72% of the company's stock.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently modified their holdings of the company. Meeder Asset Management Inc. increased its stake in L3Harris Technologies by 234.3% in the fourth quarter. Meeder Asset Management Inc. now owns 117 shares of the company's stock valued at $25,000 after purchasing an additional 82 shares in the last quarter. Clearstead Trust LLC bought a new position in shares of L3Harris Technologies in the first quarter valued at $26,000. Nova Wealth Management Inc. acquired a new position in shares of L3Harris Technologies during the first quarter valued at about $26,000. Independence Bank of Kentucky raised its holdings in shares of L3Harris Technologies by 44.4% in the 2nd quarter. Independence Bank of Kentucky now owns 130 shares of the company's stock worth $33,000 after acquiring an additional 40 shares during the last quarter. Finally, Beacon Capital Management LLC lifted its position in L3Harris Technologies by 79.5% in the 1st quarter. Beacon Capital Management LLC now owns 131 shares of the company's stock valued at $27,000 after acquiring an additional 58 shares in the last quarter. Institutional investors and hedge funds own 84.76% of the company's stock.

About L3Harris Technologies

(

Get Free Report)

L3Harris Technologies, Inc provides mission-critical solutions for government and commercial customers worldwide. The company's Integrated Mission Systems segment provides intelligence, surveillance, and reconnaissance (ISR) systems, passive sensing and targeting, electronic attack, autonomy, power and communications, and networks and sensors, as well as advanced combat systems for air, land, and sea sectors.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider L3Harris Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and L3Harris Technologies wasn't on the list.

While L3Harris Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.