LyondellBasell Industries (NYSE:LYB - Get Free Report) is projected to post its Q3 2025 results before the market opens on Friday, October 31st. Analysts expect LyondellBasell Industries to post earnings of $0.89 per share and revenue of $7.4058 billion for the quarter. Individuals can check the company's upcoming Q3 2025 earningsummary page for the latest details on the call scheduled for Friday, October 31, 2025 at 11:00 AM ET.

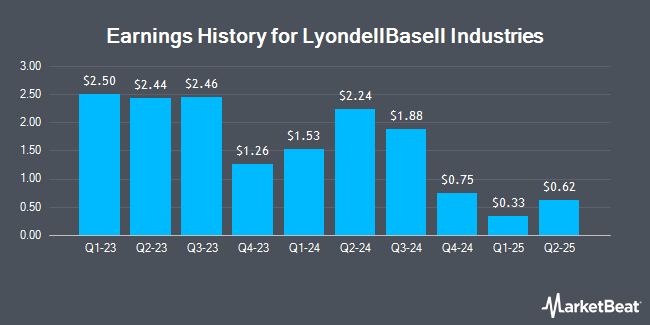

LyondellBasell Industries (NYSE:LYB - Get Free Report) last posted its earnings results on Friday, August 1st. The specialty chemicals company reported $0.62 earnings per share for the quarter, missing analysts' consensus estimates of $0.87 by ($0.25). LyondellBasell Industries had a return on equity of 9.35% and a net margin of 0.74%.The business had revenue of $7.66 billion for the quarter, compared to the consensus estimate of $7.58 billion. During the same period in the previous year, the firm earned $2.24 earnings per share. The company's revenue was down 11.8% compared to the same quarter last year. On average, analysts expect LyondellBasell Industries to post $6 EPS for the current fiscal year and $8 EPS for the next fiscal year.

LyondellBasell Industries Trading Up 3.5%

LYB opened at $46.80 on Friday. LyondellBasell Industries has a fifty-two week low of $44.87 and a fifty-two week high of $89.50. The company has a debt-to-equity ratio of 0.94, a current ratio of 1.77 and a quick ratio of 1.04. The firm has a market capitalization of $15.05 billion, a price-to-earnings ratio of 60.78 and a beta of 0.87. The company's 50 day moving average price is $51.51 and its two-hundred day moving average price is $55.93.

LyondellBasell Industries Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, September 2nd. Stockholders of record on Monday, August 25th were paid a $1.37 dividend. This represents a $5.48 dividend on an annualized basis and a dividend yield of 11.7%. The ex-dividend date of this dividend was Monday, August 25th. LyondellBasell Industries's dividend payout ratio is currently 711.69%.

Insiders Place Their Bets

In other LyondellBasell Industries news, CEO Peter Z. E. Vanacker sold 20,000 shares of the company's stock in a transaction on Friday, August 15th. The shares were sold at an average price of $53.57, for a total transaction of $1,071,400.00. Following the transaction, the chief executive officer owned 160,351 shares in the company, valued at approximately $8,590,003.07. This represents a 11.09% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Insiders own 0.14% of the company's stock.

Institutional Trading of LyondellBasell Industries

Several institutional investors have recently made changes to their positions in the company. Thrivent Financial for Lutherans grew its stake in shares of LyondellBasell Industries by 140.9% in the 2nd quarter. Thrivent Financial for Lutherans now owns 30,230 shares of the specialty chemicals company's stock worth $1,749,000 after acquiring an additional 17,682 shares in the last quarter. CYBER HORNET ETFs LLC bought a new position in LyondellBasell Industries during the second quarter valued at about $39,000. MUFG Securities EMEA plc purchased a new stake in LyondellBasell Industries during the second quarter worth about $44,000. Corient Private Wealth LLC increased its holdings in LyondellBasell Industries by 20.8% during the second quarter. Corient Private Wealth LLC now owns 55,869 shares of the specialty chemicals company's stock worth $3,233,000 after buying an additional 9,634 shares during the last quarter. Finally, Chapman Financial Group LLC purchased a new stake in LyondellBasell Industries during the second quarter worth about $155,000. Institutional investors own 71.20% of the company's stock.

Analysts Set New Price Targets

A number of research analysts recently issued reports on the stock. Rothschild & Co Redburn dropped their target price on shares of LyondellBasell Industries from $80.00 to $75.00 and set a "buy" rating on the stock in a research report on Friday, September 12th. BMO Capital Markets dropped their target price on shares of LyondellBasell Industries from $60.00 to $58.00 and set a "market perform" rating on the stock in a research report on Wednesday, August 6th. The Goldman Sachs Group dropped their target price on shares of LyondellBasell Industries from $59.00 to $51.00 and set a "sell" rating on the stock in a research report on Friday, October 17th. Bank of America dropped their target price on shares of LyondellBasell Industries from $55.00 to $50.00 and set a "neutral" rating on the stock in a research report on Tuesday, October 14th. Finally, Mizuho dropped their target price on shares of LyondellBasell Industries from $62.00 to $54.00 and set a "neutral" rating on the stock in a research report on Friday, October 3rd. One analyst has rated the stock with a Strong Buy rating, three have assigned a Buy rating, thirteen have assigned a Hold rating and three have issued a Sell rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $58.56.

Get Our Latest Stock Report on LyondellBasell Industries

About LyondellBasell Industries

(

Get Free Report)

LyondellBasell Industries N.V. operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally. The company operates in six segments: Olefins and PolyolefinsAmericas; Olefins and PolyolefinsEurope, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider LyondellBasell Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LyondellBasell Industries wasn't on the list.

While LyondellBasell Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.