Lumen Technologies (NYSE:LUMN - Get Free Report) is expected to issue its Q3 2025 results after the market closes on Thursday, October 30th. Analysts expect the company to announce earnings of ($0.20) per share and revenue of $3.0449 billion for the quarter. Parties can find conference call details on the company's upcoming Q3 2025 earningreport page for the latest details on the call scheduled for Thursday, October 30, 2025 at 5:00 PM ET.

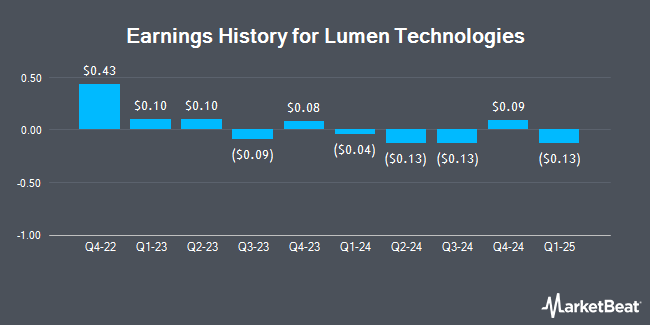

Lumen Technologies (NYSE:LUMN - Get Free Report) last posted its quarterly earnings data on Friday, January 27th. The technology company reported $0.49 earnings per share (EPS) for the quarter. The company had revenue of $4.05 billion during the quarter. Lumen Technologies had a negative return on equity of 158.40% and a negative net margin of 9.19%. On average, analysts expect Lumen Technologies to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Lumen Technologies Price Performance

NYSE:LUMN opened at $7.05 on Thursday. The firm has a market capitalization of $7.23 billion, a price-to-earnings ratio of -5.97 and a beta of 1.45. Lumen Technologies has a 52-week low of $3.01 and a 52-week high of $10.33. The stock has a fifty day moving average of $5.78 and a 200 day moving average of $4.62. The company has a debt-to-equity ratio of 59.98, a quick ratio of 2.13 and a current ratio of 2.13.

Wall Street Analysts Forecast Growth

Several equities research analysts have issued reports on LUMN shares. Wall Street Zen raised Lumen Technologies from a "sell" rating to a "hold" rating in a research note on Sunday, August 3rd. Citigroup lifted their price target on Lumen Technologies from $6.00 to $7.50 and gave the stock a "buy" rating in a research note on Thursday, September 25th. Raymond James Financial lifted their price target on Lumen Technologies from $4.50 to $5.00 and gave the stock an "outperform" rating in a research note on Friday, August 1st. Weiss Ratings reaffirmed a "sell (d-)" rating on shares of Lumen Technologies in a research note on Wednesday, October 8th. Finally, BNP Paribas raised Lumen Technologies to a "hold" rating in a research note on Wednesday, June 25th. Two investment analysts have rated the stock with a Buy rating, five have issued a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat, the stock has an average rating of "Hold" and a consensus target price of $5.39.

Get Our Latest Stock Analysis on Lumen Technologies

Insider Transactions at Lumen Technologies

In related news, CEO Kathleen E. Johnson purchased 135,870 shares of the company's stock in a transaction dated Tuesday, August 5th. The shares were purchased at an average cost of $3.69 per share, with a total value of $501,360.30. Following the transaction, the chief executive officer directly owned 9,616,947 shares in the company, valued at $35,486,534.43. This trade represents a 1.43% increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Christopher Stansbury purchased 42,000 shares of the company's stock in a transaction dated Thursday, August 14th. The stock was bought at an average cost of $4.29 per share, for a total transaction of $180,180.00. Following the completion of the transaction, the chief financial officer owned 518,000 shares in the company, valued at approximately $2,222,220. This represents a 8.82% increase in their ownership of the stock. The disclosure for this purchase can be found here. In the last 90 days, insiders have purchased 217,870 shares of company stock worth $859,140. 2.30% of the stock is owned by company insiders.

Institutional Trading of Lumen Technologies

A number of hedge funds have recently made changes to their positions in LUMN. Canada Pension Plan Investment Board bought a new stake in shares of Lumen Technologies in the 2nd quarter worth approximately $8,151,000. CANADA LIFE ASSURANCE Co bought a new stake in shares of Lumen Technologies in the 2nd quarter worth approximately $5,073,000. Balyasny Asset Management L.P. bought a new stake in shares of Lumen Technologies in the 2nd quarter worth approximately $3,538,000. Invesco Ltd. boosted its position in shares of Lumen Technologies by 6.3% in the 2nd quarter. Invesco Ltd. now owns 10,928,906 shares of the technology company's stock worth $47,869,000 after purchasing an additional 652,124 shares in the last quarter. Finally, BNP Paribas Financial Markets lifted its position in Lumen Technologies by 685.3% in the 2nd quarter. BNP Paribas Financial Markets now owns 627,422 shares of the technology company's stock valued at $2,748,000 after acquiring an additional 547,527 shares in the last quarter. 66.19% of the stock is owned by institutional investors.

Lumen Technologies Company Profile

(

Get Free Report)

Lumen Technologies, Inc, a facilities-based technology and communications company, provides various integrated products and services to business and residential customers in the United States and internationally. The company operates in two segments, Business and Mass Markets. It offers dark fiber, edge cloud services, internet protocol, managed security, software-defined wide area networks, secure access service edge, unified communications and collaboration, and optical wavelengths services; ethernet and VPN data networks services; and legacy services to manage cash flow, including time division multiplexing voice, private line, and other legacy services, as well as sells communication equipment, and IT solutions.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lumen Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumen Technologies wasn't on the list.

While Lumen Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.