LeMaitre Vascular (NASDAQ:LMAT - Get Free Report) is expected to be posting its Q2 2025 quarterly earnings results after the market closes on Tuesday, August 5th. Analysts expect LeMaitre Vascular to post earnings of $0.57 per share and revenue of $62.48 million for the quarter.

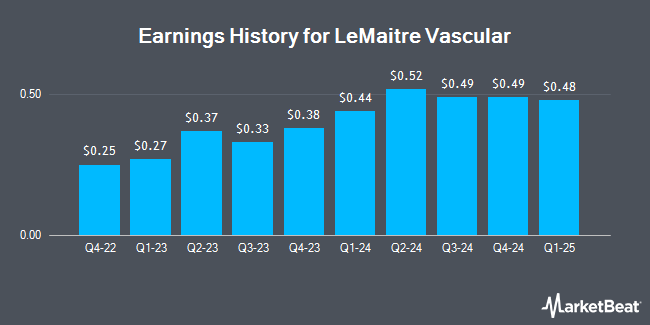

LeMaitre Vascular (NASDAQ:LMAT - Get Free Report) last posted its quarterly earnings results on Thursday, May 1st. The medical instruments supplier reported $0.48 EPS for the quarter, missing analysts' consensus estimates of $0.50 by ($0.02). LeMaitre Vascular had a return on equity of 13.53% and a net margin of 19.96%. The company had revenue of $59.87 million during the quarter, compared to the consensus estimate of $57.61 million. During the same period in the previous year, the business earned $0.44 earnings per share. LeMaitre Vascular's revenue was up 12.0% on a year-over-year basis. On average, analysts expect LeMaitre Vascular to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

LeMaitre Vascular Stock Performance

Shares of LeMaitre Vascular stock traded down $0.20 during trading hours on Friday, reaching $81.04. The company had a trading volume of 126,468 shares, compared to its average volume of 101,135. The firm has a market cap of $1.83 billion, a PE ratio of 40.93, a price-to-earnings-growth ratio of 2.14 and a beta of 0.82. LeMaitre Vascular has a one year low of $71.42 and a one year high of $109.58. The business has a fifty day simple moving average of $82.52 and a 200 day simple moving average of $86.95. The company has a debt-to-equity ratio of 0.48, a current ratio of 16.49 and a quick ratio of 13.83.

Wall Street Analysts Forecast Growth

Separately, Barrington Research reissued a "market perform" rating on shares of LeMaitre Vascular in a research note on Tuesday, July 22nd. Five investment analysts have rated the stock with a hold rating and two have issued a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $97.83.

View Our Latest Analysis on LeMaitre Vascular

Insiders Place Their Bets

In other LeMaitre Vascular news, CEO George W. Lemaitre sold 4,399 shares of the firm's stock in a transaction dated Tuesday, May 20th. The stock was sold at an average price of $85.10, for a total transaction of $374,354.90. Following the sale, the chief executive officer owned 1,827,003 shares in the company, valued at $155,477,955.30. This trade represents a 0.24% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Insiders sold a total of 100,000 shares of company stock worth $8,556,857 in the last quarter. Company insiders own 9.50% of the company's stock.

Institutional Investors Weigh In On LeMaitre Vascular

A number of large investors have recently added to or reduced their stakes in LMAT. Geneos Wealth Management Inc. raised its position in LeMaitre Vascular by 250.3% during the first quarter. Geneos Wealth Management Inc. now owns 557 shares of the medical instruments supplier's stock valued at $47,000 after purchasing an additional 398 shares in the last quarter. Strs Ohio bought a new stake in shares of LeMaitre Vascular in the first quarter worth about $168,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in shares of LeMaitre Vascular by 4.7% in the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 12,078 shares of the medical instruments supplier's stock worth $1,013,000 after purchasing an additional 539 shares during the last quarter. Jane Street Group LLC grew its holdings in shares of LeMaitre Vascular by 738.7% during the 1st quarter. Jane Street Group LLC now owns 20,096 shares of the medical instruments supplier's stock worth $1,686,000 after acquiring an additional 17,700 shares during the period. Finally, Intech Investment Management LLC grew its holdings in shares of LeMaitre Vascular by 116.6% during the 1st quarter. Intech Investment Management LLC now owns 20,967 shares of the medical instruments supplier's stock worth $1,759,000 after acquiring an additional 11,288 shares during the period. Hedge funds and other institutional investors own 84.64% of the company's stock.

About LeMaitre Vascular

(

Get Free Report)

LeMaitre Vascular, Inc develops, manufactures, and markets medical devices and implants used in the field of vascular surgery worldwide. It offers human cadaver tissue cryopreservation services; angioscope, a fiberoptic catheter used for viewing the lumen of a blood vessel; embolectomy catheters to remove blood clots from arteries; thrombectomy catheters for removing thrombi in the venous system; occlusion catheters that temporarily occlude the blood flow; and perfusion catheters to perfuse the blood and other fluids into the vasculature.

Featured Articles

Before you consider LeMaitre Vascular, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LeMaitre Vascular wasn't on the list.

While LeMaitre Vascular currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.