Lucid Group (NASDAQ:LCID - Get Free Report) is expected to be announcing its Q2 2025 earnings results after the market closes on Tuesday, August 5th. Analysts expect the company to announce earnings of ($0.26) per share and revenue of $288.10 million for the quarter.

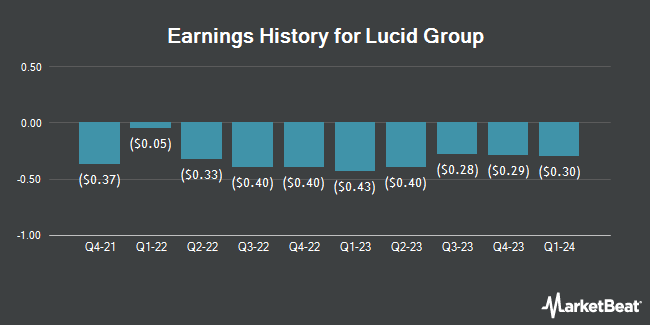

Lucid Group (NASDAQ:LCID - Get Free Report) last posted its earnings results on Tuesday, May 6th. The company reported ($0.24) EPS for the quarter, missing the consensus estimate of ($0.23) by ($0.01). Lucid Group had a negative return on equity of 68.64% and a negative net margin of 275.73%. The firm had revenue of $235.05 million during the quarter, compared to the consensus estimate of $250.50 million. During the same quarter last year, the company posted ($0.27) EPS. Lucid Group's revenue for the quarter was up 36.1% on a year-over-year basis. On average, analysts expect Lucid Group to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Lucid Group Stock Performance

NASDAQ LCID traded down $0.06 on Friday, hitting $2.41. The stock had a trading volume of 72,775,781 shares, compared to its average volume of 119,671,625. Lucid Group has a one year low of $1.93 and a one year high of $4.43. The company has a quick ratio of 2.97, a current ratio of 3.32 and a debt-to-equity ratio of 0.65. The stock has a market cap of $7.34 billion, a price-to-earnings ratio of -1.99 and a beta of 0.78. The company's 50-day moving average is $2.37 and its two-hundred day moving average is $2.51.

Institutional Investors Weigh In On Lucid Group

Several hedge funds have recently made changes to their positions in LCID. Envestnet Asset Management Inc. lifted its position in shares of Lucid Group by 13.8% in the 2nd quarter. Envestnet Asset Management Inc. now owns 41,340 shares of the company's stock valued at $87,000 after acquiring an additional 5,013 shares in the last quarter. NewEdge Advisors LLC lifted its position in Lucid Group by 103.2% in the 1st quarter. NewEdge Advisors LLC now owns 37,987 shares of the company's stock worth $92,000 after buying an additional 19,294 shares in the last quarter. Royal Bank of Canada lifted its position in Lucid Group by 9.5% in the 1st quarter. Royal Bank of Canada now owns 110,716 shares of the company's stock worth $267,000 after buying an additional 9,578 shares in the last quarter. Empowered Funds LLC lifted its position in Lucid Group by 11.3% in the 1st quarter. Empowered Funds LLC now owns 110,844 shares of the company's stock worth $268,000 after buying an additional 11,252 shares in the last quarter. Finally, Focus Partners Wealth lifted its position in Lucid Group by 450.9% in the 1st quarter. Focus Partners Wealth now owns 215,241 shares of the company's stock worth $521,000 after buying an additional 176,170 shares in the last quarter. Hedge funds and other institutional investors own 75.17% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts have commented on LCID shares. Robert W. Baird upped their target price on shares of Lucid Group from $2.00 to $3.00 and gave the stock a "neutral" rating in a research report on Monday, April 21st. Cantor Fitzgerald reiterated a "neutral" rating and issued a $3.00 price objective on shares of Lucid Group in a report on Wednesday, May 7th. Two analysts have rated the stock with a sell rating, eight have issued a hold rating and two have assigned a buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of $2.68.

View Our Latest Stock Analysis on LCID

About Lucid Group

(

Get Free Report)

Lucid Group, Inc a technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems. It also designs and develops proprietary software in-house for Lucid vehicles. The company sells vehicles directly to consumers through its retail sales network and direct online sales, including Lucid Financial Services.

Recommended Stories

Before you consider Lucid Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lucid Group wasn't on the list.

While Lucid Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.