Lazard Asset Management LLC boosted its position in La-Z-Boy Incorporated (NYSE:LZB - Free Report) by 164.4% in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 56,060 shares of the company's stock after purchasing an additional 34,858 shares during the period. Lazard Asset Management LLC owned 0.14% of La-Z-Boy worth $2,442,000 at the end of the most recent quarter.

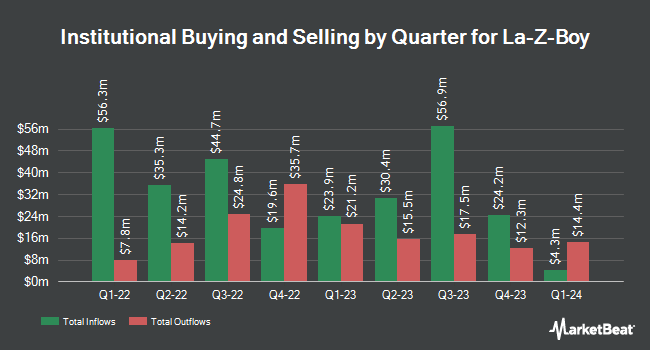

A number of other institutional investors and hedge funds have also bought and sold shares of LZB. Charles Schwab Investment Management Inc. increased its stake in shares of La-Z-Boy by 2.8% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 801,140 shares of the company's stock valued at $34,906,000 after buying an additional 22,168 shares during the period. Verity Asset Management Inc. acquired a new stake in shares of La-Z-Boy in the fourth quarter valued at about $275,000. Rhumbline Advisers increased its stake in shares of La-Z-Boy by 1.1% in the fourth quarter. Rhumbline Advisers now owns 160,292 shares of the company's stock valued at $6,984,000 after buying an additional 1,818 shares during the period. Amundi increased its stake in shares of La-Z-Boy by 174.5% in the fourth quarter. Amundi now owns 20,325 shares of the company's stock valued at $876,000 after buying an additional 12,921 shares during the period. Finally, Principal Financial Group Inc. increased its stake in shares of La-Z-Boy by 3.2% in the fourth quarter. Principal Financial Group Inc. now owns 223,683 shares of the company's stock valued at $9,746,000 after buying an additional 6,908 shares during the period. Institutional investors and hedge funds own 99.62% of the company's stock.

La-Z-Boy Trading Down 0.9%

NYSE LZB traded down $0.36 during trading hours on Thursday, hitting $41.88. 76,326 shares of the company's stock were exchanged, compared to its average volume of 485,259. The stock has a 50-day simple moving average of $39.70 and a 200 day simple moving average of $42.53. La-Z-Boy Incorporated has a 1-year low of $33.34 and a 1-year high of $48.31. The firm has a market cap of $1.73 billion, a price-to-earnings ratio of 14.39 and a beta of 1.33.

La-Z-Boy (NYSE:LZB - Get Free Report) last released its earnings results on Tuesday, February 18th. The company reported $0.68 EPS for the quarter, topping the consensus estimate of $0.67 by $0.01. La-Z-Boy had a return on equity of 12.38% and a net margin of 5.92%. The business had revenue of $521.78 million during the quarter, compared to analysts' expectations of $516.47 million. On average, sell-side analysts anticipate that La-Z-Boy Incorporated will post 2.99 earnings per share for the current fiscal year.

La-Z-Boy Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, June 16th. Shareholders of record on Tuesday, June 3rd will be paid a $0.22 dividend. The ex-dividend date of this dividend is Tuesday, June 3rd. This represents a $0.88 dividend on an annualized basis and a yield of 2.10%. La-Z-Boy's dividend payout ratio (DPR) is presently 30.24%.

Analyst Upgrades and Downgrades

Separately, KeyCorp raised La-Z-Boy from a "sector weight" rating to an "overweight" rating and set a $46.00 price target for the company in a research note on Friday, April 25th.

View Our Latest Analysis on La-Z-Boy

La-Z-Boy Profile

(

Free Report)

La-Z-Boy Incorporated manufactures, markets, imports, exports, distributes, and retails upholstery furniture products, accessories, and casegoods furniture products in the United States, Canada, and internationally. It operates through Wholesale, Retail, Corporate and Other segments. The Wholesale segment manufactures, and imports upholstered furniture, such as recliners and motion furniture, sofas, loveseats, chairs, sectionals, modulars, ottomans, and sleeper sofas; and imports, distributes, and retails casegoods (wood) furniture, including occasional pieces, bedroom sets, dining room sets, entertainment centers, and occasional pieces.

Further Reading

Before you consider La-Z-Boy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and La-Z-Boy wasn't on the list.

While La-Z-Boy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.