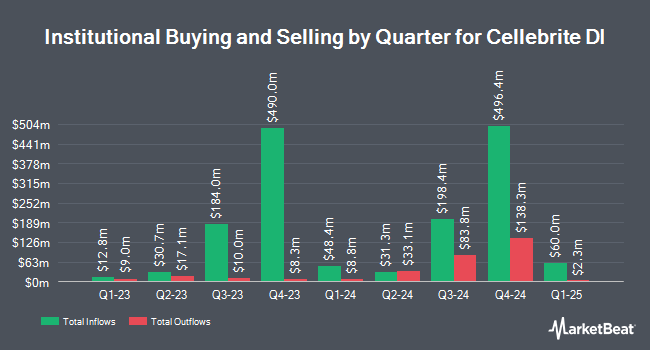

Legal & General Group Plc raised its stake in Cellebrite DI Ltd. (NASDAQ:CLBT - Free Report) by 30.0% in the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 160,223 shares of the company's stock after acquiring an additional 36,949 shares during the quarter. Legal & General Group Plc owned approximately 0.08% of Cellebrite DI worth $3,530,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors have also made changes to their positions in the company. R Squared Ltd purchased a new stake in shares of Cellebrite DI in the fourth quarter valued at $100,000. Polen Capital Management LLC purchased a new stake in shares of Cellebrite DI in the fourth quarter valued at $222,000. Victory Capital Management Inc. purchased a new stake in shares of Cellebrite DI in the fourth quarter valued at $234,000. HighTower Advisors LLC purchased a new stake in Cellebrite DI during the fourth quarter valued at about $274,000. Finally, Pictet Asset Management Holding SA acquired a new stake in Cellebrite DI during the fourth quarter worth about $283,000. Hedge funds and other institutional investors own 45.88% of the company's stock.

Analyst Ratings Changes

A number of analysts have recently issued reports on CLBT shares. Needham & Company LLC reiterated a "buy" rating and set a $28.00 target price on shares of Cellebrite DI in a report on Wednesday, April 2nd. Lake Street Capital raised their price target on shares of Cellebrite DI from $17.00 to $26.00 and gave the company a "buy" rating in a report on Friday, February 14th. Finally, JPMorgan Chase & Co. raised their price target on shares of Cellebrite DI from $24.00 to $28.00 and gave the company an "overweight" rating in a report on Tuesday, February 11th. Seven analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, Cellebrite DI has an average rating of "Buy" and a consensus price target of $23.43.

Read Our Latest Stock Analysis on CLBT

Cellebrite DI Stock Up 0.7 %

Shares of CLBT traded up $0.14 during mid-day trading on Monday, reaching $19.78. 608,985 shares of the stock traded hands, compared to its average volume of 1,412,070. The firm has a market cap of $4.74 billion, a price-to-earnings ratio of -14.23, a P/E/G ratio of 4.27 and a beta of 1.44. The stock has a fifty day simple moving average of $18.73 and a 200 day simple moving average of $20.15. Cellebrite DI Ltd. has a 12-month low of $10.25 and a 12-month high of $26.30.

Cellebrite DI (NASDAQ:CLBT - Get Free Report) last posted its quarterly earnings data on Thursday, February 13th. The company reported $0.07 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.10 by ($0.03). Cellebrite DI had a negative net margin of 70.54% and a positive return on equity of 58.70%. On average, equities research analysts expect that Cellebrite DI Ltd. will post 0.3 earnings per share for the current fiscal year.

About Cellebrite DI

(

Free Report)

Cellebrite DI Ltd. develops solutions for legally sanctioned investigations in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific. The company's DI suite of solutions allows users to collect, review, analyze, and manage digital data across the investigative lifecycle with respect to legally sanctioned investigations used in various cases, including child exploitation, homicide, anti-terror, border control, sexual crimes, human trafficking, corporate security, cryptocurrency, and intellectual property theft.

Featured Stories

Before you consider Cellebrite DI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cellebrite DI wasn't on the list.

While Cellebrite DI currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.