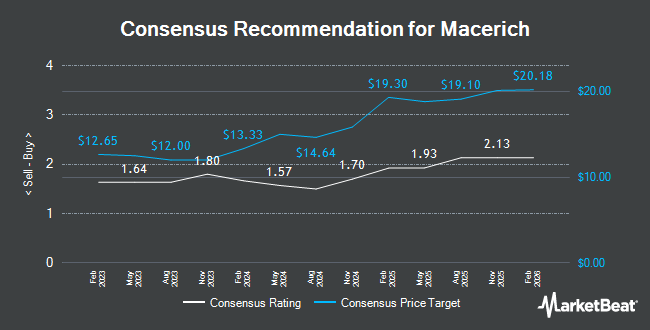

Macerich (NYSE:MAC - Get Free Report)'s stock had its "sell (d+)" rating reiterated by equities researchers at Weiss Ratings in a report issued on Wednesday,Weiss Ratings reports.

MAC has been the subject of a number of other reports. Scotiabank upped their target price on Macerich from $16.00 to $18.00 and gave the company a "sector perform" rating in a research report on Thursday, August 28th. Bank of America raised Macerich from a "neutral" rating to a "buy" rating and boosted their price target for the stock from $19.00 to $23.00 in a report on Friday, September 26th. Evercore ISI boosted their price target on Macerich from $18.00 to $20.00 and gave the stock an "in-line" rating in a report on Monday, September 15th. LADENBURG THALM/SH SH began coverage on Macerich in a report on Friday, July 18th. They set a "buy" rating and a $25.00 price target for the company. Finally, JPMorgan Chase & Co. boosted their price target on Macerich from $18.00 to $19.00 and gave the stock an "underweight" rating in a report on Wednesday, August 27th. Six equities research analysts have rated the stock with a Buy rating, five have issued a Hold rating and three have given a Sell rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $20.11.

Check Out Our Latest Research Report on Macerich

Macerich Stock Down 1.0%

NYSE:MAC opened at $17.21 on Wednesday. The firm has a market capitalization of $4.35 billion, a price-to-earnings ratio of -9.83, a price-to-earnings-growth ratio of 3.03 and a beta of 2.23. Macerich has a twelve month low of $12.48 and a twelve month high of $22.27. The stock's 50 day moving average price is $17.63 and its two-hundred day moving average price is $16.44. The company has a quick ratio of 0.76, a current ratio of 0.76 and a debt-to-equity ratio of 2.00.

Macerich (NYSE:MAC - Get Free Report) last posted its quarterly earnings results on Monday, August 11th. The real estate investment trust reported $0.32 earnings per share for the quarter, missing the consensus estimate of $0.34 by ($0.02). Macerich had a negative return on equity of 15.15% and a negative net margin of 41.33%.The company had revenue of $249.79 million for the quarter, compared to analyst estimates of $245.19 million. During the same period last year, the firm earned $0.39 EPS. The firm's revenue for the quarter was up 15.9% compared to the same quarter last year. Equities research analysts expect that Macerich will post 1.55 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Macerich

Hedge funds have recently added to or reduced their stakes in the company. GAMMA Investing LLC boosted its holdings in Macerich by 1,644.0% during the 1st quarter. GAMMA Investing LLC now owns 76,527 shares of the real estate investment trust's stock valued at $1,314,000 after acquiring an additional 72,139 shares during the period. SG Americas Securities LLC boosted its holdings in Macerich by 89.2% during the 1st quarter. SG Americas Securities LLC now owns 49,798 shares of the real estate investment trust's stock valued at $855,000 after acquiring an additional 23,475 shares during the period. Janney Montgomery Scott LLC boosted its holdings in Macerich by 15.3% during the 1st quarter. Janney Montgomery Scott LLC now owns 63,576 shares of the real estate investment trust's stock valued at $1,092,000 after acquiring an additional 8,458 shares during the period. Murphy Pohlad Asset Management LLC boosted its holdings in Macerich by 5.2% during the 1st quarter. Murphy Pohlad Asset Management LLC now owns 123,560 shares of the real estate investment trust's stock valued at $2,122,000 after acquiring an additional 6,100 shares during the period. Finally, State of Alaska Department of Revenue boosted its holdings in Macerich by 2.3% during the 1st quarter. State of Alaska Department of Revenue now owns 258,712 shares of the real estate investment trust's stock valued at $4,440,000 after acquiring an additional 5,890 shares during the period. Institutional investors own 87.38% of the company's stock.

About Macerich

(

Get Free Report)

Macerich is a fully integrated, self-managed and self-administered real estate investment trust (REIT). As a leading owner, operator and developer of high-quality retail real estate in densely populated and attractive U.S. markets, Macerich's portfolio is concentrated in California, the Pacific Northwest, Phoenix/Scottsdale, and the Metro New York to Washington, DC corridor.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Macerich, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Macerich wasn't on the list.

While Macerich currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.