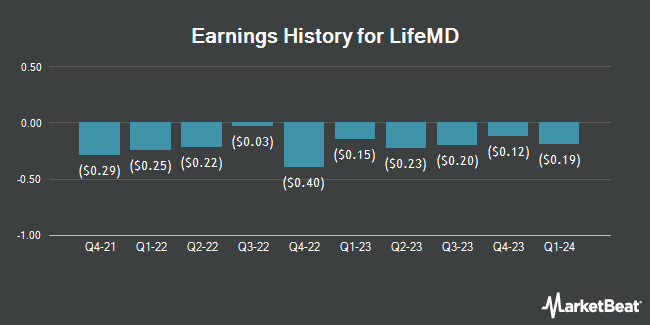

LifeMD (NASDAQ:LFMD - Get Free Report) announced its earnings results on Tuesday. The company reported ($0.06) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.02) by ($0.04), Zacks reports. The company had revenue of $62.22 million during the quarter, compared to the consensus estimate of $66.17 million. LifeMD updated its Q3 2025 guidance to EPS and its FY 2025 guidance to EPS.

LifeMD Stock Up 3.2%

Shares of NASDAQ:LFMD traded up $0.21 during trading on Friday, hitting $6.82. 2,887,298 shares of the company were exchanged, compared to its average volume of 2,214,485. The company has a debt-to-equity ratio of 9.21, a current ratio of 0.77 and a quick ratio of 0.77. The firm's 50 day moving average price is $11.86 and its 200-day moving average price is $8.47. The stock has a market capitalization of $323.40 million, a P/E ratio of -32.48 and a beta of 1.72. LifeMD has a 12-month low of $3.99 and a 12-month high of $15.84.

Analyst Ratings Changes

Several analysts have commented on LFMD shares. KeyCorp decreased their price objective on shares of LifeMD from $14.00 to $12.00 and set an "overweight" rating for the company in a research note on Wednesday. Wall Street Zen downgraded shares of LifeMD from a "buy" rating to a "hold" rating in a research report on Saturday, August 2nd. Lake Street Capital cut their price target on LifeMD from $18.00 to $14.00 and set a "buy" rating on the stock in a research report on Wednesday. BTIG Research boosted their price objective on LifeMD from $15.00 to $18.00 and gave the company a "buy" rating in a report on Wednesday, June 18th. Finally, HC Wainwright lowered their target price on LifeMD from $14.00 to $13.00 and set a "buy" rating on the stock in a research note on Thursday. Two research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $12.86.

Check Out Our Latest Report on LFMD

Insider Transactions at LifeMD

In other LifeMD news, CEO Justin Schreiber sold 25,000 shares of LifeMD stock in a transaction on Tuesday, July 1st. The shares were sold at an average price of $13.38, for a total value of $334,500.00. Following the transaction, the chief executive officer directly owned 2,500,721 shares in the company, valued at approximately $33,459,646.98. The trade was a 0.99% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Stefan Galluppi sold 85,000 shares of the stock in a transaction dated Friday, June 13th. The stock was sold at an average price of $12.38, for a total transaction of $1,052,300.00. Following the sale, the insider owned 80,449 shares of the company's stock, valued at $995,958.62. This trade represents a 51.38% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 275,000 shares of company stock worth $3,564,550. 18.40% of the stock is owned by company insiders.

Hedge Funds Weigh In On LifeMD

An institutional investor recently raised its position in LifeMD stock. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in LifeMD, Inc. (NASDAQ:LFMD - Free Report) by 4.7% in the 1st quarter, according to its most recent filing with the SEC. The firm owned 49,647 shares of the company's stock after acquiring an additional 2,235 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. owned approximately 0.11% of LifeMD worth $270,000 at the end of the most recent reporting period. 35.52% of the stock is owned by hedge funds and other institutional investors.

About LifeMD

(

Get Free Report)

LifeMD, Inc operates as a direct-to-patient telehealth company that connects consumers to healthcare professionals for medical care in the United States. The company offers telehealth platform comprising RexMD, a men's telehealth brand that provides access to virtual medical treatment for a variety of men's health needs from licensed physician; ShapiroMD that provides virtual medical treatment, prescription medications, patented doctor formulated OTC products, topical compounded medications, and medical devices treating male and female hair loss; NavaMD, a female-oriented tele-dermatology that offers virtual medical treatment from dermatologists and other providers; and prescription oral and compounded topical medications to treat aging and acne; and Cleared which provides personalized treatments for allergy, asthma and immunology, including in-home tests for both environmental and food allergies, prescriptions for allergies and asthma and immunotherapies for treating chronic allergies.

Recommended Stories

Before you consider LifeMD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LifeMD wasn't on the list.

While LifeMD currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.