Lucid Diagnostics (NASDAQ:LUCD - Get Free Report) was downgraded by Wall Street Zen from a "hold" rating to a "sell" rating in a report issued on Saturday.

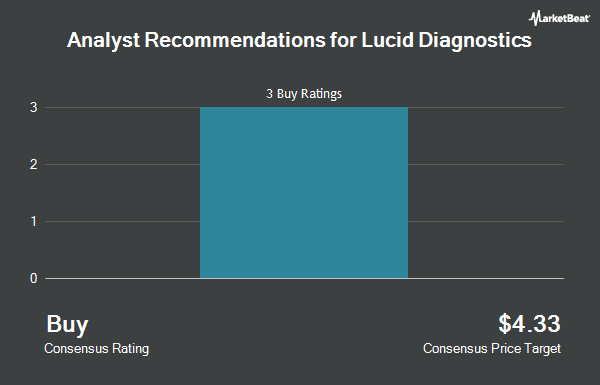

LUCD has been the subject of a number of other reports. Ascendiant Capital Markets lifted their price target on shares of Lucid Diagnostics from $7.50 to $7.75 and gave the company a "buy" rating in a research report on Friday, June 6th. BTIG Research lifted their price target on shares of Lucid Diagnostics from $2.00 to $2.50 and gave the stock a "buy" rating in a research note on Friday, September 5th. Finally, Needham & Company LLC restated a "buy" rating and set a $3.00 target price on shares of Lucid Diagnostics in a research report on Wednesday, August 13th. Five analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, the stock currently has an average rating of "Buy" and a consensus target price of $3.65.

Check Out Our Latest Research Report on Lucid Diagnostics

Lucid Diagnostics Price Performance

LUCD traded down $0.02 during trading on Friday, hitting $1.07. 108,881 shares of the stock traded hands, compared to its average volume of 1,056,640. The firm has a market capitalization of $142.16 million, a P/E ratio of -0.89 and a beta of 1.24. The firm has a 50-day moving average of $1.10 and a 200 day moving average of $1.24. Lucid Diagnostics has a 12-month low of $0.75 and a 12-month high of $1.80.

Insider Activity

In related news, Director Dennis Matheis acquired 100,000 shares of the company's stock in a transaction that occurred on Wednesday, August 20th. The stock was purchased at an average price of $1.02 per share, for a total transaction of $102,000.00. Following the transaction, the director owned 665,443 shares in the company, valued at $678,751.86. This trade represents a 17.69% increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 6.80% of the stock is owned by company insiders.

Institutional Trading of Lucid Diagnostics

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Alyeska Investment Group L.P. purchased a new stake in shares of Lucid Diagnostics during the 1st quarter worth about $2,813,000. Geode Capital Management LLC grew its holdings in shares of Lucid Diagnostics by 420.3% during the 2nd quarter. Geode Capital Management LLC now owns 1,577,369 shares of the company's stock worth $1,814,000 after purchasing an additional 1,274,194 shares during the period. Ghisallo Capital Management LLC purchased a new stake in shares of Lucid Diagnostics during the 1st quarter worth about $629,000. XML Financial LLC purchased a new stake in shares of Lucid Diagnostics during the 1st quarter worth about $266,000. Finally, Citadel Advisors LLC purchased a new stake in shares of Lucid Diagnostics during the 4th quarter worth about $98,000. Hedge funds and other institutional investors own 74.01% of the company's stock.

About Lucid Diagnostics

(

Get Free Report)

Lucid Diagnostics Inc operates as a commercial-stage medical diagnostics technology company in the United States. The company focuses on patients with gastroesophageal reflux disease (GERD) who are at risk of developing esophageal precancer and cancer, primarily highly lethal esophageal adenocarcinoma.

Featured Articles

Before you consider Lucid Diagnostics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lucid Diagnostics wasn't on the list.

While Lucid Diagnostics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.