Crestline Management LP boosted its holdings in shares of MarketAxess Holdings Inc. (NASDAQ:MKTX - Free Report) by 26.4% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 8,851 shares of the financial services provider's stock after buying an additional 1,850 shares during the quarter. Crestline Management LP's holdings in MarketAxess were worth $2,001,000 as of its most recent SEC filing.

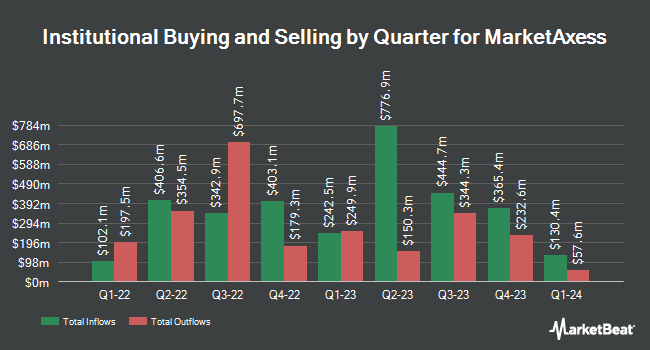

A number of other large investors also recently bought and sold shares of the business. Cetera Investment Advisers lifted its stake in shares of MarketAxess by 7.6% during the 4th quarter. Cetera Investment Advisers now owns 3,340 shares of the financial services provider's stock worth $755,000 after purchasing an additional 237 shares during the last quarter. Centiva Capital LP boosted its holdings in shares of MarketAxess by 484.5% in the 4th quarter. Centiva Capital LP now owns 7,569 shares of the financial services provider's stock valued at $1,711,000 after buying an additional 6,274 shares in the last quarter. Captrust Financial Advisors grew its position in shares of MarketAxess by 6.3% in the 4th quarter. Captrust Financial Advisors now owns 2,981 shares of the financial services provider's stock worth $674,000 after buying an additional 177 shares during the last quarter. Caxton Associates LP bought a new position in shares of MarketAxess during the 4th quarter worth approximately $1,847,000. Finally, BNP Paribas Financial Markets lifted its position in MarketAxess by 48.4% during the fourth quarter. BNP Paribas Financial Markets now owns 101,442 shares of the financial services provider's stock valued at $22,930,000 after acquiring an additional 33,078 shares during the last quarter. Institutional investors own 99.01% of the company's stock.

MarketAxess Stock Performance

NASDAQ MKTX traded down $5.26 on Tuesday, reaching $212.83. 336,233 shares of the company's stock traded hands, compared to its average volume of 493,151. The stock has a 50 day moving average price of $217.03 and a 200-day moving average price of $227.13. The firm has a market cap of $7.92 billion, a price-to-earnings ratio of 29.28, a P/E/G ratio of 3.89 and a beta of 0.89. MarketAxess Holdings Inc. has a fifty-two week low of $186.84 and a fifty-two week high of $296.68.

MarketAxess (NASDAQ:MKTX - Get Free Report) last issued its earnings results on Wednesday, May 7th. The financial services provider reported $1.87 EPS for the quarter, topping analysts' consensus estimates of $1.82 by $0.05. The firm had revenue of $208.58 million for the quarter, compared to the consensus estimate of $211.81 million. MarketAxess had a return on equity of 20.23% and a net margin of 33.56%. The company's revenue was down .8% compared to the same quarter last year. During the same quarter in the prior year, the business earned $1.92 earnings per share. As a group, equities research analysts anticipate that MarketAxess Holdings Inc. will post 7.79 EPS for the current fiscal year.

MarketAxess Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, June 4th. Investors of record on Wednesday, May 21st will be paid a $0.76 dividend. This represents a $3.04 annualized dividend and a dividend yield of 1.43%. The ex-dividend date is Wednesday, May 21st. MarketAxess's dividend payout ratio is currently 52.87%.

Analyst Ratings Changes

A number of brokerages have recently issued reports on MKTX. Piper Sandler reduced their price target on MarketAxess from $213.00 to $202.00 and set a "neutral" rating on the stock in a research report on Thursday, May 8th. Keefe, Bruyette & Woods increased their price target on MarketAxess from $223.00 to $226.00 and gave the company a "market perform" rating in a research note on Thursday, May 8th. Barclays boosted their price target on MarketAxess from $232.00 to $240.00 and gave the stock an "equal weight" rating in a research note on Thursday, May 8th. William Blair initiated coverage on shares of MarketAxess in a research report on Friday, April 4th. They issued an "outperform" rating for the company. Finally, Citigroup boosted their target price on shares of MarketAxess from $250.00 to $265.00 and gave the stock a "buy" rating in a research report on Thursday, May 8th. One equities research analyst has rated the stock with a sell rating, six have issued a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $241.78.

Get Our Latest Report on MarketAxess

MarketAxess Company Profile

(

Free Report)

MarketAxess Holdings Inc, together with its subsidiaries, operates an electronic trading platform for institutional investor and broker-dealer companies worldwide. The company offers trading technology that provides liquidity access in U.S. high-grade bonds, U.S. high-yield bonds, emerging market debt, eurobonds, municipal bonds, U.S.

Read More

Before you consider MarketAxess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MarketAxess wasn't on the list.

While MarketAxess currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.