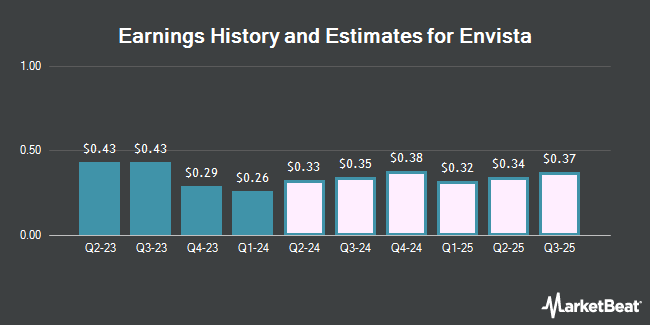

Envista Holdings Corporation (NYSE:NVST - Free Report) - Analysts at Leerink Partnrs dropped their Q3 2025 earnings per share (EPS) estimates for shares of Envista in a research note issued to investors on Tuesday, October 14th. Leerink Partnrs analyst M. Cherny now expects that the company will earn $0.26 per share for the quarter, down from their previous forecast of $0.28. The consensus estimate for Envista's current full-year earnings is $1.00 per share. Leerink Partnrs also issued estimates for Envista's Q4 2025 earnings at $0.32 EPS and FY2025 earnings at $1.07 EPS.

Envista (NYSE:NVST - Get Free Report) last posted its quarterly earnings results on Thursday, July 31st. The company reported $0.26 earnings per share for the quarter, topping the consensus estimate of $0.24 by $0.02. Envista had a return on equity of 4.84% and a net margin of 2.11%.The business had revenue of $682.10 million during the quarter, compared to the consensus estimate of $638.21 million. During the same period in the prior year, the company posted $0.11 EPS. The firm's revenue for the quarter was up 7.7% compared to the same quarter last year. Envista has set its FY 2025 guidance at 1.050-1.15 EPS.

Other research analysts also recently issued reports about the company. Evercore ISI set a $25.00 price target on Envista in a research note on Wednesday, October 8th. Piper Sandler increased their target price on Envista from $17.00 to $19.00 and gave the company a "neutral" rating in a research report on Friday, August 1st. Zacks Research lowered shares of Envista from a "strong-buy" rating to a "hold" rating in a report on Monday, September 15th. Wells Fargo & Company raised their target price on shares of Envista from $17.00 to $19.00 and gave the company an "equal weight" rating in a report on Friday, August 1st. Finally, Weiss Ratings reissued a "sell (d)" rating on shares of Envista in a report on Wednesday, October 8th. One investment analyst has rated the stock with a Strong Buy rating, four have issued a Buy rating, ten have given a Hold rating and two have assigned a Sell rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Hold" and an average target price of $21.08.

Get Our Latest Report on NVST

Envista Trading Up 0.7%

NVST stock opened at $19.58 on Thursday. Envista has a 1-year low of $14.22 and a 1-year high of $23.00. The company has a debt-to-equity ratio of 0.46, a current ratio of 2.44 and a quick ratio of 2.08. The company has a market capitalization of $3.25 billion, a price-to-earnings ratio of 61.20, a PEG ratio of 1.04 and a beta of 1.01. The business has a 50 day simple moving average of $20.67 and a two-hundred day simple moving average of $19.00.

Institutional Investors Weigh In On Envista

Several hedge funds and other institutional investors have recently made changes to their positions in the company. CWM LLC lifted its holdings in shares of Envista by 10.8% in the 3rd quarter. CWM LLC now owns 46,312 shares of the company's stock worth $943,000 after acquiring an additional 4,508 shares during the last quarter. Optas LLC purchased a new stake in Envista in the 3rd quarter worth about $248,000. Farther Finance Advisors LLC lifted its stake in Envista by 317.6% in the third quarter. Farther Finance Advisors LLC now owns 1,349 shares of the company's stock worth $27,000 after purchasing an additional 1,026 shares during the last quarter. Oak Thistle LLC purchased a new position in shares of Envista during the third quarter valued at approximately $228,000. Finally, Aaron Wealth Advisors LLC bought a new position in shares of Envista during the third quarter valued at approximately $579,000.

About Envista

(

Get Free Report)

Envista Holdings Corporation, together with its subsidiaries, develops, manufactures, markets, and sells dental products in the United States, China, and internationally. The company operates in two segments, Specialty Products & Technologies, and Equipment & Consumables. The Specialty Products & Technologies segment offers dental implant systems, guided surgery systems, biomaterials, and prefabricated and custom-built prosthetics to oral surgeons, prosthodontists and periodontists, and general dentist; and brackets and wires, tubes and bands, archwires, clear aligners, digital orthodontic treatments, retainers, and other orthodontic laboratory products.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Envista, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Envista wasn't on the list.

While Envista currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.