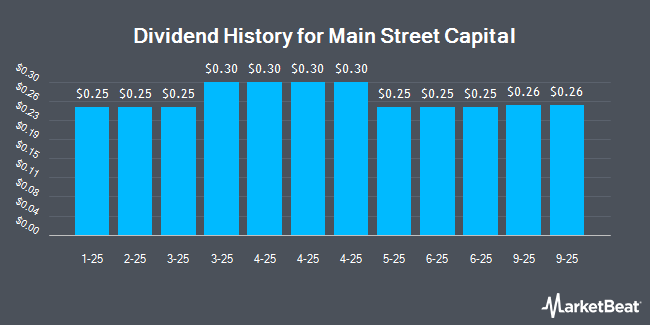

Main Street Capital Corporation (NYSE:MAIN - Get Free Report) announced a quarterly dividend on Monday, August 4th, investing.com reports. Stockholders of record on Wednesday, October 8th will be paid a dividend of 0.30 per share by the financial services provider on Wednesday, October 15th. This represents a c) dividend on an annualized basis and a dividend yield of 1.9%. The ex-dividend date is Wednesday, October 8th.

Main Street Capital has a payout ratio of 78.9% meaning its dividend is currently covered by earnings, but may not be in the future if the company's earnings fall. Analysts expect Main Street Capital to earn $4.06 per share next year, which means the company should continue to be able to cover its $3.00 annual dividend with an expected future payout ratio of 73.9%.

Main Street Capital Price Performance

Shares of NYSE MAIN traded down $1.52 during mid-day trading on Monday, reaching $64.26. The company's stock had a trading volume of 757,604 shares, compared to its average volume of 563,715. The company has a debt-to-equity ratio of 0.12, a quick ratio of 0.09 and a current ratio of 0.09. The stock has a 50-day moving average of $65.36 and a two-hundred day moving average of $59.39. Main Street Capital has a 1-year low of $47.00 and a 1-year high of $67.77. The stock has a market capitalization of $5.75 billion, a P/E ratio of 10.59 and a beta of 0.88.

Main Street Capital (NYSE:MAIN - Get Free Report) last issued its earnings results on Thursday, August 7th. The financial services provider reported $0.99 EPS for the quarter, hitting analysts' consensus estimates of $0.99. The company had revenue of $143.97 million for the quarter, compared to the consensus estimate of $137.23 million. Main Street Capital had a net margin of 96.16% and a return on equity of 12.70%. On average, equities research analysts anticipate that Main Street Capital will post 4.11 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of equities research analysts have weighed in on the stock. Wall Street Zen upgraded shares of Main Street Capital from a "sell" rating to a "hold" rating in a research report on Sunday, August 3rd. Zacks Research upgraded shares of Main Street Capital from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, August 20th. Royal Bank Of Canada lifted their price target on shares of Main Street Capital from $52.00 to $67.00 and gave the company an "outperform" rating in a research report on Thursday, August 28th. UBS Group reissued a "neutral" rating and issued a $58.00 price objective (up previously from $56.00) on shares of Main Street Capital in a research note on Wednesday, July 16th. Finally, Truist Financial raised their price objective on shares of Main Street Capital from $54.00 to $64.00 and gave the company a "hold" rating in a research note on Monday, August 11th. One investment analyst has rated the stock with a Strong Buy rating, one has issued a Buy rating and four have assigned a Hold rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $61.20.

Get Our Latest Stock Report on Main Street Capital

Main Street Capital Company Profile

(

Get Free Report)

Main Street Capital Corporation is a business development company specializes in equity capital to lower middle market companies. The firm specializing in recapitalizations, management buyouts, refinancing, family estate planning, management buyouts, refinancing, industry consolidation, mature, later stage emerging growth.

Recommended Stories

Before you consider Main Street Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Main Street Capital wasn't on the list.

While Main Street Capital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.