Lamb Weston (NYSE:LW - Free Report) had its target price hoisted by Barclays from $61.00 to $68.00 in a research report released on Friday morning,Benzinga reports. They currently have an overweight rating on the specialty retailer's stock.

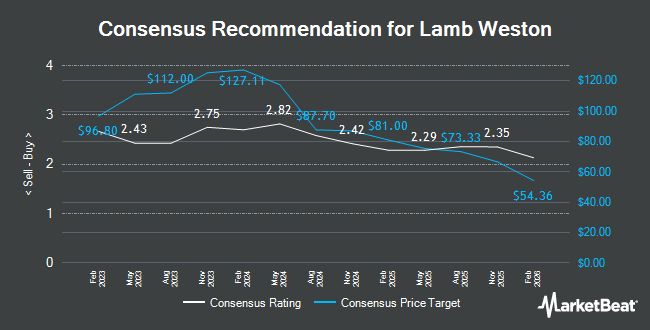

Several other brokerages also recently issued reports on LW. Bank of America decreased their target price on Lamb Weston from $60.00 to $56.00 and set a "neutral" rating on the stock in a research note on Wednesday, June 18th. Stifel Nicolaus set a $56.00 target price on Lamb Weston and gave the stock a "hold" rating in a report on Thursday, April 24th. Wells Fargo & Company upped their target price on Lamb Weston from $65.00 to $66.00 and gave the company an "overweight" rating in a research report on Thursday. Wall Street Zen raised Lamb Weston from a "sell" rating to a "hold" rating in a report on Thursday, May 8th. Finally, Jefferies Financial Group lowered their target price on Lamb Weston from $80.00 to $75.00 and set a "buy" rating on the stock in a research note on Friday, April 11th. Nine equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, Lamb Weston has an average rating of "Hold" and a consensus target price of $67.40.

Check Out Our Latest Stock Analysis on Lamb Weston

Lamb Weston Stock Performance

Lamb Weston stock traded up $2.26 during midday trading on Friday, reaching $60.87. The stock had a trading volume of 3,561,525 shares, compared to its average volume of 3,003,690. The firm's 50-day moving average price is $53.28 and its 200 day moving average price is $54.43. Lamb Weston has a 12 month low of $47.87 and a 12 month high of $83.98. The firm has a market capitalization of $8.48 billion, a PE ratio of 24.25, a P/E/G ratio of 1.38 and a beta of 0.46. The company has a quick ratio of 0.58, a current ratio of 1.38 and a debt-to-equity ratio of 2.12.

Lamb Weston (NYSE:LW - Get Free Report) last issued its earnings results on Wednesday, July 23rd. The specialty retailer reported $0.87 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.64 by $0.23. The business had revenue of $1.68 billion during the quarter, compared to analyst estimates of $1.59 billion. Lamb Weston had a return on equity of 27.99% and a net margin of 5.54%. Lamb Weston's revenue for the quarter was up 4.0% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.78 earnings per share. As a group, research analysts predict that Lamb Weston will post 3.1 earnings per share for the current fiscal year.

Lamb Weston Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, August 29th. Shareholders of record on Friday, August 1st will be given a dividend of $0.37 per share. This represents a $1.48 annualized dividend and a yield of 2.43%. The ex-dividend date is Friday, August 1st. Lamb Weston's payout ratio is 58.96%.

Institutional Investors Weigh In On Lamb Weston

Several hedge funds have recently made changes to their positions in LW. Sei Investments Co. raised its stake in Lamb Weston by 10.3% during the fourth quarter. Sei Investments Co. now owns 116,036 shares of the specialty retailer's stock valued at $7,755,000 after buying an additional 10,855 shares in the last quarter. Envestnet Asset Management Inc. grew its stake in Lamb Weston by 23.0% in the first quarter. Envestnet Asset Management Inc. now owns 723,215 shares of the specialty retailer's stock valued at $38,547,000 after purchasing an additional 135,188 shares in the last quarter. Atlas FRM LLC bought a new position in Lamb Weston during the fourth quarter valued at about $20,383,000. Soviero Asset Management LP acquired a new stake in shares of Lamb Weston in the fourth quarter valued at about $3,342,000. Finally, Siemens Fonds Invest GmbH acquired a new stake in Lamb Weston during the fourth quarter worth about $823,000. Institutional investors and hedge funds own 89.56% of the company's stock.

About Lamb Weston

(

Get Free Report)

Lamb Weston Holdings, Inc produces, distributes, and markets frozen potato products worldwide. The company operates through four segments: Global, Foodservice, Retail, and Other. It offers frozen potatoes, commercial ingredients, and appetizers under the Lamb Weston brand, as well as under various customer labels.

Featured Articles

Before you consider Lamb Weston, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lamb Weston wasn't on the list.

While Lamb Weston currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.