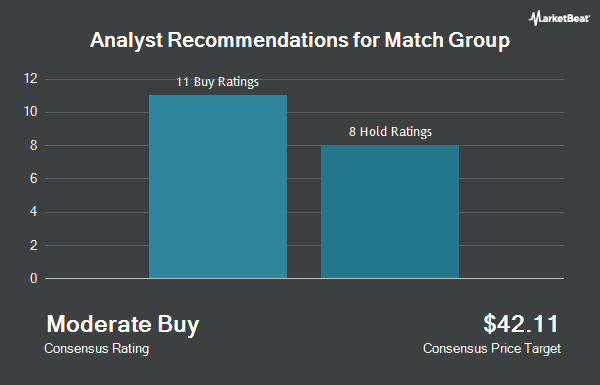

Shares of Match Group Inc. (NASDAQ:MTCH - Get Free Report) have been assigned a consensus rating of "Hold" from the twenty-four analysts that are covering the company, MarketBeat Ratings reports. One investment analyst has rated the stock with a sell recommendation, fourteen have given a hold recommendation and nine have issued a buy recommendation on the company. The average 12 month price target among analysts that have covered the stock in the last year is $35.91.

Several equities analysts have weighed in on MTCH shares. JPMorgan Chase & Co. cut their price target on Match Group from $29.00 to $28.00 and set a "neutral" rating for the company in a report on Friday, May 9th. Wall Street Zen lowered shares of Match Group from a "buy" rating to a "hold" rating in a report on Saturday, May 17th. Wells Fargo & Company reduced their price target on shares of Match Group from $32.00 to $31.00 and set an "equal weight" rating on the stock in a research report on Wednesday, April 9th. Bank of America lowered their price objective on shares of Match Group from $36.00 to $33.00 and set a "neutral" rating for the company in a research report on Monday, April 21st. Finally, Evercore ISI reissued a "cautious" rating and issued a $32.00 price objective on shares of Match Group in a research note on Wednesday, May 21st.

Get Our Latest Stock Report on Match Group

Insider Buying and Selling at Match Group

In other news, CEO Spencer M. Rascoff acquired 70,885 shares of Match Group stock in a transaction on Friday, May 9th. The shares were bought at an average cost of $28.05 per share, for a total transaction of $1,988,324.25. Following the acquisition, the chief executive officer now directly owns 137,478 shares of the company's stock, valued at $3,856,257.90. This trade represents a 106.45% increase in their position. The purchase was disclosed in a legal filing with the SEC, which is available at this hyperlink. 0.64% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On Match Group

A number of hedge funds and other institutional investors have recently made changes to their positions in MTCH. Metis Global Partners LLC lifted its stake in Match Group by 3.0% in the fourth quarter. Metis Global Partners LLC now owns 10,956 shares of the technology company's stock worth $358,000 after acquiring an additional 318 shares during the period. Applied Finance Capital Management LLC raised its holdings in shares of Match Group by 5.1% in the 1st quarter. Applied Finance Capital Management LLC now owns 6,880 shares of the technology company's stock valued at $215,000 after purchasing an additional 334 shares in the last quarter. Cornerstone Investment Partners LLC raised its holdings in shares of Match Group by 2.2% in the 4th quarter. Cornerstone Investment Partners LLC now owns 15,889 shares of the technology company's stock valued at $520,000 after purchasing an additional 349 shares in the last quarter. Assetmark Inc. lifted its position in shares of Match Group by 14.2% in the 4th quarter. Assetmark Inc. now owns 3,035 shares of the technology company's stock worth $99,000 after purchasing an additional 378 shares during the period. Finally, Fulton Bank N.A. boosted its stake in shares of Match Group by 3.9% during the first quarter. Fulton Bank N.A. now owns 10,290 shares of the technology company's stock valued at $321,000 after purchasing an additional 388 shares in the last quarter. Institutional investors own 94.05% of the company's stock.

Match Group Price Performance

Shares of MTCH stock traded down $0.71 during mid-day trading on Friday, hitting $30.86. The company had a trading volume of 3,575,756 shares, compared to its average volume of 4,868,598. The stock's 50 day moving average price is $29.99 and its 200-day moving average price is $31.39. Match Group has a 52-week low of $26.39 and a 52-week high of $38.84. The company has a market capitalization of $7.73 billion, a P/E ratio of 15.18, a P/E/G ratio of 0.72 and a beta of 1.35.

Match Group Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, July 18th. Investors of record on Thursday, July 3rd will be issued a dividend of $0.19 per share. The ex-dividend date of this dividend is Thursday, July 3rd. This represents a $0.76 dividend on an annualized basis and a yield of 2.46%. Match Group's payout ratio is 37.62%.

About Match Group

(

Get Free ReportMatch Group, Inc engages in the provision of dating products. Its portfolio of brands includes Tinder, Hinge, Match, Meetic, OkCupid, Pairs, Plenty Of Fish, Azar, BLK, and Hakuna, as well as a various other brands, each built to increase users' likelihood of connecting with others. Its services are available in over 40 languages to users worldwide.

Featured Stories

Before you consider Match Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Match Group wasn't on the list.

While Match Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.