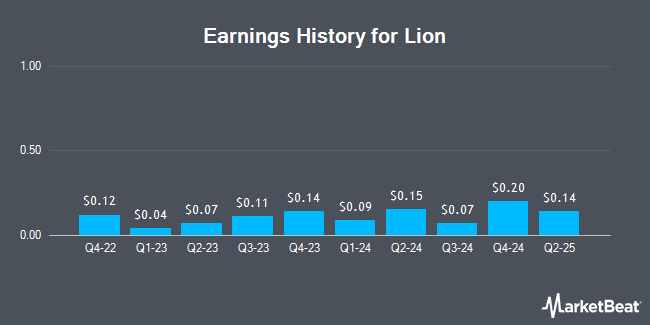

Lion (OTCMKTS:LIOPF - Get Free Report) issued its quarterly earnings data on Thursday. The company reported $0.14 EPS for the quarter, Zacks reports. Lion had a return on equity of 6.81% and a net margin of 5.04%.

Lion Price Performance

LIOPF stock remained flat at $11.20 during midday trading on Friday. The stock has a market capitalization of $3.10 billion, a price-to-earnings ratio of 21.96 and a beta of 0.30. The business has a 50 day simple moving average of $11.20 and a 200 day simple moving average of $11.17. Lion has a 52-week low of $9.13 and a 52-week high of $11.20.

Lion Company Profile

(

Get Free Report)

Lion Corporation manufactures and sells consumer and industrial products in Japan and internationally. It operates through three segments: Consumer Products Business, Industrial Products Business, and Overseas Business. The company provides dental and oral care products, including toothpastes, toothbrushes, dental floss, dental rinses, mouthwashes, periodontitis ointments, and denture products; body care products, such as shampoos and conditioners, hand soaps, sanitizers, wet wipes, body washes, skin and acne care products, antiperspirants and deodorants, hair-nourishment treatments, men's care and toiletries products, and foot care products.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lion wasn't on the list.

While Lion currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.