Lam Research (NASDAQ:LRCX - Get Free Report) had its price target boosted by research analysts at Mizuho from $120.00 to $130.00 in a report released on Friday,Benzinga reports. The firm presently has an "outperform" rating on the semiconductor company's stock. Mizuho's price target would indicate a potential upside of 12.48% from the stock's current price.

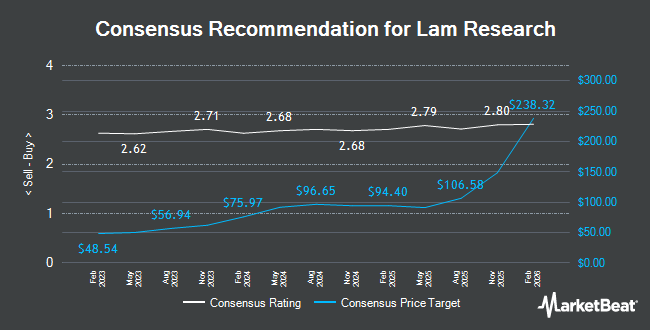

LRCX has been the subject of several other reports. Citigroup lifted their price target on Lam Research from $113.00 to $120.00 and gave the company a "buy" rating in a research report on Monday. Wall Street Zen upgraded Lam Research from a "hold" rating to a "buy" rating in a research report on Saturday, August 2nd. UBS Group boosted their target price on Lam Research from $95.00 to $120.00 and gave the stock a "buy" rating in a research report on Monday, July 21st. TD Cowen boosted their target price on Lam Research from $100.00 to $125.00 and gave the stock a "buy" rating in a research report on Thursday, July 31st. Finally, Summit Insights cut Lam Research from a "buy" rating to a "hold" rating in a research report on Thursday, July 31st. Twenty equities research analysts have rated the stock with a Buy rating, six have issued a Hold rating and one has issued a Sell rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $107.96.

View Our Latest Stock Analysis on Lam Research

Lam Research Price Performance

Shares of NASDAQ LRCX opened at $115.58 on Friday. The stock has a market cap of $146.28 billion, a PE ratio of 27.78, a price-to-earnings-growth ratio of 1.38 and a beta of 1.76. Lam Research has a fifty-two week low of $56.32 and a fifty-two week high of $115.90. The company has a debt-to-equity ratio of 0.38, a quick ratio of 1.55 and a current ratio of 2.21. The stock has a fifty day moving average of $100.71 and a 200-day moving average of $86.43.

Lam Research (NASDAQ:LRCX - Get Free Report) last announced its quarterly earnings results on Wednesday, July 30th. The semiconductor company reported $1.33 earnings per share for the quarter, beating the consensus estimate of $1.21 by $0.12. The company had revenue of $5.17 billion during the quarter, compared to analysts' expectations of $4.99 billion. Lam Research had a return on equity of 58.17% and a net margin of 29.07%.The firm's quarterly revenue was up 33.6% compared to the same quarter last year. During the same period in the previous year, the business earned $1.03 earnings per share. Lam Research has set its Q1 2026 guidance at 1.100-1.300 EPS. Equities research analysts anticipate that Lam Research will post 3.71 earnings per share for the current year.

Institutional Investors Weigh In On Lam Research

Hedge funds have recently added to or reduced their stakes in the company. IMG Wealth Management Inc. bought a new stake in Lam Research during the second quarter worth about $26,000. Howard Hughes Medical Institute bought a new stake in Lam Research during the second quarter worth about $27,000. Strategic Wealth Investment Group LLC bought a new stake in Lam Research during the second quarter worth about $29,000. Delos Wealth Advisors LLC bought a new stake in Lam Research during the second quarter worth about $30,000. Finally, REAP Financial Group LLC bought a new stake in shares of Lam Research in the 2nd quarter valued at about $31,000. Institutional investors own 84.61% of the company's stock.

Lam Research Company Profile

(

Get Free Report)

Lam Research Corporation designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits. The company offers ALTUS systems to deposit conformal films for tungsten metallization applications; SABRE electrochemical deposition products for copper interconnect transition that offers copper damascene manufacturing; SOLA ultraviolet thermal processing products for film treatments; and VECTOR plasma-enhanced CVD ALD products.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lam Research, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lam Research wasn't on the list.

While Lam Research currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.