Lexicon Pharmaceuticals (NASDAQ:LXRX - Free Report) had its target price raised by Citigroup from $1.20 to $1.90 in a research note released on Thursday,Benzinga reports. The brokerage currently has a buy rating on the biopharmaceutical company's stock.

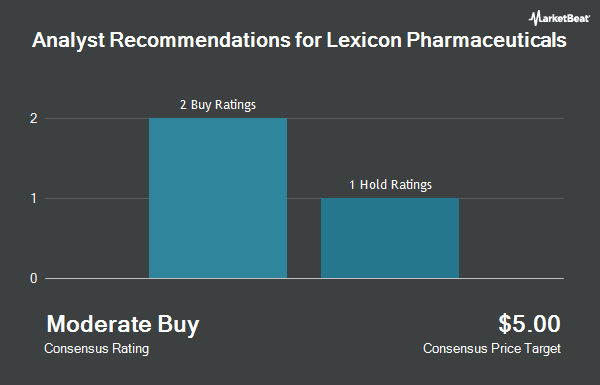

A number of other brokerages have also recently commented on LXRX. HC Wainwright reissued a "buy" rating and issued a $4.00 price objective on shares of Lexicon Pharmaceuticals in a research note on Tuesday, June 24th. Wall Street Zen began coverage on shares of Lexicon Pharmaceuticals in a research report on Monday, April 21st. They set a "sell" rating for the company. One research analyst has rated the stock with a sell rating, three have assigned a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average price target of $3.23.

Read Our Latest Report on LXRX

Lexicon Pharmaceuticals Stock Down 1.4%

Shares of NASDAQ:LXRX traded down $0.02 during mid-day trading on Thursday, hitting $1.07. 302,841 shares of the company traded hands, compared to its average volume of 8,923,128. The firm has a market cap of $384.99 million, a P/E ratio of -3.23 and a beta of 1.17. The firm's 50 day simple moving average is $0.94 and its 200 day simple moving average is $0.72. The company has a debt-to-equity ratio of 0.43, a quick ratio of 4.16 and a current ratio of 4.16. Lexicon Pharmaceuticals has a 52-week low of $0.28 and a 52-week high of $2.18.

Lexicon Pharmaceuticals (NASDAQ:LXRX - Get Free Report) last posted its quarterly earnings results on Wednesday, August 6th. The biopharmaceutical company reported $0.01 earnings per share for the quarter, beating analysts' consensus estimates of ($0.08) by $0.09. Lexicon Pharmaceuticals had a negative return on equity of 83.63% and a negative net margin of 206.43%. The company had revenue of $28.87 million for the quarter, compared to the consensus estimate of $4.87 million. On average, equities analysts anticipate that Lexicon Pharmaceuticals will post -0.66 EPS for the current year.

Institutional Investors Weigh In On Lexicon Pharmaceuticals

Large investors have recently modified their holdings of the business. Savant Capital LLC raised its holdings in Lexicon Pharmaceuticals by 33.2% in the 2nd quarter. Savant Capital LLC now owns 69,578 shares of the biopharmaceutical company's stock valued at $66,000 after acquiring an additional 17,348 shares in the last quarter. R Squared Ltd purchased a new stake in shares of Lexicon Pharmaceuticals in the 2nd quarter worth $28,000. Vanguard Personalized Indexing Management LLC boosted its holdings in shares of Lexicon Pharmaceuticals by 77.8% during the 2nd quarter. Vanguard Personalized Indexing Management LLC now owns 65,330 shares of the biopharmaceutical company's stock valued at $62,000 after purchasing an additional 28,594 shares during the last quarter. Compagnie Lombard Odier SCmA lifted its holdings in shares of Lexicon Pharmaceuticals by 200.0% in the 2nd quarter. Compagnie Lombard Odier SCmA now owns 330,000 shares of the biopharmaceutical company's stock valued at $312,000 after acquiring an additional 220,000 shares during the last quarter. Finally, Acadian Asset Management LLC purchased a new stake in Lexicon Pharmaceuticals in the 1st quarter worth about $263,000. 74.70% of the stock is currently owned by institutional investors.

Lexicon Pharmaceuticals Company Profile

(

Get Free Report)

Lexicon Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the discovery, development, and commercialization of pharmaceutical products. Its orally-delivered small molecule drug candidates under development comprise Sotagliflozin that completed Phase III clinical trials for the for the treatment of heart failure and type 1 diabetes; and LX9211, which is in Phase II clinical development for the treatment of neuropathic pain and LX2761, which is in Phase I clinical development for gastrointestinal tract.

Further Reading

Before you consider Lexicon Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lexicon Pharmaceuticals wasn't on the list.

While Lexicon Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.