Labcorp (NYSE:LH - Free Report) had its target price lifted by Evercore ISI from $285.00 to $300.00 in a research note issued to investors on Friday morning,Benzinga reports. The firm currently has an outperform rating on the medical research company's stock.

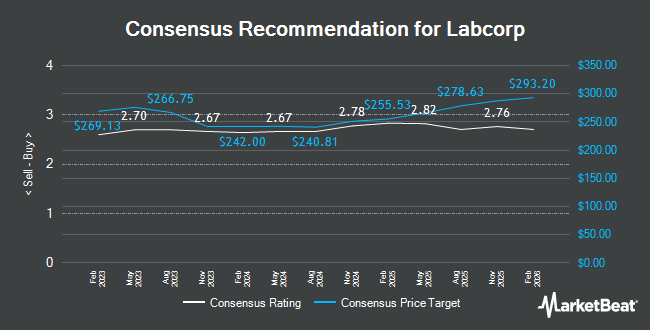

Several other equities analysts also recently issued reports on LH. Wall Street Zen downgraded shares of Labcorp from a "buy" rating to a "hold" rating in a research note on Friday, April 18th. Morgan Stanley raised their price target on shares of Labcorp from $283.00 to $306.00 and gave the company an "overweight" rating in a research note on Friday. Robert W. Baird lifted their target price on shares of Labcorp from $290.00 to $302.00 and gave the stock an "outperform" rating in a research note on Friday. UBS Group lowered their target price on shares of Labcorp from $284.00 to $282.00 and set a "buy" rating for the company in a research note on Friday, July 18th. Finally, Barclays reissued a "cautious" rating on shares of Labcorp in a research note on Wednesday, June 25th. One analyst has rated the stock with a sell rating, four have issued a hold rating and ten have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $285.00.

Get Our Latest Stock Analysis on LH

Labcorp Stock Performance

Shares of NYSE:LH traded down $3.23 on Friday, reaching $264.46. 1,152,351 shares of the company's stock were exchanged, compared to its average volume of 840,803. The company has a fifty day moving average of $254.43 and a 200-day moving average of $244.60. Labcorp has a twelve month low of $209.38 and a twelve month high of $283.47. The company has a market capitalization of $22.14 billion, a price-to-earnings ratio of 29.19, a PEG ratio of 1.68 and a beta of 0.82. The company has a current ratio of 1.50, a quick ratio of 1.60 and a debt-to-equity ratio of 0.61.

Labcorp (NYSE:LH - Get Free Report) last announced its earnings results on Thursday, July 24th. The medical research company reported $4.35 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $4.14 by $0.21. The firm had revenue of $3.53 billion for the quarter, compared to analyst estimates of $3.49 billion. Labcorp had a net margin of 5.66% and a return on equity of 15.45%. The business's revenue was up 9.6% compared to the same quarter last year. During the same quarter in the prior year, the business posted $3.94 EPS. On average, research analysts predict that Labcorp will post 16.01 EPS for the current fiscal year.

Labcorp Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, September 11th. Stockholders of record on Thursday, August 28th will be issued a dividend of $0.72 per share. This represents a $2.88 dividend on an annualized basis and a dividend yield of 1.09%. Labcorp's dividend payout ratio is currently 33.29%.

Insider Activity

In related news, CAO Peter J. Wilkinson sold 829 shares of the business's stock in a transaction dated Thursday, May 1st. The shares were sold at an average price of $242.26, for a total transaction of $200,833.54. Following the transaction, the chief accounting officer directly owned 2,054 shares in the company, valued at approximately $497,602.04. The trade was a 28.75% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, EVP Der Vaart Sandra D. Van sold 1,900 shares of the business's stock in a transaction dated Thursday, May 1st. The stock was sold at an average price of $238.36, for a total transaction of $452,884.00. Following the transaction, the executive vice president owned 2,244 shares in the company, valued at approximately $534,879.84. This trade represents a 45.85% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 11,834 shares of company stock valued at $2,928,714. 0.84% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently added to or reduced their stakes in LH. Golden State Wealth Management LLC raised its position in shares of Labcorp by 88.1% in the first quarter. Golden State Wealth Management LLC now owns 111 shares of the medical research company's stock valued at $26,000 after purchasing an additional 52 shares during the period. North Capital Inc. bought a new stake in shares of Labcorp in the first quarter valued at approximately $27,000. TruNorth Capital Management LLC bought a new stake in shares of Labcorp in the first quarter valued at approximately $28,000. Larson Financial Group LLC raised its position in shares of Labcorp by 140.4% in the first quarter. Larson Financial Group LLC now owns 125 shares of the medical research company's stock valued at $29,000 after purchasing an additional 73 shares during the period. Finally, Financial Gravity Asset Management Inc. bought a new stake in shares of Labcorp in the first quarter valued at approximately $31,000. 95.94% of the stock is currently owned by hedge funds and other institutional investors.

Labcorp Company Profile

(

Get Free Report)

Labcorp Holdings, Inc engages in providing medical testing services. The company was founded on April 16, 2024 and is headquartered in Burlington, NC.

Further Reading

Before you consider Labcorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Labcorp wasn't on the list.

While Labcorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.