MasTec (NYSE:MTZ - Get Free Report) had its target price increased by analysts at Stifel Nicolaus from $181.00 to $198.00 in a note issued to investors on Monday,Benzinga reports. The brokerage currently has a "buy" rating on the construction company's stock. Stifel Nicolaus' target price points to a potential upside of 12.06% from the stock's current price.

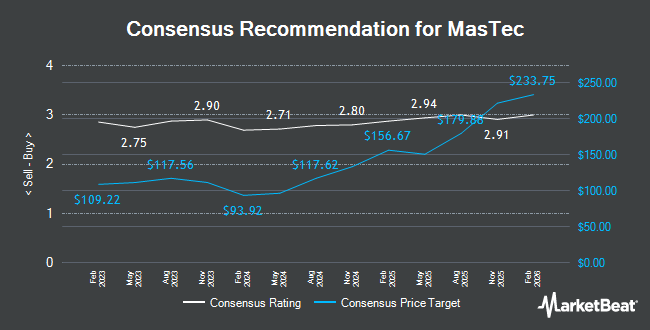

A number of other equities analysts have also recently issued reports on the company. Roth Capital assumed coverage on MasTec in a report on Tuesday, July 1st. They set a "buy" rating and a $210.00 target price for the company. Citigroup increased their target price on MasTec from $192.00 to $220.00 and gave the stock a "buy" rating in a report on Monday, July 28th. KeyCorp raised their price objective on MasTec from $196.00 to $205.00 and gave the company an "overweight" rating in a report on Monday. Piper Sandler raised their price objective on MasTec from $134.00 to $175.00 and gave the company an "overweight" rating in a report on Monday, May 5th. Finally, The Goldman Sachs Group upgraded MasTec from a "neutral" rating to a "buy" rating and raised their price objective for the company from $156.00 to $195.00 in a report on Friday, June 6th. One equities research analyst has rated the stock with a hold rating, fifteen have issued a buy rating and three have assigned a strong buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Buy" and an average price target of $191.82.

View Our Latest Stock Analysis on MasTec

MasTec Trading Up 1.5%

Shares of MTZ traded up $2.64 during trading hours on Monday, reaching $176.69. The stock had a trading volume of 677,922 shares, compared to its average volume of 1,054,236. The company has a quick ratio of 1.19, a current ratio of 1.22 and a debt-to-equity ratio of 0.70. MasTec has a 52 week low of $89.96 and a 52 week high of $194.00. The firm has a 50-day moving average of $169.01 and a 200 day moving average of $144.98. The company has a market cap of $13.94 billion, a P/E ratio of 52.28 and a beta of 1.83.

MasTec (NYSE:MTZ - Get Free Report) last released its earnings results on Thursday, July 31st. The construction company reported $1.49 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.41 by $0.08. The firm had revenue of $3.55 billion during the quarter, compared to analysts' expectations of $3.40 billion. MasTec had a return on equity of 12.71% and a net margin of 2.04%. The company's revenue was up 19.7% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.96 EPS. On average, sell-side analysts expect that MasTec will post 3.44 earnings per share for the current fiscal year.

Insider Activity at MasTec

In other MasTec news, COO Robert E. Apple sold 10,000 shares of the firm's stock in a transaction that occurred on Wednesday, July 16th. The shares were sold at an average price of $175.00, for a total transaction of $1,750,000.00. Following the completion of the sale, the chief operating officer directly owned 194,249 shares in the company, valued at $33,993,575. This trade represents a 4.90% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, Director C Robert Campbell sold 3,000 shares of the firm's stock in a transaction that occurred on Monday, May 12th. The stock was sold at an average price of $153.89, for a total transaction of $461,670.00. Following the sale, the director owned 39,782 shares of the company's stock, valued at $6,122,051.98. This trade represents a 7.01% decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 21.30% of the company's stock.

Institutional Investors Weigh In On MasTec

Several hedge funds have recently bought and sold shares of the stock. Amalgamated Bank lifted its position in MasTec by 1.5% during the second quarter. Amalgamated Bank now owns 28,719 shares of the construction company's stock worth $4,895,000 after acquiring an additional 435 shares during the last quarter. Atria Investments Inc raised its position in shares of MasTec by 16.7% in the second quarter. Atria Investments Inc now owns 4,122 shares of the construction company's stock valued at $703,000 after buying an additional 589 shares in the last quarter. Hantz Financial Services Inc. raised its position in shares of MasTec by 914.3% in the second quarter. Hantz Financial Services Inc. now owns 639 shares of the construction company's stock valued at $109,000 after buying an additional 576 shares in the last quarter. Arkadios Wealth Advisors acquired a new stake in shares of MasTec in the second quarter valued at approximately $794,000. Finally, Jennison Associates LLC raised its position in shares of MasTec by 11.1% in the second quarter. Jennison Associates LLC now owns 81,830 shares of the construction company's stock valued at $13,946,000 after buying an additional 8,158 shares in the last quarter. 78.10% of the stock is currently owned by institutional investors and hedge funds.

MasTec Company Profile

(

Get Free Report)

MasTec, Inc, an infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada. It operates through five segments: Communications, Clean Energy and Infrastructure, Oil and Gas, Power Delivery, and Other.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MasTec, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MasTec wasn't on the list.

While MasTec currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.